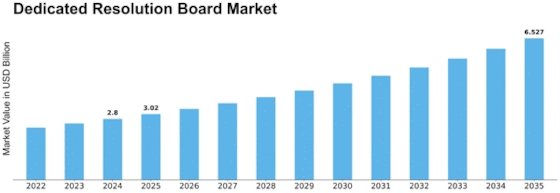

Dedicated Resolution Board Size

Dedicated Resolution Board Market Growth Projections and Opportunities

The DRB market is influenced by various factors that drive its dynamics significantly. High-resolution displays for industries and other sectors are one key factor contributing in this market. With advances in technology, there emerges as well need for the dedicated resolution boards which can make and orient the visual output of monitors projectors or digital signage. Areas, such as the sector of health care, gaming, teaching, and entertainment are pursuing to produce sharper and clearer images are expected propel consumption growth in vision technology markets DRB. Also, government regulations and industry standards are key drivers in determining how the DRB market looks like. Resolution standard level is often prescribed by regulatory bodies in a specified area, for instance, medical imaging or aviation. As such, attempting to meet such standards becomes an essential component of a manufacturer’s consideration when penetrating the DRB market because ensuring that the products comply with established requirement secure their quality and accuracy as demanded by the industries. Obedience within such rules not only ensures market acceptance but also helps in promoting faith from end users.

Opportunities from the Display Technology sector that drives Dedicated Resolution Board market dynamics include constant technological advancements in display technology. With the advent of new display technologies, such as 4K and 8K resolution boards, there is a need for a resolution compatible board to have all its full potentials. The third factor that the manufacturers consider is to develop boards with better resolution, higher refresh rate and enhanced colour. Thus, there needs to be a consistency in innovation to ensure that advancing consumer’s demands are addressed in the DRB market. Various counts sectors are also a contributor to the DRB market. For example, fields such as health and design usually need resolution boards with support resolutions of direct high-resolution detailed imaging. But the gaming sector requires boards configured to end up with high refresh rate while latency remains low for better gameplay.

Thus, satisfying and filling these industry niches is a critical task for the manufactures of DRB market products that helps to gain competitive advantage and conquer niche markets. Some economic factors, such as overall growth of economy, expenses for technology investments and disposable income that appliance buyers can consume influence the state of development and design burdens requirement market. As countries are facing substantial economic development, there would be an increased number of investments, and consequent increase in technological advancements that require higher need on dedicated resolution boards. On the other side, economic stagnations can cause a short period of showing low growth market development because of a tightening budget by companies and their clients who is delaying non-essential purchases.

Leave a Comment