Dissolvable Sutures Size

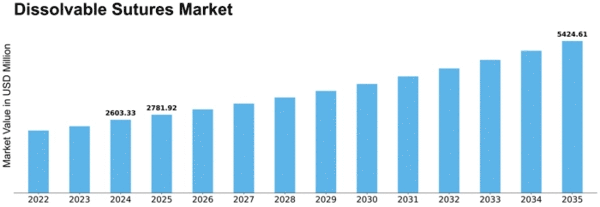

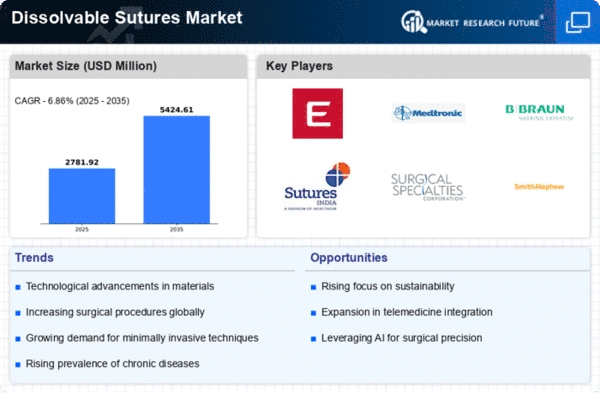

Dissolvable Sutures Market Growth Projections and Opportunities

The dissolvable sutures market is driven by the rising number of surgeries internationally. As careful intercessions become more predominant across different clinical claims to fame, the interest for dissolvable sutures, otherwise called absorbable sutures, is developing. This pattern impacts market elements, with an emphasis on creating progressed and flexible sutures reasonable for various careful applications. The market is affected by the developing inclination for negligibly invasive careful strategies. As negligibly invasive strategies become more well known because of reduced convalescence times and lower risks, there is an expanded interest for dissolvable sutures appropriate for these methodologies. Organizations adjusting their items to take special care of minimally invasive surgeries add to market development. Dissolvable sutures play an essential job in injury recuperating and tissue recovery. The market is molded by a developing spotlight on sutures that give successful injury completion as well as support normal tissue recuperating processes. Organizations putting resources into innovative work to upgrade the tissue-accommodating properties of dissolvable sutures add to worked on understanding results. The dissolvable sutures market takes care of different careful applications across clinical strengths, including general surgery, obstetrics, gynecology, and orthopedics. The flexibility of dissolvable sutures adds to their far-reaching reception, and organizations creating sutures reasonable for various careful settings are strategically situated in the market. Biocompatibility and the capacity to prompt negligible inflammatory reactions are basic factors in dissolvable sutures. The market is impacted by the interest for sutures that limit tissue disturbance and advance a favorable recuperating climate. Organizations zeroing in on upgrading biocompatibility add to the general acknowledgment of dissolvable sutures in clinical practice. The dissolvable sutures market is affected by the continuous advancement of worldwide medical services framework. Upgrades in medical care offices and admittance to careful mediations in arising economies add to expanded interest for dissolvable sutures. Organizations growing their market presence universally need to think about varieties in medical care framework.

Leave a Comment