Dental Services Organization Size

Dental Services Organization Market Growth Projections and Opportunities

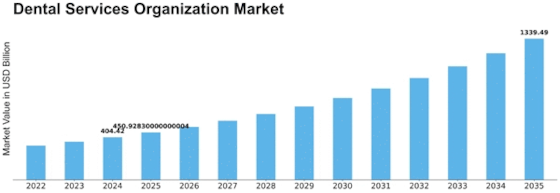

Dental services organization market to reach USD 866.4 billion by 2032 at 11.5% CAGR. Several variables shape the Dental Services Organization (DSO) Market's growth and development. Dental support organizations (DSOs) help offices reduce operations, improve efficiency, and focus on patient care. The rising of corporate dentistry, changing dental care delivery, technological advances, regulatory issues, and changing dental professional and consumer preferences drive market dynamics.

Changes in dental care delivery shape the DSO Market. Traditional solo dental practices are struggling with administrative costs, operational complexity, and digital technology adoption. DSOs provide staffing, billing, marketing, and technical infrastructure to help dentists focus on patient care. DSO market dynamics are growing due to need for more effective dental office management.

Corporate dentistry has a major impact on DSO markets. Corporate dental chains, frequently linked with DSOs, have become popular alternatives to private practices. Consolidating dental services into corporate organizations improves operational efficiency, scalability, and supplier negotiations. Corporate dentistry and DSO affiliations indicate a more organized and business-oriented approach to dental care delivery, affecting market dynamics.

Advances in technology affect DSO market dynamics. Digital tools and software improve efficiency, communication, and patient experience in dentistry practise management. DSOs use technology to standardize standards, manage scheduling, and improve treatment among associated offices. The movement toward digitization and automation in healthcare affects DSO market dynamics through digital technology adoption.

DSO market dynamics depend on regulations. Dentists must follow licensing, invoicing, and quality of care standards. To comply and reduce legal risks, DSOs must manage regulations. The regulatory environment affects DSO organization, operations, growth strategies, and market presence. DSO Market companies strategically address regulatory considerations to build a strong and compliant business strategy, affecting market dynamics.

DSO markets are heavily influenced by changing dental professional and patient preferences. Due to pooled resources, mentorship, and a more predictable income structure, dentists, especially younger ones, may join DSOs. However, DSO-affiliated practices may appeal to patients with their convenience, accessibility, and standardization. DSO offers that match dental professionals' and patients' tastes make the market dynamic.

Economic variables also affect DSO market dynamics. Economic conditions affect dental practice income, making DSO participation affordable and appealing to dentists. Economic downturns may cause cost-conscious dental practice management, affecting market growth. Conversely, a strengthening economy may enhance dental care investments, driving DSO support model demand."

Leave a Comment