Dental Anesthesia Size

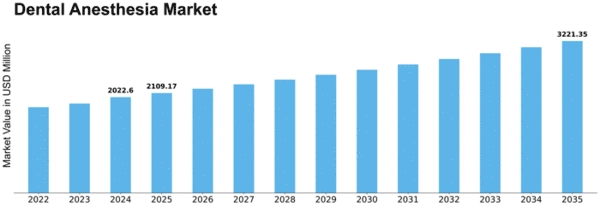

Dental Anesthesia Market Growth Projections and Opportunities

Anesthesia, a pharmaceutical agent used to induce the loss of sensation, distinguishes itself from analgesics or painkillers by causing sensory loss rather than merely offering pain relief. The dental anesthesia market is witnessing rapid growth attributed to factors such as the expanding geriatric population, a rising incidence of various dental diseases, and the introduction of new products by key players and manufacturers. However, challenges arise from factors like the availability of skilled anesthesiologists and stringent regulatory guidelines across different regions. Dental anesthesia, integral to dentistry, encompasses the application of anesthesia through various means such as local anesthetics, sedation, and general anesthesia. Its primary role lies in managing patients' pain during dental procedures and surgeries. In terms of product types, the global dental anesthesia market is categorized into lidocaine, mepivacaine, prilocaine, bupivacaine, articaine, and other variants, including ropivacaine and chloroprocaine. The Lidocaine segment, contributing the most substantial market share of 28.0% in 2020, is anticipated to reach USD 291.68 million by 2027, growing at a CAGR of 5.83% during the forecast period.

In considering the mode of administration, the global dental anesthesia market is segmented into maxillary, mandibular, and other methods. The maxillary segment holds the dominant market share at 51.9% in 2020, with an expected growth to USD 585.22 million by 2027, showcasing a CAGR of 5.56% during the forecast period.

Further categorization based on technique includes local infiltration, field block, and nerve block. The nerve block segment leads with the largest market share at 47.9% in 2020, projected to reach USD 513.63 million by 2027, growing at a CAGR of 4.96% during the forecast period.

Examining the duration of action, the global dental anesthesia market classifies into short, medium, and long. The medium duration segment commands the largest market share, comprising 50.9% in 2020, and is anticipated to reach USD 565.61 million by 2027, growing at a CAGR of 5.31% during the forecast period. Notably, the short duration segment is forecasted to exhibit the highest CAGR of 5.45%, reaching a market share of 38.5% by 2027.

Considering end-user segments, the global dental anesthesia market is categorized into hospital clinics, clinics, and others. Clinics dominate with the largest market share at 53.1% in 2020, expected to reach USD 507.79 million by 2027, growing at a CAGR of 5.50% during the forecast period.

In summary, the growth of the dental anesthesia market is propelled by demographic factors, technological advancements, and increased awareness. While challenges exist in terms of regulatory constraints and the need for skilled professionals, the market's trajectory remains optimistic. The comprehensive segmentation across product types, administration modes, techniques, duration of action, and end-user segments provides a nuanced understanding of the diverse dynamics influencing the growth and direction of the global dental anesthesia market.

Leave a Comment