Digital Business Card Size

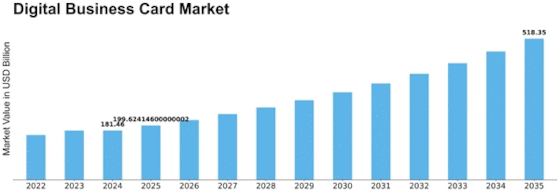

Digital Business Card Market Growth Projections and Opportunities

The rapid digitization of business processes is one of the main reasons for the strong growth of the market." As companies around the world move toward digital change, digital business cards will follow suit. These digital options are better than paper cards because they are more efficient and better for the environment. This fits with many groups' goals for sustainability. The trend toward working from home has also increased the need for virtual networking tools, which has helped the digital business card market grow even more. Since workers don't have to work out of an office anymore, they need a way to keep their contact information with them wherever they go and share it quickly. Smartphones and other devices that can access digital business cards make networking easy in this digital and faraway age. The increased focus on personal branding is another important change.

Everyone, including companies, knows how important it is to have a strong online footprint. Digital business cards are a big part of this. People can put their contact information and links to social media accounts, resumes, and other relevant content on these cards. This makes them look more professional and leaves a long impact on those who receive them. Also helping the digital business card market are features like interoperability and interaction. Users want options that work well with their current contact and apps, so they can share information more quickly. Many digital business card platforms work with well-known email clients, CRM systems, and other business apps. This makes them more appealing to a large group of users. Another big change in the world of digital business cards is the rise of artificial intelligence (AI) and data analytics. Analytics, smart contact updates, and data insights are some of the more advanced features that give users helpful data about their network and exchanges.

This approach is based on data, which not only makes the user experience better but also helps people make smarter choices about networking. Also, companies and people are making decisions about digital business card options based on growing concerns about data privacy and security. People like sites that put the safety of their personal and business info first. This led to the creation of safe and protected digital business card solutions that protect user data and keep it safe. Another important issue is the amount of competition and the growth of the business. Each digital business card company has its own set of features and functions, and more and more are getting into the market. Businesses are joining and buying other businesses to make the market bigger. They do this to improve their goods and services and reach more people.

Leave a Comment