Market Share

Dental Services Market Share Analysis

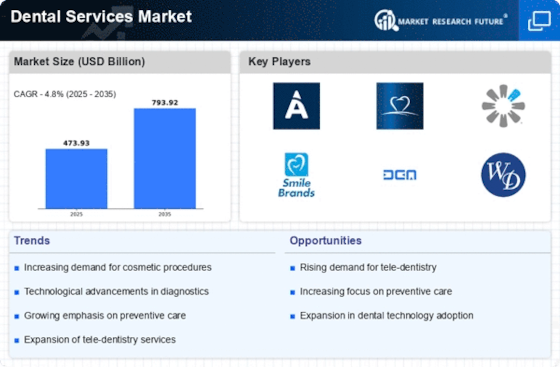

Inside the powerful scene of the dental services market, associations decisively position themselves to get a significant piece of the pie by utilizing various comprehensive methodologies. An essential spotlight is on conveying creative and particular dental administrations to meet the different necessities of patients. This includes coordinating state of the art innovations like laser dentistry, computerized radiography, and imaginative treatment draws near, guaranteeing an upper hand in conveying great dental administrations. To grow their market presence and take care of the different necessities of patients, dental specialist organizations offer a thorough exhibit of medicines, including preventive consideration, supportive methodology, restorative dentistry, and specific medicines. The situating of piece of the pie for dental services is considerably influenced by essential collusions with medical care foundations, protection suppliers, and local area associations; these partnerships work with the procurement of a greater patient segment, reinforce validity, and develop a positive brand discernment. Market situating puts huge accentuation on giving patient-driven care, improving facility conditions, coordinating mechanical headways, and fitting treatment plans to individual patients to develop dependability and energize ideal verbal exchange proposals. Dental services organizations should focus on computerized promoting and online perceivability to lay out associations with patients, disperse instructive materials, and feature their mastery, subsequently getting a part of the market. To lay out certainty among patients and administrative bodies, dental services suppliers should maintain authorization, quality principles, and administrative consistence. This exhibits their commitment to guaranteeing patient wellbeing and directing business morally. Dental specialist organizations are executing an overall extension technique to oblige territorial varieties in medical services foundation, social inclinations, and dental services rehearses. Dental specialist co-ops take part in dynamic local area investment by arranging instructive drives, supporting effort programs, taking part in neighbourhood occasions, and giving instructive assets that advance preventive consideration and oral wellbeing. Market entrance and patient accommodation are improved in the dental services market through the execution of straightforward evaluating models, reasonable valuing, and associations with protection suppliers. In the dental services industry, consistent headway and mechanical fuse that is educated by understanding information are basic for laying out a serious position. Associations that proactively request criticism from patients, distribute assets towards state-of-the-art advances, and adjust their administrations in light of pragmatic encounters decidedly affect patient dedication and fulfilment.

Leave a Comment