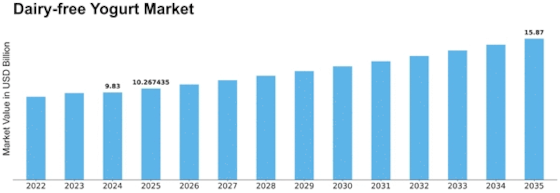

Dairy Free Yogurt Size

Dairy-free Yogurt Market Growth Projections and Opportunities

The dairy-free yogurt business is influenced by client preferences, health trends, and finances. Wellness-conscious consumers' need for plant-based and dairy-free products is key. Lactose intolerance, allergies, and vegetarianism lead many to select dairy-free yogurt. Dairy-free yogurt is better and may be healthier, supporting the plant-based diet trend. Dairy-free Yogurt Market was valued USD 8.9 billion in 2022, exhibiting worldwide dominance. From 2022 to 2032, gauges show a sustained vertical trend of 5.10% CAGR. This good trend should lead to a $13.9256 billion market by 2032. Health-conscious lives and diets are driving demand for dairy-free yogurt. Dairy-free yogurt programs for different tastes and nutritional demands have grown the sector. The dairy-free yogurt sector will profit as more people select lactose-free and vegan products.

Wellness drives the dairy-free yogurt market. People hunt for healthy items as they become more diet-conscious. Almond, coconut, soy, or oat dairy-free yogurt is healthy. It offers low-fat, cholesterol-free, and maybe stomach-healthy options. This health-consciousness drives dairy-free yogurt sales. Dairy-free yogurt benefits from ethical manufacture. Food shoppers care more about the environment. Vegan diets, including dairy-free yogurt, are more environmentally friendly. Consumers like dairy-free yogurt because of its eco-friendly production and packaging.

The dairy-free yogurt industry is competitive and brand-focused. Layout brands and newcomers diversify markets. Customers choose trustworthy dairy-free yogurt companies based on advertising, branding, and product positioning. Innovative taste, health, and unconventional flavor marketing methods increase market intensity.

The dairy-free yogurt industry is also affected by social and culinary trends. As diets change, dairy-free yogurt is adaptable. Social recognition and variation influence local flavor and surface preferences.

Leave a Comment