Digital Printing Size

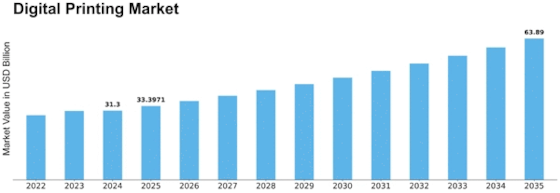

Digital Printing Market Growth Projections and Opportunities

The digital printing market is inspired by a myriad of elements that together shape its trajectory and improvement. One pivotal thing is the escalating demand for quick-run and on-call printing. Businesses across numerous industries are seeking the power supplied by digital printing step by step, permitting them to produce smaller quantities without incurring excessive charges. Technological advancements play an essential part in driving marketplace conditions. The relentless pursuit of stronger performance and efficiency by way of technology providers fuels the market's evolution, permitting organizations to access current solutions that deal with their unique printing necessities. Market components are also closely prompted by the versatility of digital printing programs. The capacity of digital printing to cater to diverse substrates, inclusive of paper, textiles, ceramics, and three-dimensional objects, expands its applicability across diverse industries. This versatility is especially glaring in packaging, in which digital printing enables complicated and customized designs on a huge range of substances. The competitive landscape and market consolidation represent vast marketplace factors. The digital printing market is witnessing improved opposition among generation providers, leading to a steady race for innovation and cost-effective answers. Mergers and acquisitions inside the enterprise, in addition, contribute to the evolution of marketplace conditions, with companies searching to reinforce their abilities and develop their market attainment. While the digital printing market offers numerous opportunities, it also faces challenges that affect its trajectory. In summary, the digital printing market is formed by way of a combination of elements, from technological advancements and value-effectiveness to sustainability issues and market opposition.

Leave a Comment