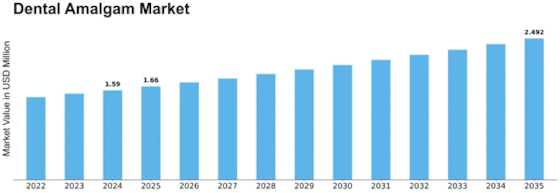

Dental Amalgam Size

Dental amalgam Market Growth Projections and Opportunities

The dental amalgam market depends on material price security. Mercury, silver, tin, and copper—amalgam's major ingredients—change prices. Manufacturers and sellers monitor these expenses to keep pricing competitive and the market alive. Regulations affect dental amalgam sales. Dental amalgam conversations and decisions impact market considerations, notably due to health and environmental concerns over mercury concentration. Some stringent laws or prohibitions may alter demand and supply. Technology in dentistry drives the market. Resin-based composites and ceramics are competing with dental mercury. New items that are attractive, durable, and eco-friendly are popular. Dental tourism also alters the market. Countries with accessible dental care may increase dental amalgam demand, whereas those that emphasize mercury-free choices may modify client desires. Global dental tourism trends affect market location. Demographics like age and oral health knowledge affect the dental amalgam industry. Due to extended lifespans, more dental treatments are required, affecting therapeutic material sales. Places with better oral health awareness have more preventive and therapeutic dental services. Dentists' preferences impact the market. Different dentists utilize dental mercury differently than other materials. Educational and training programs influence dentists' choices and the market. Mercury in dental amalgam raises environmental concerns, which is affecting the market. More consumers and dentists who understand mercury's environmental impact may choose mercury-free solutions. Companies using eco-friendly practices and goods may have an advantage. Patient awareness and desires impact the market. Some like dental amalgam since it's sturdy and affordable. Mercury-free alternatives may appeal to those concerned about their health or appearance. Marketers must adapt to changing client preferences. Insurance coverage and payment regulations affect dental amalgam sales. Policies that allow or restrict dental goods determine what physicians use, which affects market demand. Market participants must obey insurance regulations to succeed. GDP growth and consumer spending impact the dental amalgam industry. People may spend more on dental procedures in prosperous economies, which boosts market growth. However, in a difficult economy, consumers may spend less on unneeded dental treatment.

Leave a Comment