Emergence of 5G Technology

The Data Center Accelerator Market is poised for growth with the emergence of 5G technology. The rollout of 5G networks is expected to revolutionize data transmission speeds and connectivity, leading to an increased demand for accelerators that can handle the resulting data influx. Industries such as automotive, healthcare, and entertainment are likely to benefit from enhanced data processing capabilities enabled by 5G. The global 5G market is projected to reach over 700 billion dollars by 2026, which will likely drive investments in data center infrastructure, including accelerators. This technological advancement is anticipated to significantly impact the Data Center Accelerator Market.

Expansion of Edge Computing

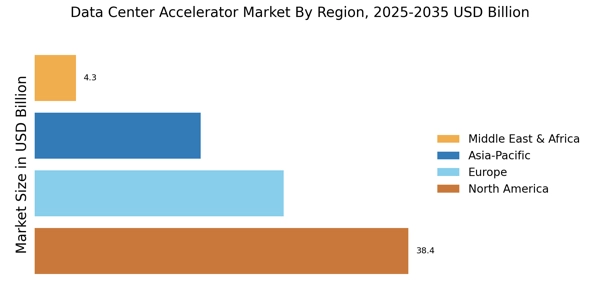

The Data Center Accelerator Market is witnessing a notable expansion due to the rise of edge computing. As businesses seek to process data closer to the source, the demand for accelerators that can efficiently handle localized data processing is increasing. This trend is particularly evident in industries such as telecommunications and IoT, where low latency and real-time processing are critical. The edge computing market is expected to grow at a robust pace, with projections indicating a potential market size exceeding 15 billion dollars by 2026. This shift necessitates the integration of accelerators within edge data centers, thereby driving growth in the Data Center Accelerator Market.

Growing Focus on Data Security

The Data Center Accelerator Market is also shaped by a growing focus on data security. As cyber threats become more sophisticated, organizations are prioritizing the implementation of robust security measures within their data centers. Accelerators that enhance encryption and data protection processes are increasingly sought after. The Data Center Accelerator Market is projected to exceed 300 billion dollars by 2024, indicating a strong demand for solutions that can safeguard sensitive information. Consequently, data center operators are investing in accelerators that not only improve performance but also bolster security, thereby influencing the trajectory of the Data Center Accelerator Market.

Advancements in AI and Machine Learning

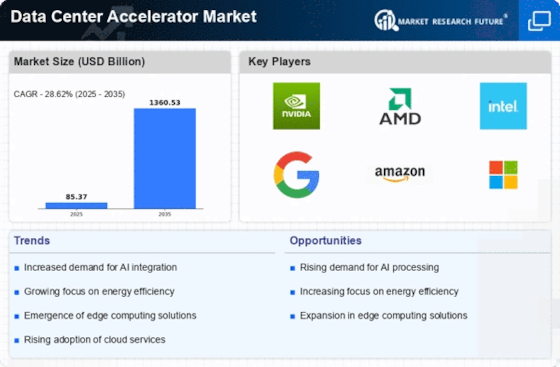

The Data Center Accelerator Market is significantly influenced by advancements in artificial intelligence (AI) and machine learning (ML). As organizations adopt AI-driven solutions, the need for specialized accelerators that can efficiently process complex algorithms becomes increasingly apparent. The AI market is anticipated to reach over 300 billion dollars by 2026, with a substantial portion of this growth attributed to the demand for data center accelerators. These technologies enable faster training and inference of AI models, which is essential for applications ranging from natural language processing to computer vision. Thus, the integration of AI and ML capabilities within data centers is likely to propel the Data Center Accelerator Market.

Increased Demand for High-Performance Computing

The Data Center Accelerator Market experiences heightened demand for high-performance computing (HPC) solutions. As organizations increasingly rely on data-intensive applications, the need for accelerators that enhance processing capabilities becomes paramount. The market for HPC is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by sectors such as finance, healthcare, and scientific research, which require rapid data processing and analysis. Consequently, data center operators are investing in advanced accelerator technologies to meet these demands, thereby propelling the Data Center Accelerator Market forward.