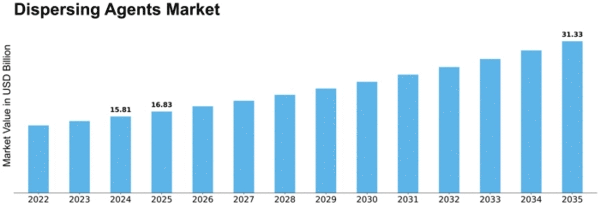

Dispersing Agents Size

Dispersing Agents Market Growth Projections and Opportunities

The dispersing agents market is influenced by various market factors that impact supply, demand, and pricing dynamics. These factors include raw material availability, end-user industries, regulatory policies, technological advancements, and market competition.

Dispersants are also known as dispersing agents or plasticizers. They are non-surface active polymers used for the prevention of clumping and to help in separation of particles. These agents consist of surfactants, which act as chemical compounds and reduces surface tension, in turn, preventing the coagulation or settling of particles.

Raw material availability plays a crucial role in the dispersing agents market. Dispersing agents are typically derived from chemicals such as surfactants, polymers, and solvents. Fluctuations in the availability and prices of these raw materials can directly affect the production costs of dispersing agents. For example, shortages or price spikes in key raw materials can increase manufacturing expenses, leading to higher prices for dispersing agents.

End-user industries also significantly influence the dispersing agents market. Various industries such as paints and coatings, construction, textiles, pulp and paper, and agriculture rely on dispersing agents to improve the dispersion of solid particles in liquid formulations. Changes in demand from these industries, driven by factors such as economic conditions, consumer preferences, and technological innovations, can impact the overall demand for dispersing agents.

Regulatory policies play a crucial role in shaping the dispersing agents market. Governments worldwide impose regulations on the use of chemicals, including dispersing agents, to ensure environmental and human safety. Compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the European Union and EPA (Environmental Protection Agency) regulations in the United States can influence product formulations, manufacturing processes, and market access for dispersing agents.

Technological advancements drive innovation in the dispersing agents market. Manufacturers continuously invest in research and development to improve the performance and efficiency of dispersing agents. New formulations, production processes, and application techniques enable dispersing agents to meet evolving industry requirements and address emerging challenges. For example, advancements in nanotechnology have led to the development of nanoscale dispersing agents capable of dispersing nanoparticles more effectively.

Market competition among dispersing agent manufacturers also affects market dynamics. The dispersing agents market is characterized by intense competition, with numerous players competing for market share. Companies differentiate themselves based on product quality, performance, price, and customer service. Market consolidation, mergers, acquisitions, and partnerships are common strategies adopted by companies to strengthen their competitive position and expand their market presence.

Leave a Comment