-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

2.1.

-

Definition

-

Scope of the Study

- Research Objective

- Limitations

-

2.2.2.

-

Assumptions

-

RESEARCH METHODOLOGY

-

Overview

-

Data Mining

-

Secondary Research

-

Primary Research

- Breakdown of Primary

-

3.4.1.

-

Primary Interviews and Information Gathering Process

-

Respondents

-

Forecasting Modality

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

-

Data Triangulation

-

Validation

-

MARKET DYNAMICS

-

Overview

-

Drivers

-

Restraints

-

Opportunities

-

MARKET FACTOR ANALYSIS

-

5.1.

-

Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining

- Bargaining Power of Buyers

- Threat of

- Threat of Substitutes

- Intensity of Rivalry

-

Power of Suppliers

-

New Entrants

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Opportunity and Threat Analysis

-

5.3.2.

-

Regional Impact

-

GLOBAL DIGITAL

-

IDENTITY IN AIRPORTS MARKET, BY OFFERINGS

-

Overview

-

Solutions

-

Services

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION

-

TYPE

-

Overview

-

Identity Verification

-

Authentication

-

Identity Lifecycle Management

-

Other Solution Types

-

GLOBAL

-

DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE

-

Overview

-

8.2.

-

Biometric

-

Non- biometric

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY ORGANIZATION SIZE

-

Overview

-

Large Enterprises

-

9.3.

-

SMEs

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET, BY REGION

-

10.1.1.

-

Overview

-

10.2.

-

Europe

-

10.3.1.

-

China

-

10.3.5.

-

Australia

-

10.4.1.

-

Middle East

-

North America

-

U.S.

-

Canada

-

Germany

-

France

-

U.K

-

Italy

-

Spain

-

Rest of Europe

-

Asia-Pacific

- India

- Japan

- South Korea

- Rest of Asia-Pacific

-

Rest of the World

- Africa

- Latin America

-

COMPETITIVE

-

LANDSCAPE

-

Overview

-

Competitive Analysis

-

Market

-

Share Analysis

-

Major Growth Strategy in the Global DIGITAL IDENTITY IN

-

AIRPORTS MARKET,

-

Competitive Benchmarking

-

Leading Players

-

in Terms of Number of Developments in the Global DIGITAL IDENTITY IN AIRPORTS MARKET,

-

Key developments and Growth Strategies

- New Offering Launch/Solution

- Merger & Acquisitions

- Joint Ventures

-

Type Deployment

-

Major Players Financial Matrix

- Sales & Operating Income,

- Major Players R&D Expenditure. 2022

-

COMPANY PROFILES

-

NEC

- Company Overview

- Financial Overview

- Key Developments

- : SWOT ANALYSIS

-

12.1.3.

-

Product Offered

-

12.1.6.

-

Key Strategies

-

Samsung SDS

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.2.2.

-

Financial Overview

-

Thales

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.3.1.

-

Company Overview

-

Telus

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

IDEMIA

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.5.2.

-

Financial Overview

-

GBG

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.6.1.

-

Company Overview

-

Tessi

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

Daon

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.8.2.

-

Financial Overview

-

ForgeRock

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.9.1.

-

Company Overview

-

ImageWare

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

Jumio

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.11.2.

-

Financial Overview

-

iProov

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.12.1.

-

Company Overview

-

ID R&D

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

Refinitiv

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

OneSpan

- Company Overview

- Financial Overview

- Product

- Key Developments

- : SWOT ANALYSIS

-

Offered

-

12.15.6.

-

Key Strategies

-

Smartmatic

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.16.2.

-

Financial Overview

-

Freja EID Group

- Company Overview

- Financial Overview

- Product

- Key Developments

- : SWOT ANALYSIS

-

Offered

-

12.17.6.

-

Key Strategies

-

Vintegris

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.18.2.

-

Financial Overview

-

AU10TIX

- Company Overview

- Financial Overview

- Product

- Key Developments

- : SWOT ANALYSIS

-

Offered

-

12.19.6.

-

Key Strategies

-

Signicat

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.20.2.

-

Financial Overview

-

Duo Security

- Company Overview

- Financial Overview

- Product

- Key Developments

- : SWOT ANALYSIS

-

Offered

-

12.21.6.

-

Key Strategies

-

Syntizen

- Company Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

12.22.2.

-

Financial Overview

-

Hashcash Consultant

- Company Overview

- Financial Overview

- Product

- Key Developments

- : SWOT ANALYSIS

-

Offered

-

12.23.6.

-

Key Strategies

-

Good Digital Identity

- Company Overview

- Financial Overview

- Product Offered

- Key Developments

- : SWOT ANALYSIS

- Key Strategies

-

APPENDIX

-

13.1.

-

References

-

Related Reports

-

-

LIST OF TABLES

-

TABLE

-

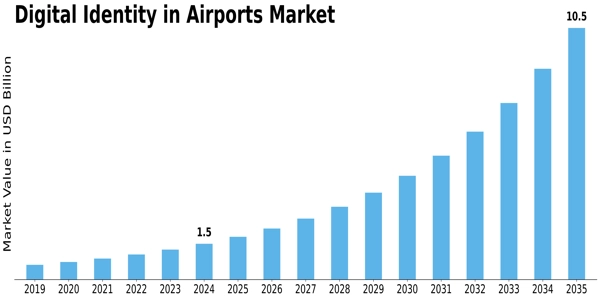

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET, SYNOPSIS, 2018-2032

-

GLOBAL

-

DIGITAL IDENTITY IN AIRPORTS MARKET, ESTIMATES & FORECAST, 2018-2032 (USD BILLION)

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD

-

BILLION)

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE,

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

GLOBAL DIGITAL IDENTITY IN

-

AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

NORTH

-

AMERICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

NORTH AMERICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032

-

(USD BILLION)

-

NORTH AMERICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY

-

IDENTITY TYPE, 2018-2032 (USD BILLION)

-

NORTH AMERICA DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

TABLE 11

-

NORTH AMERICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

-

U.S. DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD

-

BILLION)

-

U.S. DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE,

-

U.S. DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

U.S. DIGITAL IDENTITY IN

-

AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

CANADA

-

DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

TABLE

-

CANADA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD

-

BILLION)

-

CANADA DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE,

-

CANADA DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

EUROPE DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

EUROPE DIGITAL

-

IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

TABLE

-

EUROPE DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD

-

BILLION)

-

EUROPE DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION

-

SIZE, 2018-2032 (USD BILLION)

-

EUROPE DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

-

GERMANY DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

GERMANY DIGITAL

-

IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

TABLE

-

GERMANY DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD

-

BILLION)

-

GERMANY DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION

-

SIZE, 2018-2032 (USD BILLION)

-

FRANCE DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

FRANCE DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

FRANCE

-

DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

FRANCE DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032

-

(USD BILLION)

-

U.K DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING,

-

U.K DIGITAL IDENTITY IN AIRPORTS MARKET, BY

-

SOLUTION TYPE, 2018-2032 (USD BILLION)

-

U.K DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

U.K DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

TABLE 37

-

ITALY DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

ITALY DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032

-

(USD BILLION)

-

ITALY DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY

-

TYPE, 2018-2032 (USD BILLION)

-

ITALY DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

SPAIN DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

SPAIN DIGITAL

-

IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

TABLE

-

SPAIN DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

SPAIN DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032

-

(USD BILLION)

-

REST OF EUROPE DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY OFFERING, 2018-2032 (USD BILLION)

-

REST OF EUROPE DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

REST

-

OF EUROPE DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD

-

BILLION)

-

REST OF EUROPE DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION

-

SIZE, 2018-2032 (USD BILLION)

-

ASIA PACIFIC DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

ASIA PACIFIC DIGITAL

-

IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

TABLE

-

ASIA PACIFIC DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032

-

(USD BILLION)

-

ASIA PACIFIC DIGITAL IDENTITY IN AIRPORTS MARKET, BY

-

ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

ASIA PACIFIC DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

-

CHINA DIGITAL

-

IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

TABLE 55

-

CHINA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

CHINA DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032

-

(USD BILLION)

-

CHINA DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION

-

SIZE, 2018-2032 (USD BILLION)

-

JAPAN DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY OFFERING, 2018-2032 (USD BILLION)

-

JAPAN DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

JAPAN DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

JAPAN

-

DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

INDIA DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD

-

BILLION)

-

INDIA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE,

-

INDIA DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

INDIA DIGITAL IDENTITY IN

-

AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

SOUTH

-

KOREA DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

SOUTH KOREA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032

-

(USD BILLION)

-

SOUTH KOREA DIGITAL IDENTITY IN AIRPORTS MARKET, BY

-

IDENTITY TYPE, 2018-2032 (USD BILLION)

-

SOUTH KOREA DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

TABLE 70

-

AUSTRALIA DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

AUSTRALIA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032

-

(USD BILLION)

-

AUSTRALIA DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY

-

TYPE, 2018-2032 (USD BILLION)

-

AUSTRALIA DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

REST OF ASIA

-

PACIFIC DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

REST OF ASIA PACIFIC DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION

-

TYPE, 2018-2032 (USD BILLION)

-

REST OF ASIA PACIFIC DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD BILLION)

-

REST

-

OF ASIA PACIFIC DIGITAL IDENTITY IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032

-

(USD BILLION)

-

REST OF THE WORLD DIGITAL IDENTITY IN AIRPORTS MARKET,

-

BY OFFERING, 2018-2032 (USD BILLION)

-

REST OF THE WORLD DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032 (USD BILLION)

-

REST

-

OF THE WORLD DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY TYPE, 2018-2032 (USD

-

BILLION)

-

REST OF THE WORLD DIGITAL IDENTITY IN AIRPORTS MARKET, BY

-

ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

REST OF THE WORLD DIGITAL

-

IDENTITY IN AIRPORTS MARKET, BY COUNTRY, 2018-2032 (USD BILLION)

-

MIDDLE

-

EAST DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

MIDDLE EAST DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032

-

(USD BILLION)

-

MIDDLE EAST DIGITAL IDENTITY IN AIRPORTS MARKET, BY

-

IDENTITY TYPE, 2018-2032 (USD BILLION)

-

MIDDLE EAST DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

TABLE 87

-

AFRICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

AFRICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032

-

(USD BILLION)

-

AFRICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY IDENTITY

-

TYPE, 2018-2032 (USD BILLION)

-

AFRICA DIGITAL IDENTITY IN AIRPORTS

-

MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

LATIN AMERICA

-

DIGITAL IDENTITY IN AIRPORTS MARKET, BY OFFERING, 2018-2032 (USD BILLION)

-

TABLE

-

LATIN AMERICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY SOLUTION TYPE, 2018-2032

-

(USD BILLION)

-

LATIN AMERICA DIGITAL IDENTITY IN AIRPORTS MARKET, BY

-

IDENTITY TYPE, 2018-2032 (USD BILLION)

-

LATIN AMERICA DIGITAL IDENTITY

-

IN AIRPORTS MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD BILLION)

-

-

LIST OF FIGURES

-

RESEARCH PROCESS

-

MARKET STRUCTURE

-

FOR THE GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET

-

MARKET DYNAMICS

-

FOR THE GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET

-

GLOBAL DIGITAL

-

IDENTITY IN AIRPORTS MARKET, SHARE (%), BY OFFERING, 2022

-

GLOBAL DIGITAL

-

IDENTITY IN AIRPORTS MARKET, SHARE (%), BY SOLUTION TYPE, 2022

-

GLOBAL

-

DIGITAL IDENTITY IN AIRPORTS MARKET, SHARE (%), BY IDENTITY TYPE, 2022

-

FIGURE

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET, SHARE (%), BY ORGANIZATION SIZE, 2022

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS MARKET, SHARE (%), BY REGION, 2022

-

NORTH AMERICA: DIGITAL IDENTITY IN AIRPORTS MARKET, SHARE (%), BY REGION,

-

EUROPE: DIGITAL IDENTITY IN AIRPORTS MARKET, SHARE (%), BY

-

REGION, 2022

-

ASIA-PACIFIC: DIGITAL IDENTITY IN AIRPORTS MARKET, SHARE

-

(%), BY REGION, 2022

-

REST OF THE WORLD: DIGITAL IDENTITY IN AIRPORTS

-

MARKET, SHARE (%), BY REGION, 2022

-

GLOBAL DIGITAL IDENTITY IN AIRPORTS

-

MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

-

NEC: : FINANCIAL OVERVIEW

-

SNAPSHOT

-

NEC : SWOT ANALYSIS

-

SAMSUNG SDS : FINANCIAL

-

OVERVIEW SNAPSHOT

-

SAMSUNG SDS : SWOT ANALYSIS

-

THALES

-

: FINANCIAL OVERVIEW SNAPSHOT

-

THALES : SWOT ANALYSIS

-

FIGURE

-

TELUS : FINANCIAL OVERVIEW SNAPSHOT

-

TELUS : SWOT ANALYSIS

-

FIGURE

-

IDEMIA : FINANCIAL OVERVIEW SNAPSHOT

-

IDEMIA : SWOT ANALYSIS

-

GBG : FINANCIAL OVERVIEW SNAPSHOT

-

GBG : SWOT ANALYSIS

-

TESSI : FINANCIAL OVERVIEW SNAPSHOT

-

TESSI : SWOT ANALYSIS

-

DAON : FINANCIAL OVERVIEW SNAPSHOT

-

DAON : SWOT ANALYSIS

-

FORGEROCK : FINANCIAL OVERVIEW SNAPSHOT

-

FORGEROCK : SWOT

-

ANALYSIS

-

IMAGEWARE : FINANCIAL OVERVIEW SNAPSHOT

-

IMAGEWARE

-

: SWOT ANALYSIS

-

JUMIO : FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 35

-

JUMIO : SWOT ANALYSIS

-

IPROOV : FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE

-

IPROOV : SWOT ANALYSIS

-

ID R&D : FINANCIAL OVERVIEW SNAPSHOT

-

ID R&D : SWOT ANALYSIS

-

REFINITIV : FINANCIAL OVERVIEW

-

SNAPSHOT

-

REFINITIV : SWOT ANALYSIS

-

ONESPAN : FINANCIAL

-

OVERVIEW SNAPSHOT

-

ONESPAN : SWOT ANALYSIS

-

SMARTMATIC

-

: FINANCIAL OVERVIEW SNAPSHOT

-

SMARTMATIC : SWOT ANALYSIS

-

FIGURE

-

FREJA EID GROUP : FINANCIAL OVERVIEW SNAPSHOT

-

FREJA EID GROUP

-

: SWOT ANALYSIS

-

VINTEGRIS : FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE

-

VINTEGRIS : SWOT ANALYSIS

-

AU10TIX : FINANCIAL OVERVIEW SNAPSHOT

-

AU10TIX : SWOT ANALYSIS

-

SIGNICAT : FINANCIAL OVERVIEW

-

SNAPSHOT

-

SIGNICAT : SWOT ANALYSIS

-

DUO SECURITY : FINANCIAL

-

OVERVIEW SNAPSHOT

-

DUO SECURITY : SWOT ANALYSIS

-

SYNTIZEN

-

: FINANCIAL OVERVIEW SNAPSHOT

-

SYNTIZEN : SWOT ANALYSIS

-

FIGURE

-

HASHCASH CONSULTANT : FINANCIAL OVERVIEW SNAPSHOT

-

HASHCASH CONSULTANT

-

: SWOT ANALYSIS

-

GOOD DIGITAL IDENTITY : FINANCIAL OVERVIEW SNAPSHOT

-

GOOD DIGITAL IDENTITY : SWOT ANALYSIS

Leave a Comment