Market Analysis

Disaster recovery as a service (Global, 2023)

Introduction

DRaaS has become a key element of modern business continuity strategies, with the increasing frequency and severity of natural disasters, cyber-attacks and operational interruptions. Many companies across a range of industries are now looking for disaster recovery solutions that not only protect their data but also ensure minimal downtime and fast recovery in the face of unforeseen events. The increasing migration of IT services to the cloud is driving the demand for scalable, flexible and cost-effective DRaaS solutions. This report explores the changing DRaaS landscape, examining the key trends, technological developments and competitive dynamics shaping the future of disaster recovery services. By understanding these developments, it is possible to manage risk more effectively and increase resilience in the face of unforeseen events.

PESTLE Analysis

- Political

- In 2023, governments have become more restrictive on data protection and cyber security. Over thirty countries have passed new regulations to strengthen data security. GDPR in the European Union, for example, has increased the cost of compliance by 25 per cent for companies, which are looking for more reliable disaster recovery solutions. Meanwhile, the US government has allocated $US 1.5 billion for cyber security, including $US 800 million for disaster recovery.

- Economic

- The rise in information technology spending has been accompanied by an increase in the amount of money invested in it, with the total amount spent on it in 2023 expected to reach $ 4.5 billion. In particular, the need for effective disaster recovery solutions has increased, as companies are becoming more aware of the financial consequences of data loss. The average cost of downtime has reached $ 5,600 per minute. In order to reduce this cost, companies are investing more in disaster recovery as a service (DRaaS) and ensuring the continuity of their business.

- Social

- In recent years, awareness of data security and disaster recovery has increased, and recent research shows that 78% of consumers are concerned about the security of their personal data. This increased awareness has led to a demand for transparency in disaster recovery, and 65% of consumers prefer companies that have a clear disaster recovery plan. So in order to meet the expectations of consumers and to ensure trust in the data security of their data, companies are increasingly adopting disaster recovery as a service.

- Technological

- The cloud and virtualization have had a considerable influence on the DRaaS market. In 2023, it is expected that around 70 per cent of organizations will have migrated to cloud-based solutions, which can speed up recovery times and improve data availability. Artificial intelligence and machine learning are also having a significant effect on the DRaaS market. They can help companies to make better predictions about potential risks and automate their DR procedures more effectively.

- Legal

- Moreover, the legal framework has undergone a change, with more than fifty new data protection laws being passed in 2023. Among other things, these laws require companies to put in place disaster recovery plans, in order to meet the requirements of data retention and protection. For example, the Californian Consumer Protection Act (CCPA) imposes a fine of up to $ 7,500 per day of non-compliance. In this way, companies are obliged to adopt DRaaS in order to avoid the consequences of the law and to comply with the increasingly strict data protection regulations.

- Environmental

- Data centers are being scrutinized for their impact on the environment. By 2023 the information technology industry will contribute about 2% of the world's carbon dioxide emissions. In response, many companies are looking for eco-friendly disaster recovery solutions. In fact, 40% of companies have made a sustainable IT strategy a priority. Energy-efficient data centers and green energy sources are being adopted as a means of reducing carbon emissions while still maintaining effective disaster recovery.

Porter's Five Forces

- Threat of New Entrants

- The market for disaster recovery as a service (DRaaS) has moderate entry barriers. The initial investment in the necessary technology and the required equipment can be high, but the growing demand for cloud solutions and the increasing awareness of the need for disaster recovery are attracting new entrants to the market. There are, however, established players in the market with strong brand recognition and customer loyalty that can pose a challenge to new entrants.

- Bargaining Power of Suppliers

- The bargaining power of the suppliers in the DRaaS market is relatively low. There are many different technology suppliers and cloud service platforms. This makes it easy for companies to change suppliers if they wish. This abundance of choices reduces the influence of individual suppliers on the price and conditions of the service.

- Bargaining Power of Buyers

- High - Buyers in the DRaaS market have high bargaining power, because of the availability of several service providers and the critical importance of disaster recovery solutions. Customers can demand better terms and prices, especially if they are large companies with high data protection requirements. Comparisons between the various offers and services also increase the bargaining power of the buyer.

- Threat of Substitutes

- The threat of substitutes in the DRaaS market is moderate. Various backup solutions and on-premises disaster recovery methods are still available, but the growing popularity of cloud-based services and their advantages, such as scalability and cost-effectiveness, make them more attractive. The threat of substitutes is moderate because some companies may still prefer to use the traditional methods.

- Competitive Rivalry

- Competition is high in the DRaaS market. There are many players who are trying to win market share. These companies are constantly improving their service offerings in order to differentiate themselves. These changes are being driven by the speed of technological change and the number of new entrants. This is driving companies to improve their service offerings and their pricing strategies.

SWOT Analysis

Strengths

- High demand for data protection and business continuity solutions.

- Scalability and flexibility of services to meet diverse client needs.

- Cost-effectiveness compared to traditional disaster recovery solutions.

- Rapid deployment and ease of integration with existing IT infrastructure.

Weaknesses

- Dependence on internet connectivity for service access.

- Potential data security and privacy concerns.

- Limited customization options for specific industry needs.

- Challenges in managing multi-cloud environments.

Opportunities

- Growing awareness of the importance of disaster recovery planning.

- Expansion into emerging markets with increasing digitalization.

- Integration of advanced technologies like AI and machine learning.

- Partnerships with cloud service providers to enhance service offerings.

Threats

- Intense competition from established players and new entrants.

- Rapid technological changes requiring constant adaptation.

- Regulatory changes impacting data management and storage.

- Economic downturns affecting IT budgets and spending.

Summary

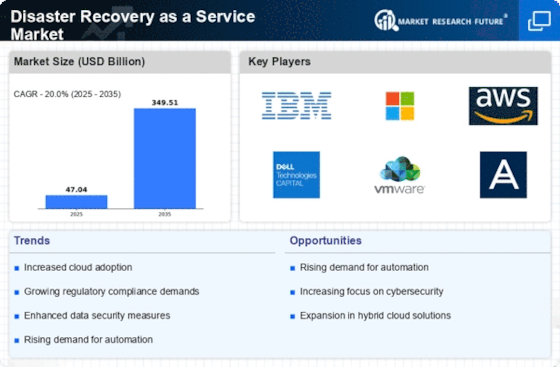

The Disaster Recovery as a Service market will be characterized by strong demand in 2023, driven by the need for data protection and business continuity. The market is characterized by its scalability and cost effectiveness. However, the market is faced with the need for reliable Internet connections and data security concerns. The market is growing in emerging countries and technologically. However, the market must be able to deal with competition and regulatory changes to maintain its momentum.

Leave a Comment