Market Analysis

In-depth Analysis of Diabetic Neuropathy Treatment Market Industry Landscape

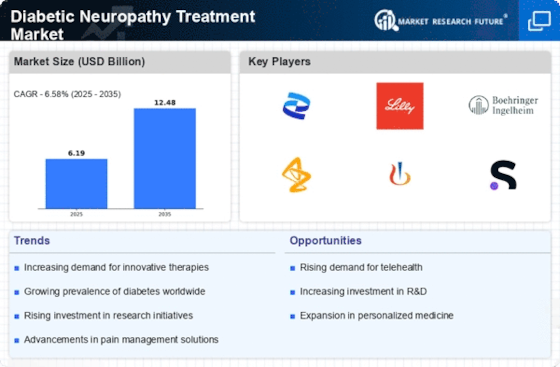

The market dynamics of Diabetic Neuropathy Treatment are drastically encouraged by means of the growing incidence of diabetes globally. As the number of individuals with diabetes keeps rising, the demand for powerful neuropathy remedies is witnessing a parallel surge. Growing cognizance among healthcare experts and sufferers about the complications associated with Diabetic Neuropathy is contributing to early analysis and remedy initiation. This heightened recognition is impacting the market boom as timely intervention turns into a priority. A shift closer to an affected person-centric method in healthcare is influencing the market dynamics, with a focus on improving the first-class lifestyles for people with Diabetic Neuropathy. Treatment strategies are increasingly tailored to a person's desires, fostering a more customized and effective approach. Collaborations and partnerships between pharmaceutical agencies, studies institutions, and healthcare businesses are becoming increasingly common. These alliances' goal is to pool resources, proportion knowledge, and accelerate the improvement and commercialization of the latest Diabetic Neuropathy Treatments. The dynamics of the Diabetic Neuropathy Treatment market are also stimulated by way of compensation policies and market admission. Favorable compensation situations for brand-spanking new remedy alternatives can significantly affect their adoption rates and market penetration. The market is characterized by severe competition among pharmaceutical groups striving to gain an aggressive side through product differentiation and market positioning. Continuous efforts to outperform competitors force ongoing studies, improvement, and advertising of sports. Economic factors on a global scale, along with healthcare expenditure tendencies and authorities' healthcare rules, play an essential role in shaping the market dynamics. Economic situations can affect the affordability and accessibility of Diabetic Neuropathy Treatments. Variances in patient demographics and geographic factors contribute to the diverse market dynamics of Diabetic Neuropathy Treatment. Factors like local occurrence quotes, healthcare infrastructure, and socio-monetary situations have an impact on treatment styles and market boom. The regulatory landscape governing the approval and commercialization of Diabetic Neuropathy Treatments is a key component impacting market dynamics. Stringent regulatory necessities can pose challenges, while streamlined approval strategies can expedite market entry for new treatment plans. The Diabetic Neuropathy Treatment market is increasing in emerging economies, imparting untapped opportunities for market players. The rising incidence of diabetes in those areas creates an ability growth road for corporations willing to spend money on market enlargement strategies.

Leave a Comment