Data Center Rack Size

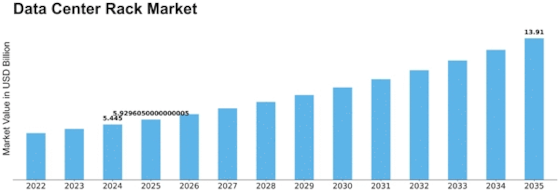

Data Center Rack Market Growth Projections and Opportunities

Within the dynamic landscape of the Data Center Rack Market, companies employ a range of market share positioning strategies to assert themselves and gain a competitive advantage in the industry. One primary strategy is differentiation, where companies focus on offering unique and innovative features in their data center rack solutions. This may include advanced cooling technologies, modular designs for scalability, or integrated cable management systems. By providing racks with distinct functionalities, companies aim to attract clients seeking specific features that align with their data center requirements, thus establishing a niche for themselves in a competitive market.

Cost leadership is another significant approach within the Data Center Rack Market, emphasizing efficiency and affordability in rack solutions. Companies adopting this strategy aim to provide cost-effective racks without compromising on quality or performance. This is particularly important in a market where data center operators seek solutions that offer value for money. To achieve cost leadership, companies often optimize manufacturing processes, explore economies of scale, and negotiate favorable supplier agreements to maintain a competitive cost structure, making their products more appealing to a broader customer base.

Targeting specific customer segments or industries is a strategic avenue for market share positioning in the Data Center Rack Market. Companies may specialize in designing racks tailored to the unique needs of sectors such as telecommunications, healthcare, or finance. For example, a company targeting the telecommunications industry might focus on providing racks with enhanced cable management and connectivity options. This targeted approach allows companies to position themselves as experts in specific domains, catering to the distinct requirements of businesses within those industries.

Collaboration and partnerships play a crucial role in gaining market share in the Data Center Rack Market. Companies often form strategic alliances with technology partners, data center solution providers, or industry leaders. These collaborations can lead to the development of comprehensive data center solutions that integrate seamlessly with existing technologies. Additionally, partnerships can enhance the compatibility of racks with other data center infrastructure components, offering clients a more cohesive and interoperable solution. By aligning with key players, companies not only expand their market reach but also enhance their credibility and provide clients with a more holistic data center solution.

Leave a Comment