Market Trends

Key Emerging Trends in the Dental Biomaterials Market

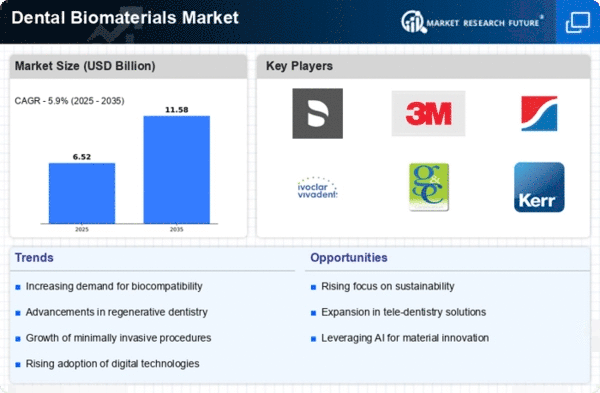

Dental polymers are used increasingly because dental technology is improving, people are living longer, and they are more conscious of tooth care. The key market shifts affecting dental nanomaterials will be discussed in this essay. Beauty dentistry, therapeutic dentistry, and a focus on oral health are increasing dental operations worldwide. Dental polymers must be innovative and reliable as dental care needs expand. Restorative dentistry is revolutionizing dental polymers. Composites, ceramics, and glass ionomers used in dentistry are improving in appearance, durability, and biocompatibility. This will improve and prolong repair techniques. Popular digital dentistry is transforming dental polymers. CAD/CAM, intraoral scanning, and 3D printing are revolutionizing dental crowns, bridges, and prostheses. Finding polymers that function with modern technologies is crucial. Dental issues are being treated with less invasive and meticulous dentistry. To reduce surgery harm, biomaterials are being developed for dentistry. This preserves tooth structure and improves appearance and function. The dental plastics industry is affected by the global aging population. Biomaterials for tooth decay, tooth loss, and gum disorders are required as more seniors see the dentist. Market demand for bioactive, tissue-regenerative tooth polymers is rising. When placing dental implants or performing periodontal surgery, employ materials that promote tissue, bone, and wound healing. These breakthroughs improve health. Most dental polymers are for cosmetic dentistry. More individuals are getting cosmetic dentistry, thus natural-looking plastics are needed. Tooth-colored composites, veneers, and ceramics are being employed in cosmetic repairs. Always-changing implant dentistry influences biomaterials for tooth implants. To fulfill rising demand for dental implants, researchers are developing safer, better osseointegration, and body-compatible materials. Dentistry polymers are becoming longer-lasting. Manufacturers aim to make eco-friendly goods. Biodegradable and recyclable materials are becoming increasingly common in dentistry to meet environmental aims. New polymers are altering orthodontics. Nickel-titanium metals, transparent aligners, and safe braces are driving oral biomaterials growth. Modern dentistry is more effective and pleasant. Oral polymers are developing worldwide, particularly in emerging markets. The market is growing because more individuals know about oral health, have money, and can afford dental treatment.

Leave a Comment