- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

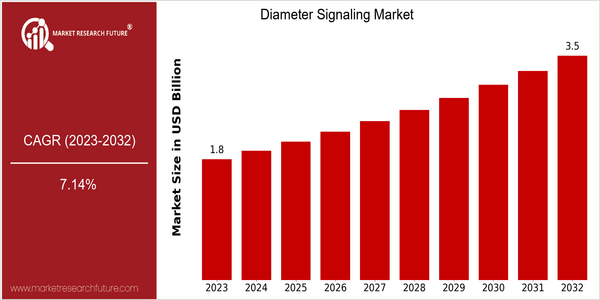

| Year | Value |

|---|---|

| 2023 | USD 1.83 Billion |

| 2032 | USD 3.45 Billion |

| CAGR (2024-2032) | 7.14 % |

Note – Market size depicts the revenue generated over the financial year

The Diameter Signaling Market is currently valued at USD 1.83 billion in 2023 and is projected to reach USD 3.45 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 7.14% from 2024 to 2032. This growth trajectory indicates a strong demand for Diameter signaling solutions, which are essential for managing signaling traffic in telecommunications networks, particularly with the increasing adoption of 4G and 5G technologies. As mobile data consumption continues to surge, the need for efficient signaling management becomes critical, driving investments in Diameter signaling infrastructure and services. Several factors are propelling this market expansion, including the rising number of mobile subscribers, the proliferation of IoT devices, and the ongoing transition to next-generation networks. Technological advancements, such as the integration of artificial intelligence and machine learning in signaling management, are also enhancing operational efficiencies and service quality. Key players in the Diameter signaling space, such as Oracle, Ericsson, and Nokia, are actively pursuing strategic initiatives, including partnerships and product innovations, to strengthen their market positions and address the evolving needs of telecommunications operators. These developments underscore the dynamic nature of the Diameter Signaling Market and its critical role in supporting the future of connectivity.

Regional Market Size

Regional Deep Dive

The Diameter Signaling Market is experiencing significant growth across various regions, driven by the increasing demand for efficient network management and the rise of 4G and 5G technologies. In North America, the market is characterized by advanced telecommunications infrastructure and a high adoption rate of new technologies, while Europe is focusing on regulatory compliance and interoperability among different signaling protocols. The Asia-Pacific region is witnessing rapid expansion due to the growing number of mobile subscribers and investments in telecom infrastructure. Meanwhile, the Middle East and Africa are gradually adopting Diameter signaling as part of their digital transformation initiatives, and Latin America is seeing a surge in mobile data consumption, further propelling the market.

Europe

- The European Telecommunications Standards Institute (ETSI) has introduced new standards for Diameter signaling, which are expected to improve interoperability and security across different networks, thereby boosting market growth.

- Telecom giants such as Vodafone and Deutsche Telekom are collaborating on projects to enhance their Diameter signaling capabilities, focusing on optimizing network performance and user experience.

Asia Pacific

- Countries like China and India are rapidly expanding their telecom infrastructure, with significant investments in 5G technology, which is expected to increase the demand for Diameter signaling solutions to handle the surge in mobile data traffic.

- Local companies such as Huawei and ZTE are developing advanced Diameter signaling products tailored to meet the specific needs of the region's diverse telecom landscape.

Latin America

- The increasing smartphone penetration in Latin America is driving mobile data consumption, prompting telecom operators to adopt Diameter signaling solutions to manage network traffic effectively.

- Companies such as América Móvil are enhancing their Diameter signaling infrastructure to support the growing demand for mobile services and improve overall network performance.

North America

- The Federal Communications Commission (FCC) has been actively promoting the deployment of 5G networks, which is driving the demand for Diameter signaling solutions to manage increased data traffic and ensure seamless connectivity.

- Key players like Oracle and Ericsson are investing in innovative Diameter signaling solutions, enhancing their product offerings to support the growing needs of telecom operators in the region.

Middle East And Africa

- The UAE's Telecommunications Regulatory Authority (TRA) is promoting the adoption of advanced signaling protocols, including Diameter, to enhance the region's telecom capabilities and support the rollout of smart city initiatives.

- Telecom operators like Etisalat and MTN are investing in Diameter signaling solutions to improve their network efficiency and customer experience, particularly as mobile data consumption continues to rise.

Did You Know?

“Did you know that Diameter signaling can support up to 1,000 times more transactions per second than its predecessor, the Signaling System 7 (SS7)? This capability is crucial for managing the massive data traffic generated by modern mobile networks.” — Telecom Industry Association

Segmental Market Size

The Diameter Signaling Market is experiencing stable growth, driven by the increasing demand for efficient network management and the rise of IoT applications. Key factors propelling this segment include the need for enhanced data traffic management due to the proliferation of mobile devices and the implementation of regulatory policies that mandate improved network security and reliability. Additionally, the shift towards 5G networks necessitates robust signaling solutions to handle the increased complexity of network interactions. Currently, the market is in a scaled deployment stage, with notable adoption by telecom giants such as Ericsson and Nokia, particularly in regions like North America and Europe. Primary applications include managing signaling traffic in mobile networks, facilitating real-time data exchange for applications like VoLTE and IoT services. Trends such as the ongoing digital transformation across industries and government initiatives promoting smart city developments are catalyzing growth. Technologies like Network Functions Virtualization (NFV) and Software-Defined Networking (SDN) are shaping the evolution of Diameter signaling, enabling more flexible and efficient network architectures.

Future Outlook

The Diameter Signaling Market is poised for significant growth from 2023 to 2032, with the market value projected to increase from $1.83 billion to $3.45 billion, reflecting a robust compound annual growth rate (CAGR) of 7.14%. This growth trajectory is primarily driven by the escalating demand for efficient network management and the increasing complexity of mobile networks, particularly with the ongoing rollout of 5G technology. As operators seek to enhance user experience and optimize resource allocation, the adoption of Diameter signaling solutions is expected to penetrate deeper into telecommunications infrastructure, with usage rates anticipated to reach approximately 60% of global telecom operators by 2032, up from around 35% in 2023. Key technological advancements, such as the integration of artificial intelligence and machine learning into Diameter signaling platforms, are expected to further propel market growth. These technologies will enable real-time analytics and automated decision-making, enhancing the ability to manage signaling traffic effectively. Additionally, regulatory policies promoting network security and data privacy will drive investments in Diameter signaling solutions, as operators strive to comply with stringent regulations. Emerging trends, including the rise of IoT devices and the need for seamless connectivity across various platforms, will also contribute to the market's expansion, positioning Diameter signaling as a critical component in the evolving telecommunications landscape.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.8394 Billion |

| Growth Rate | 8.20% (2023-2032) |

Diameter Signaling Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.