Increased Awareness and Education

The growing awareness and education surrounding sleep health are pivotal in driving the Dental Sleep Medicine Market. Campaigns aimed at educating the public about the risks associated with untreated sleep disorders have gained momentum. Healthcare professionals are increasingly emphasizing the link between oral health and sleep quality, leading to a greater understanding of dental sleep medicine. This heightened awareness is likely to result in more patients seeking dental interventions for sleep apnea, thereby expanding the market. Additionally, educational initiatives targeting dental practitioners are fostering a more informed workforce capable of addressing sleep-related issues, further propelling the Dental Sleep Medicine Market.

Rising Prevalence of Sleep Disorders

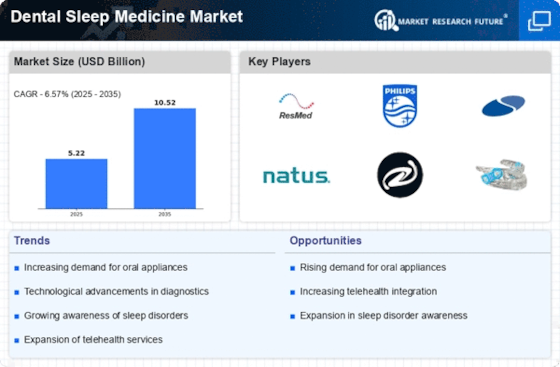

The increasing prevalence of sleep disorders, particularly obstructive sleep apnea, is a primary driver of the Dental Sleep Medicine Market. Recent estimates suggest that approximately 22 million individuals suffer from sleep apnea in the United States alone. This growing patient population necessitates effective treatment options, thereby propelling demand for dental sleep medicine solutions. As awareness of sleep disorders rises, more patients seek diagnosis and treatment, leading to a surge in the market. The Dental Sleep Medicine Market is likely to expand as healthcare providers recognize the importance of integrating dental solutions into sleep disorder management, potentially improving patient outcomes and quality of life.

Technological Innovations in Dental Devices

Technological advancements in dental devices are significantly influencing the Dental Sleep Medicine Market. Innovations such as custom-fitted oral appliances and advanced diagnostic tools enhance the effectiveness of treatments for sleep apnea and other sleep-related disorders. The introduction of 3D printing technology allows for the rapid production of personalized dental devices, improving patient comfort and compliance. Furthermore, the integration of telemedicine in dental practices facilitates remote consultations and follow-ups, making it easier for patients to access care. As these technologies continue to evolve, they are expected to drive growth in the Dental Sleep Medicine Market, attracting both practitioners and patients seeking modern solutions.

Aging Population and Associated Health Issues

The aging population is a significant factor contributing to the growth of the Dental Sleep Medicine Market. As individuals age, the likelihood of developing sleep disorders increases, with studies indicating that sleep apnea prevalence is higher among older adults. This demographic shift is expected to lead to a greater demand for dental sleep medicine solutions tailored to the needs of older patients. Furthermore, the correlation between age-related health issues and sleep disorders underscores the necessity for comprehensive treatment approaches. Consequently, the Dental Sleep Medicine Market is poised for expansion as healthcare systems adapt to the needs of an aging population, integrating dental solutions into broader health management strategies.

Interdisciplinary Collaboration in Healthcare

Interdisciplinary collaboration among healthcare providers is emerging as a crucial driver of the Dental Sleep Medicine Market. The integration of dental professionals into sleep medicine teams fosters a holistic approach to patient care, enhancing treatment outcomes. Collaborative efforts between dentists, sleep specialists, and primary care physicians facilitate comprehensive management of sleep disorders, leading to improved patient satisfaction. This trend is likely to encourage more dental practitioners to engage in sleep medicine, thereby expanding the market. As healthcare systems increasingly recognize the value of interdisciplinary approaches, the Dental Sleep Medicine Market is expected to benefit from enhanced cooperation and shared expertise among various healthcare disciplines.

Leave a Comment