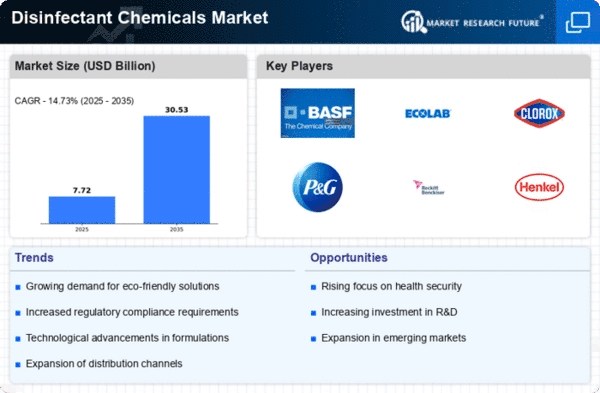

Top Industry Leaders in the Disinfectant Chemicals Market

The global disinfectant chemicals market is a dynamic and fragmented space, with a diverse mix of established players and emerging entrants vying for market share. This dynamic landscape is driven by several factors, including increasing awareness of hygiene and sanitation, rising healthcare spending, stringent regulations, and the growing popularity of eco-friendly solutions.

Strategies Adopted:

To gain a competitive edge in this market, key players are adopting various strategies, including:

-

Product Innovation: This involves developing new and improved disinfectant formulations with enhanced efficacy, broader spectrum coverage, and longer shelf life. Eco-friendly and biodegradable solutions are gaining traction to cater to the growing demand for sustainable products. -

Mergers and Acquisitions: This helps companies expand their product portfolio, acquire new technologies and expertise, and strengthen their market presence. For example, Ecolab recently acquired Purolite, a leading provider of ion exchange resins and related technologies, to expand its water treatment solutions portfolio. -

Strategic Partnerships: Collaborations with research institutions and universities enable companies to access cutting-edge research and development capabilities. Partnerships with healthcare providers and distributors can help expand market reach and improve access to potential customers. -

Strong Brand Building: Companies are focusing on building strong brand awareness and recognition through marketing campaigns, sponsorships, and participation in industry events. This helps create a positive brand image and increase customer loyalty. -

Digitalization: Companies are increasingly leveraging digital platforms for online sales, marketing, and customer service. This helps improve efficiency, reach a wider audience, and personalize the customer experience.

Factors for Market Share Analysis:

Several key factors are usually considered when analyzing market share in the disinfectant chemicals market:

-

Revenue: This is the primary indicator of market size and share. Companies are ranked based on their total revenue generated from the sale of disinfectant chemicals. -

Product Portfolio: Companies with a broader and more diverse product portfolio are generally considered to have a stronger market position. -

Geographical Reach: Companies with a wider geographical footprint are considered to have a larger market share. -

Brand Recognition: Companies with a strong brand reputation and recognition are often able to command higher prices for their products and enjoy increased customer loyalty. -

Innovation: Companies that are constantly innovating and developing new products are considered to be more competitive and likely to gain market share. -

Distribution Network: Companies with a strong and well-established distribution network can reach a wider customer base and quickly respond to market demands.

Key Companies in the Disinfectant Chemicals market include

- Johnson & Johnson Services, Inc.

- 3M

- Reckitt Benckiser Group plc

- Ecolab Inc.

- The Clorox Company

- Kemin Industries, Inc.

- Diversey Holdings, Ltd.

- STERIS plc

- ABC Compounding Co., Inc.

- Medline Industries

- LP

Recent Development

June 2023: Ecolab Inc. launched its new line of Ecolab Peroxide Plus disinfectants, which offer enhanced efficacy against viruses and bacteria while remaining safer for users and the environment.

July 2023: Diversey Holdings, Inc. announced the launch of its new Suma Bac D10 disinfectant spray, specifically formulated for use in food processing facilities.

September 2023: GOJO Industries introduced its next-generation PURELL hand sanitizer with CLEAN RELEASE™ technology, designed to deliver a cleaner, more comfortable hand-washing experience.

October 2023: Reckitt Benckiser launched Lysol® Surface Disinfectant Spray with Clean Citrus scent, expanding its product range with a more natural fragrance option.

November 2023: Steris Corporation announced the launch of its new STERIS Vaprox® Hydrogen Peroxide Vapor Sterilization System, providing a faster and more effective way to sterilize healthcare facilities.

September 2020: An important component used in disinfection formulations, oxone monopersulfate, will see production capacity increase by almost 50%, according to an official announcement from Lanxess.

August 2020: The long-term collaboration between Lonza and Servier for the production of L-asparaginase API was increased.