Degaussing System Size

Market Size Snapshot

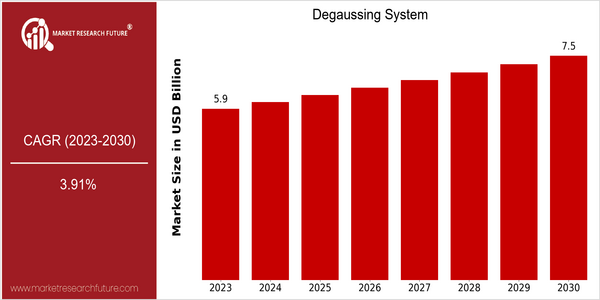

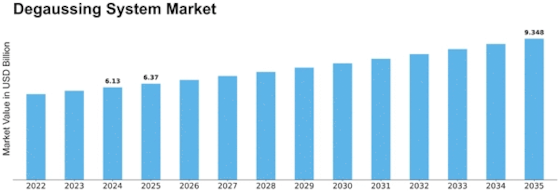

| Year | Value |

|---|---|

| 2023 | USD 5.9 Billion |

| 2030 | USD 7.45 Billion |

| CAGR (2024-2030) | 3.91 % |

Note – Market size depicts the revenue generated over the financial year

The global degaussing system market is currently valued at approximately USD 5.9 billion in 2023, with projections indicating a growth to USD 7.45 billion by 2030. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.91% from 2024 to 2030. The market's expansion can be attributed to increasing demand for data security solutions across various sectors, particularly in defense, maritime, and information technology, where the protection of sensitive information is paramount. As organizations continue to prioritize cybersecurity, the adoption of degaussing systems is expected to rise, driven by advancements in technology and heightened awareness of data breaches.

Key players in the degaussing system market, such as Data Security, Inc., and Degaussers.com, are actively innovating and expanding their product offerings to meet the evolving needs of their customers. Strategic initiatives, including partnerships and investments in research and development, are further propelling market growth. For instance, recent product launches that incorporate enhanced features for efficiency and effectiveness in data erasure are likely to attract a broader customer base, thereby contributing to the overall market size increase. As the landscape of data security continues to evolve, the degaussing system market is poised for sustained growth, driven by both technological advancements and the increasing importance of data protection.

Regional Market Size

Regional Deep Dive

The Degaussing System Market is experiencing significant growth across various regions, driven by increasing naval modernization programs and heightened security concerns. In North America, the market is characterized by advanced technological integration and a strong presence of defense contractors. Europe is witnessing a surge in demand due to regulatory changes aimed at enhancing maritime security. The Asia-Pacific region is rapidly expanding, fueled by rising defense budgets and geopolitical tensions. The Middle East and Africa are also emerging markets, with investments in naval capabilities. Latin America, while smaller, is beginning to recognize the importance of degaussing systems in protecting maritime assets.

Europe

- The European Union has implemented new regulations mandating enhanced maritime security measures, which has spurred investments in degaussing systems among member states.

- Countries like the UK and France are investing in next-generation degaussing technologies as part of their naval modernization programs, focusing on integrating these systems with other defense capabilities.

Asia Pacific

- China's significant increase in naval spending has led to a surge in demand for degaussing systems, as the country seeks to modernize its fleet and enhance its maritime defense capabilities.

- India's recent procurement of advanced degaussing systems for its naval vessels highlights the country's focus on strengthening its maritime security in response to regional tensions.

Latin America

- Brazil is exploring the integration of degaussing systems into its naval modernization efforts, recognizing the importance of protecting its maritime interests in the South Atlantic.

- Chile's recent naval exercises have emphasized the need for advanced degaussing capabilities, prompting discussions on potential collaborations with foreign defense contractors.

North America

- The U.S. Navy has been actively upgrading its fleet with advanced degaussing systems, reflecting a commitment to maintaining maritime superiority and countering threats from emerging naval powers.

- Recent collaborations between defense contractors like Raytheon and the U.S. Department of Defense have led to innovations in degaussing technology, enhancing the effectiveness of these systems in countering magnetic mines.

Middle East And Africa

- The UAE has initiated a comprehensive naval expansion program, which includes the acquisition of advanced degaussing systems to protect its growing fleet from underwater threats.

- Saudi Arabia's investment in maritime security infrastructure has led to partnerships with international defense firms to develop and implement state-of-the-art degaussing technologies.

Did You Know?

“Degaussing systems were originally developed during World War II to protect ships from magnetic mines, and they have evolved significantly since then to incorporate advanced technologies.” — Naval History and Heritage Command

Segmental Market Size

The Degaussing System Market is currently experiencing stable growth, driven by increasing demand for data security and the protection of sensitive information. Key factors propelling this segment include the rising awareness of cybersecurity threats and stringent regulatory policies mandating data destruction, particularly in sectors like defense and finance. Additionally, advancements in degaussing technology enhance the effectiveness and efficiency of these systems, further driving adoption.

Currently, the adoption stage of degaussing systems is transitioning from pilot phase to scaled deployment, with notable leaders such as Data Security, Inc. and companies in the defense sector implementing these systems extensively. Primary applications include the secure disposal of hard drives and magnetic media in industries like healthcare and government, where data breaches can have severe consequences. Trends such as increasing government mandates for data protection and sustainability initiatives are accelerating growth, as organizations seek to comply with regulations while minimizing environmental impact. Technologies like electromagnetic degaussers and innovative data sanitization methods are shaping the evolution of this segment.

Future Outlook

The Degaussing System market is poised for steady growth from 2023 to 2030, with an anticipated market value increase from $5.9 billion to $7.45 billion, reflecting a compound annual growth rate (CAGR) of 3.91%. This growth trajectory is underpinned by the increasing emphasis on maritime security and the rising need for anti-magnetic measures in naval operations. As global tensions persist and naval fleets modernize, the demand for advanced degaussing systems is expected to rise, leading to greater market penetration in both military and commercial sectors.

Key technological advancements, such as the integration of digital monitoring systems and enhanced magnetic field modeling, are likely to drive innovation within the market. Additionally, regulatory frameworks aimed at improving naval safety and environmental standards will further bolster the adoption of degaussing systems. Emerging trends, including the shift towards automation and the incorporation of artificial intelligence in degaussing operations, are expected to enhance system efficiency and effectiveness. As a result, stakeholders in the Degaussing System market should prepare for a dynamic landscape characterized by technological evolution and increased investment in maritime defense capabilities.

Leave a Comment