Adoption of Cloud Computing

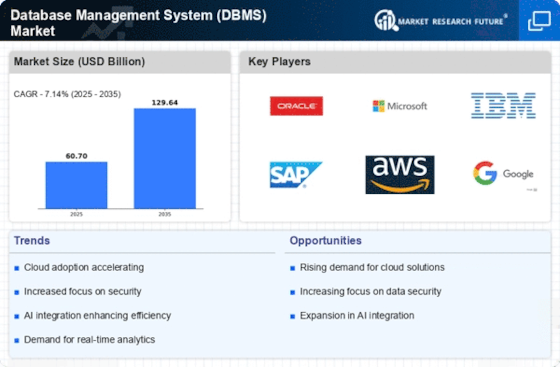

The shift towards cloud computing is significantly influencing the Database Management System Market (DBMS) Market. Organizations are increasingly migrating their data and applications to the cloud, seeking the scalability and flexibility that cloud-based DBMS solutions offer. This transition is supported by the fact that cloud services are expected to account for a substantial portion of IT spending, with estimates suggesting that cloud computing could represent over 30% of total IT budgets in the near future. As businesses seek to reduce infrastructure costs and improve operational efficiency, the demand for cloud-based DBMS solutions is likely to surge. This trend not only enhances accessibility but also allows for real-time data processing, which is essential for modern business operations.

Increased Focus on Data Security

The heightened focus on data security is a pivotal driver for the Database Management System Market (DBMS) Market. With the increasing frequency of data breaches and cyber threats, organizations are prioritizing the protection of their sensitive information. This trend is reflected in the growing investment in security features within DBMS solutions, such as encryption, access controls, and auditing capabilities. Market data indicates that The Database Management System Market (DBMS) is projected to reach over 300 billion dollars by 2025, underscoring the importance of data security in the context of database management. As businesses seek to safeguard their data assets, the demand for secure DBMS solutions is likely to rise, further propelling market growth. This focus on security not only protects organizations from potential threats but also enhances customer trust and compliance with regulatory standards.

Rising Demand for Data Analytics

The increasing reliance on data analytics across various sectors appears to be a primary driver for the Database Management System Market (DBMS) Market. Organizations are increasingly recognizing the value of data-driven decision-making, which necessitates robust database management solutions. According to recent statistics, the demand for data analytics tools is projected to grow at a compound annual growth rate of over 25% in the coming years. This trend indicates that businesses are investing heavily in DBMS technologies to harness insights from their data. As a result, the DBMS market is likely to experience substantial growth, driven by the need for efficient data storage, retrieval, and analysis capabilities. Companies that can provide innovative DBMS solutions tailored to analytics will likely find themselves at a competitive advantage.

Emergence of Big Data Technologies

The rise of big data technologies is significantly shaping the Database Management System Market (DBMS) Market. As organizations generate and collect vast amounts of data, traditional database systems often struggle to manage this influx effectively. The integration of big data technologies, such as NoSQL databases and distributed data processing frameworks, is becoming increasingly essential. Market analysis suggests that the big data analytics market is expected to grow at a rate exceeding 20% annually, which in turn drives the demand for advanced DBMS solutions capable of handling large-scale data environments. This trend indicates that organizations are seeking DBMS technologies that can efficiently process and analyze big data, thereby enhancing their operational capabilities and competitive positioning.

Regulatory Compliance Requirements

The growing emphasis on regulatory compliance is emerging as a crucial driver for the Database Management System Market (DBMS) Market. Organizations are increasingly required to adhere to stringent data protection regulations, such as GDPR and HIPAA, which necessitate robust data management practices. Compliance with these regulations often requires advanced DBMS solutions that can ensure data integrity, security, and accessibility. As a result, companies are investing in DBMS technologies that facilitate compliance, thereby driving market growth. The potential penalties for non-compliance can be severe, prompting organizations to prioritize their database management strategies. This trend indicates that the DBMS market will continue to expand as businesses seek solutions that not only meet regulatory requirements but also enhance their overall data governance.