Market Trends

Key Emerging Trends in the Digital Isolator Market

A major trend is towards ever smaller electronic components worldwide, which has led to greater demand for compactness and space efficiency. This is consistent with the digital isolators because they provide isolation but take up less space. Modern designs need high performance digital isolators with minimal footprint.

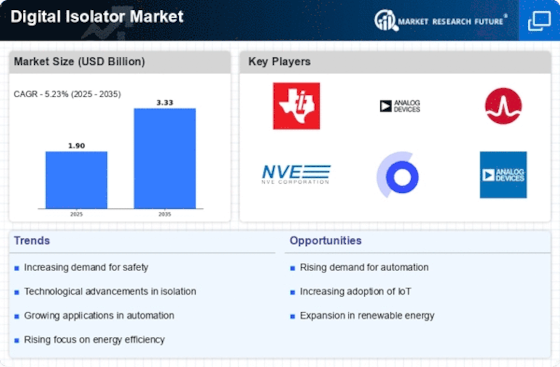

In addition, trends within this sector are affected by an increase in renewable energy applications. As a result, there is a growing requirement for digital isolators utilized in power conversion and energy storage devices as solar or wind energy systems become more common . Furthermore, such isolators enhance sustainability, safety and efficiency of renewable energy systems thereby indicating that more sustainable sources of energy are being sought after across markets globally.

Moreover, automotive industry’s push into electric vehicles has impacted how it uses this device thus affecting its marketability. The increasing prevalence of electric vehicles require increased use of this device in many aspects such as electric drivetrains or charging infrastructure battery management systems among others involved EV’s early adoption phases driving its popularity into many different aspects connected with today’s kind cars now . They have been adopted so much since they conform to certain needs profiles from different auto manufacturers hence showing acceptance changes over time.

Furthermore, IoT (Internet of Things) shapes trends within digital isolator markets significantly. With an increasing demand for secure channels between all stakeholders associated with IoT devices drove by expanding IoT adoption across various industries . For instance, ensuring data integrity on IoT applications requires digital isolators to provide isolation. The industry trend in advanced features integration into digital isolators aimed at improving performance and functionality. What this means is that now, low power consumption, high data rates and increased temperature tolerance have become standard requirements. This means manufacturers must be on their toes all the time to stay competitive with market dynamics associated with these trends. Optocouplers are being replaced by digital isolators in the market place. Optocouplers, which have traditionally been used for electrical isolation, suffer from low data rates and environmental sensitivity. Replacement of these devices with digital isolators having benefits like higher speed transmission of information and rock-solid reliability is an example of technology substitution trend within this field today. Industry 4.0 and intelligent manufacturing are other powerful trend in the area of digital isolators that are being shaped up today. For instance, industrial needs require more use of digital isolators as automation, connectivity and exchange of information among industries focusing on a term “smart factory” means they need reliable communication tools to ensure their smooth operations. These products hence play a key role in secure communication because they serve as a platform for smart factories.

Leave a Comment