Economic Incentives and Policy Frameworks

Economic incentives and supportive policy frameworks are essential drivers of growth in the Distributed Generation Market. Governments worldwide are implementing various financial mechanisms, such as tax credits, rebates, and feed-in tariffs, to encourage the adoption of distributed generation technologies. These incentives not only lower the initial investment costs for consumers but also enhance the overall attractiveness of renewable energy solutions. In many regions, the Distributed Generation Market has benefited from policies that promote energy independence and security, further stimulating investment in decentralized energy systems. As these economic incentives continue to evolve, they are likely to catalyze further growth in the market.

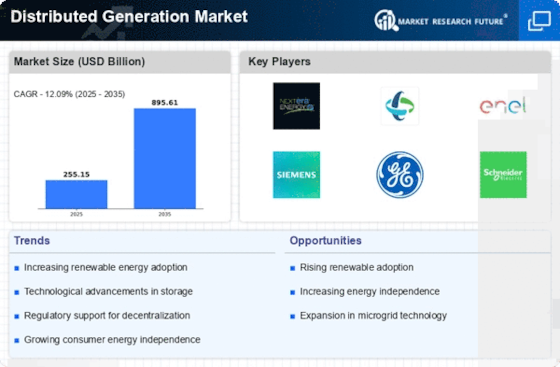

Rising Energy Demand and Decentralization

The rising energy demand, coupled with a shift towards decentralization, is a pivotal driver in the Distributed Generation Market. As urbanization and population growth continue to escalate, the need for reliable and efficient energy sources becomes increasingly critical. This trend is prompting consumers and businesses to seek localized energy solutions that can provide resilience against grid failures. The Distributed Generation Market is responding to this demand by offering a variety of options, including rooftop solar, small wind systems, and combined heat and power (CHP) systems. It is projected that by 2030, distributed generation could contribute to over 25% of total electricity generation, underscoring its growing importance in the energy landscape.

Consumer Empowerment and Energy Independence

Consumer empowerment and the quest for energy independence are increasingly influencing the dynamics of the Distributed Generation Market. As individuals and businesses become more aware of their energy consumption patterns, there is a growing desire to take control of energy production. This trend is leading to a rise in investments in distributed generation technologies, such as solar panels and battery storage systems. The Distributed Generation Market is witnessing a shift where consumers are not just passive users of energy but active participants in energy generation. This empowerment is expected to drive innovation and competition within the market, ultimately leading to more diverse and resilient energy solutions.

Environmental Concerns and Sustainability Goals

Environmental concerns and sustainability goals are driving the evolution of the Distributed Generation Market. As awareness of climate change and its impacts intensifies, stakeholders are increasingly prioritizing renewable energy sources. Governments and organizations are setting ambitious targets to reduce greenhouse gas emissions, which often include the promotion of distributed generation technologies. For example, many countries are aiming for net-zero emissions by 2050, which necessitates a significant increase in renewable energy deployment. The Distributed Generation Market is thus positioned to play a crucial role in achieving these sustainability objectives, as it enables the integration of clean energy sources at the local level, reducing reliance on fossil fuels.

Technological Advancements in Distributed Generation

Technological advancements in distributed generation systems are reshaping the landscape of the Distributed Generation Market. Innovations in solar photovoltaic (PV) systems, wind turbines, and microgrid technologies are enhancing efficiency and reducing costs. For instance, the cost of solar PV has decreased by approximately 82% since 2010, making it a more viable option for consumers and businesses alike. These advancements not only improve energy generation but also facilitate better integration with existing energy infrastructures. As a result, the Distributed Generation Market is witnessing a surge in the deployment of decentralized energy solutions, which are expected to account for a substantial share of the overall energy mix in the coming years.

Leave a Comment