Dairy Alternatives Size

dairy alternative products market Size

Searching...

What is the current valuation of the Dairy Alternative Products Market?

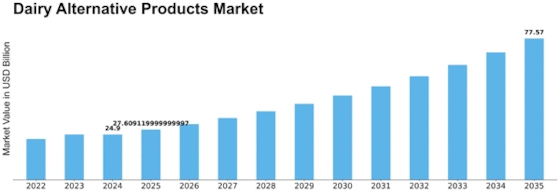

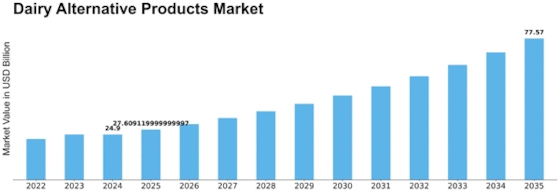

The Dairy Alternative Products Market was valued at 24.9 USD Billion in 2024.

As per Market Research Future analysis, the Dairy Alternative Products Market was estimated at 24.9 USD Billion in 2024. The Dairy Alternative Products industry is projected to grow from 27.61 USD Billion in 2025 to 77.57 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 10.88% during the forecast period 2025 - 2035

The Dairy Alternative Products Market is experiencing robust growth driven by health consciousness and sustainability.

| 2024 Market Size | 24.9 (USD Billion) |

| 2035 Market Size | 77.57 (USD Billion) |

| CAGR (2025 - 2035) | 10.88% |

| Largest Regional Market Share in 2024 | North America |

Alpro (BE), Silk (US), Oatly (SE), So Delicious (US), Ripple Foods (US), Califia Farms (US), Nutpods (US), Mooala (US), Minor Figures (GB)

The Dairy Alternative Products Market is currently experiencing a notable transformation, driven by evolving consumer preferences and heightened awareness regarding health and sustainability. As individuals increasingly seek plant-based options, the demand for alternatives to traditional dairy products has surged. This shift appears to be influenced by a combination of factors, including dietary restrictions, ethical considerations, and a growing inclination towards environmentally friendly choices. Consequently, manufacturers are innovating to meet these changing needs, introducing a diverse array of products that cater to various tastes and dietary requirements. In addition to health and sustainability, the Dairy Alternative Products Market is also witnessing a rise in the popularity of fortified and functional products. Consumers are not only looking for alternatives but are also interested in added nutritional benefits. This trend suggests that brands may need to focus on enhancing the nutritional profiles of their offerings to remain competitive. Furthermore, the expansion of distribution channels, including online platforms, is likely to facilitate greater accessibility for consumers, thereby broadening the market's reach. Overall, the Dairy Alternative Products Market is poised for continued growth as it adapts to the dynamic landscape of consumer demands and preferences.

The Dairy Alternative Products Market is increasingly shaped by a growing awareness of health and wellness among consumers. Individuals are actively seeking options that align with their dietary goals, leading to a rise in demand for plant-based alternatives that are perceived as healthier than traditional dairy.

Sustainability has emerged as a pivotal factor influencing the Dairy Alternative Products Market. Consumers are becoming more environmentally conscious, prompting a shift towards products that are produced with minimal ecological impact. This trend encourages brands to adopt sustainable practices in sourcing and manufacturing.

Innovation plays a crucial role in the Dairy Alternative Products Market, as companies strive to differentiate themselves through unique product offerings. The introduction of diverse flavors, textures, and fortified options reflects a response to consumer desires for variety and enhanced nutritional value.

Innovation plays a crucial role in the Dairy Alternative Products Market, as manufacturers continuously develop new and diverse offerings to cater to evolving consumer preferences. The introduction of fortified products, such as plant-based yogurts enriched with vitamins and minerals, has broadened the appeal of dairy alternatives. Market data suggests that the segment for flavored and functional dairy alternatives is expanding rapidly, with a growth rate of around 15% projected over the next few years. This trend indicates that consumers are not only seeking healthier options but also variety and convenience in their diets. As brands invest in research and development, the market is likely to witness an influx of innovative products that meet these demands.

The Dairy Alternative Products Market is also shaped by shifting dietary preferences, particularly among younger generations who are more inclined to adopt vegan or flexitarian diets. This demographic is increasingly rejecting traditional dairy in favor of plant-based options, driven by ethical considerations and a desire for healthier lifestyles. Data indicates that nearly 30% of millennials actively seek dairy alternatives, a trend that is expected to continue as awareness of animal welfare issues grows. This shift in consumer behavior presents a substantial opportunity for brands to capture market share by aligning their products with the values of this influential group. As dietary preferences evolve, the market is poised for sustained growth.

The Dairy Alternative Products Market is significantly influenced by the growing emphasis on environmental sustainability. As consumers become increasingly aware of the ecological impact of dairy farming, they are turning to plant-based alternatives that require fewer resources and produce lower greenhouse gas emissions. For example, producing almond milk uses substantially less water compared to traditional dairy. This shift is reflected in market data, which indicates that sales of dairy alternatives have risen by over 20% in recent years, driven by eco-conscious consumers. The potential for further growth remains high as brands innovate to enhance sustainability in their production processes, appealing to a demographic that values environmental responsibility.

The Dairy Alternative Products Market is experiencing a surge in demand due to the increasing awareness of health benefits associated with plant-based alternatives. Consumers are gravitating towards products that are lower in saturated fats and cholesterol, which are often found in traditional dairy. For instance, almond and oat milk are perceived as healthier options, contributing to a projected growth rate of approximately 10% annually in this sector. This shift is not merely a trend but reflects a broader lifestyle change where individuals prioritize nutrition and wellness. As more research highlights the advantages of dairy alternatives, the market is likely to expand further, attracting health-conscious consumers who seek to improve their dietary habits.

The Dairy Alternative Products Market is benefiting from increased accessibility and availability of dairy alternatives in retail and online platforms. As consumer demand rises, retailers are expanding their product ranges to include a variety of plant-based options, making it easier for consumers to find and purchase these products. Market data shows that sales of dairy alternatives have surged, with a notable increase in shelf space dedicated to these items in supermarkets. This trend is likely to continue, as more consumers seek convenient and accessible options that fit their lifestyles. The expansion of distribution channels, including e-commerce, further enhances the market's growth potential, allowing brands to reach a broader audience and cater to diverse consumer needs.

In the Dairy Alternative Products Market, the distribution of market share among various types has shown a significant variance, with <a href="https://www.marketresearchfuture.com/reports/almond-milk-market-2872" target="_blank">almond milk</a> leading as the largest segment. The popularity of almond milk is attributed to its taste, versatility, and wide availability in various flavors and formulations. Soy milk closely follows, known for its high protein content, while oat milk is rapidly gaining traction among health-conscious consumers, positioning itself as a key contender in the market.

Almond Milk (Dominant) vs. Oat Milk (Emerging)

Almond milk remains the dominant player in the Dairy Alternative Products Market, appreciated for its creamy texture and low calorie count, appealing to those seeking healthier alternatives to dairy. It is a well-established product with extensive distribution and brand recognition. In contrast, oat milk is emerging as a strong competitor, particularly among consumers who prioritize sustainability and taste. It boasts a creamy richness that rivals almond milk, and its eco-friendly perception makes it increasingly popular among environmentally conscious buyers. Both segments serve different consumer needs, making them pivotal in shaping future market dynamics.

The Dairy Alternative Products Market is witnessing a significant shift in consumer preferences, with nuts leading as the predominant source of dairy alternatives. This segment has established itself as a favorite due to its rich flavor profile and nutritional benefits. In contrast, legumes are emerging as a fast-growing segment, gaining traction among health-conscious consumers looking for protein-rich substitutes. The market share distribution shows that while nuts hold the largest share, legumes are rapidly catching up, reflecting changing dietary trends. Growth trends within the source segment are primarily driven by a rising demand for plant-based diets and sustainable food options. Consumers are increasingly seeking dairy alternatives that are not only nutritious but also environmentally friendly. This shift is complemented by innovative product offerings that enhance the appeal of legumes, and their incorporation into everyday diets is expected to accelerate. Overall, the Dairy Alternative Products Market is evolving, with both nuts and legumes playing pivotal roles in its expansion.

Nuts (Dominant) vs. Legumes (Emerging)

In the Dairy Alternative Products Market, nuts are recognized as the dominant source, favored for their versatility and rich flavor. Almonds, cashews, and hazelnuts are particularly popular, contributing to a diverse range of milk, yogurt, and <a href="https://www.marketresearchfuture.com/reports/cheese-market-2213" target="_blank">cheese</a> alternatives. These products not only provide a creamy texture but also boast healthy fats and proteins, appealing to consumers seeking nutritious options. On the other hand, legumes represent an emerging source within the market, increasingly utilized for their high protein content and fiber. Products derived from soy, peas, and lentils are gaining popularity, especially among those seeking plant-based protein sources. The combination of innovative product development and growing consumer awareness about the benefits of legumes is poised to enhance their market presence in the coming years.

The Dairy Alternative Products Market exhibits a diverse packaging type distribution, with cartons dominating the segment owing to their cost-effectiveness, sustainability, and ease of transport. Cartons are typically preferred for their barrier properties that help preserve the freshness of perishable products, making them the leading choice among consumers and retailers alike. In contrast, bottles are rapidly gaining popularity, particularly in the premium segment, due to their convenience and aesthetic appeal. This shift indicates a changing consumer preference towards more sophisticated and premium packaging solutions. Growth trends in the Dairy Alternative Products Market are significantly influenced by the rising demand for plant-based beverages, which is driving innovation in packaging. Bottles are becoming the fastest-growing option as consumers increasingly seek convenience, portability, and product visibility. Moreover, environmentally conscious consumers are also influencing packaging choices, prompting manufacturers to explore sustainable materials for both cartons and bottles. As the market matures, brands are focusing not only on functionality but also on providing an appealing user experience through their packaging designs.

Cartons (Dominant) vs. Pouches (Emerging)

Cartons remain the dominant packaging type in the Dairy Alternative Products Market, favored for their lightweight, recyclable properties, and efficiency in preserving product freshness. They cater to various dairy alternative beverages, including almond milk, soy milk, and oat-based drinks. Pouches, on the other hand, are emerging as a noteworthy alternative due to their lightweight nature and flexibility, appealing to on-the-go consumers. The shift towards pouches is attributed to their resealable features and minimal environmental footprint. As consumer preferences evolve, pioneering brands are beginning to explore pouches not just as practical packaging but as a sustainable option that aligns with the growing demand for eco-friendly products.

In the Dairy Alternative Products Market, Supermarkets dominate the distribution channel landscape, capturing a significant share due to their extensive reach and consumer trust. They provide a wide variety of dairy alternatives, making them the go-to choice for many consumers. Online Stores, however, are rapidly gaining ground, thanks to the convenience they offer and the growing trend of eCommerce, particularly among younger consumers and health-conscious buyers.

Supermarkets (Dominant) vs. Online Stores (Emerging)

Supermarkets serve as the dominant distribution channel for Dairy Alternative Products, supported by their established infrastructure and ability to stock a diverse range of products. They cater to a wide demographic, allowing consumers to explore different brands and options in one location. On the other hand, Online Stores have emerged as a key player in this market, driven by the rise in digital shopping behavior and the demand for specialty products. This channel allows for personalized shopping experiences and access to niche brands, thus catering to specific consumer needs. As more consumers turn to online shopping, the prominence of online stores in the Dairy Alternative Products Market is expected to increase.

The Dairy Alternative Products Market experienced significant growth across various regions. North America held a majority share, with a valuation of 6.5 USD Billion in the same year, expected to increase to 12.5 USD Billion by 2035, driven by rising demand for plant-based diets and lactose-free options.

In Europe, the market was valued at 5.2 USD Billion in 2024 and is anticipated to expand to 10.5 USD Billion by 2035, reflecting consumers' increasing awareness about health and sustainability.

The South American market, valued at 2.2 USD Billion in 2024, is also poised for growth, supported by a rising inclination towards alternative proteins, while Asia Pacific, with a valuation of 3.5 USD Billion in 2024, showed potential for significant expansion, driven by population growth and changing dietary preferences.

The Middle East and Africa, although the smallest segment with a value of 0.6 USD Billion in 2024, represented an emerging market with untapped potential for dairy alternatives. Overall, the regional dynamics in the Dairy Alternative Products Market were characterized by varied growth patterns influenced by cultural and economic factors, making each region vital for market expansion.

The Dairy Alternative Products Market has become increasingly competitive, driven by rising consumer preference for plant-based options, concerns regarding lactose intolerance, and a growing awareness of health benefits associated with non-dairy alternatives.This market includes a variety of products such as almond milk, soy milk, oat milk, rice milk, and other innovative formulations that cater to diverse dietary needs and lifestyles. The competitive landscape is characterized by a blend of established companies and emerging startups, all vying for market share.Key strategies employed by industry players include product innovation, aggressive marketing campaigns, diversification of product portfolios, and forging strategic partnerships to enhance distribution networks. As consumer trends continue to shift toward sustainable and health-oriented choices, companies must adapt swiftly to maintain relevance in this dynamic market.WhiteWave has established a formidable presence in the Dairy Alternative Products Market, primarily known for its strong commitment to sustainability and high-quality ingredients. The company focuses on organic and natural products that resonate well with health-conscious consumers.Its robust product line includes almond milks, soy milks, and other plant-based beverages, showcasing a dedication to variety and quality, which are significant strengths in gaining consumer trust and loyalty. WhiteWave has also developed a reputation for innovation, often leading the market with new product launches that meet evolving dietary preferences.Its strategic marketing emphasizes not just the functional benefits of dairy alternatives but also aligns with lifestyle choices promoting environmental stewardship, making it a formidable player in the global landscape.Blue Diamond Growers has carved out a significant niche within the Dairy Alternative Products Market, primarily recognized for its high-quality almond-based products such as almond milk and almond flour. The company benefits from its cooperative structure, which allows it to leverage the collective resources of almond growers to maintain competitive pricing and product availability on a global scale.Blue Diamond Growers emphasizes its quality assurance processes and sustainability initiatives, enhancing its brand reputation and trust among consumers. Moreover, with successful mergers and acquisitions in the recent past, the company has expanded its product portfolio significantly, allowing it to cater to a diverse consumer base.Its strategic focus on almond-based innovations and expanding distribution channels has solidified Blue Diamond Growers as a crucial player in the marketplace, addressing the rising demand for dairy alternatives.

In order to improve cow digestion using Ajinomoto's AjiPro® L enzyme additive and reduce greenhouse gas emissions in dairy and dairy alternative production, Danone and Ajinomoto announced a partnership in April 2025. The goal is to improve farm-level margins and reduce nitrous oxide emissions by up to 25%.

The industry is getting closer to commercially viable cultured dairy substitutes after Israeli precision fermentation firm Imagindairy was granted regulatory approval in Israel in April 2025 for its animal-free dairy proteins that resemble conventional milk caseins.In order to increase sustainability and customer choice, Oatly and Nestlé intensified their efforts in post-toddler plant-based nutrition in June 2024 by expanding Oatly's "NOT M'LK" oat drink, which is made entirely from locally produced German oats.

A breakthrough in precision-fermentation-derived casein for stretchable plant-based cheese was made in October 2024 by the Israeli biotech company DairyX. This cheese is anticipated to be on the market by 2027 and will save CO₂ emissions by 90% when compared to traditional dairy.

While Q1 sales statistics showed that Danone's Activia kefir and Fage Total yogurt witnessed 4 and 16 percent year-over-year growth, respectively, dairy researchers at SIAL Paris unveiled developments in high-protein lactose-free yogurts targeted at GLP-1 users in June 2024.Traditional dairy brands made a comeback in November 2024, as plant-based milk sales fell 8.4% while dairy milk sales in the US increased 3.5%, indicating a revived customer desire.

The Dairy Alternative Products Market is projected to grow at a 10.88% CAGR from 2025 to 2035, driven by rising health consciousness, environmental concerns, and innovation in product offerings.

New opportunities lie in:

By 2035, the market is expected to solidify its position as a leading segment in the global food industry.

| MARKET SIZE 2024 | 24.9(USD Billion) |

| MARKET SIZE 2025 | 27.61(USD Billion) |

| MARKET SIZE 2035 | 77.57(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 10.88% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Alpro (BE), Silk (US), Oatly (SE), So Delicious (US), Ripple Foods (US), Califia Farms (US), Nutpods (US), Mooala (US), Minor Figures (GB) |

| Segments Covered | Product Type, Source, Packaging Type, Distribution Channel, Regional |

| Key Market Opportunities | Growing consumer preference for plant-based diets drives innovation in the Dairy Alternative Products Market. |

| Key Market Dynamics | Rising consumer preference for plant-based diets drives innovation and competition in the Dairy Alternative Products Market. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

What is the current valuation of the Dairy Alternative Products Market?

The Dairy Alternative Products Market was valued at 24.9 USD Billion in 2024.

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

Nuts

Legumes

Grains

Seeds

Vegetables

Cartons

Bottles

Pouches

Cans

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

North America

Europe

South America

Asia Pacific

Middle East and Africa

North America Outlook (USD Billion, 2019-2035)

North America Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

North America Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

North America Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

North America Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

North America Dairy Alternatives Products Market by Regional Type

US

Canada

US Outlook (USD Billion, 2019-2035)

US Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

US Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

US Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

US Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

CANADA Outlook (USD Billion, 2019-2035)

CANADA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

CANADA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

CANADA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

CANADA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

Europe Outlook (USD Billion, 2019-2035)

Europe Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

Europe Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

Europe Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

Europe Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

Europe Dairy Alternatives Products Market by Regional Type

Germany

UK

France

Russia

Italy

Spain

Rest of Europe

GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

GERMANY Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

GERMANY Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

GERMANY Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

UK Outlook (USD Billion, 2019-2035)

UK Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

UK Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

UK Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

UK Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

FRANCE Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

FRANCE Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

FRANCE Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

RUSSIA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

RUSSIA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

RUSSIA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

ITALY Outlook (USD Billion, 2019-2035)

ITALY Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

ITALY Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

ITALY Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

ITALY Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

SPAIN Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

SPAIN Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

SPAIN Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

REST OF EUROPE Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

REST OF EUROPE Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

REST OF EUROPE Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

APAC Outlook (USD Billion, 2019-2035)

APAC Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

APAC Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

APAC Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

APAC Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

APAC Dairy Alternatives Products Market by Regional Type

China

India

Japan

South Korea

Malaysia

Thailand

Indonesia

Rest of APAC

CHINA Outlook (USD Billion, 2019-2035)

CHINA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

CHINA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

CHINA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

CHINA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

INDIA Outlook (USD Billion, 2019-2035)

INDIA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

INDIA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

INDIA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

INDIA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

JAPAN Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

JAPAN Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

JAPAN Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

SOUTH KOREA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

SOUTH KOREA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

SOUTH KOREA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

MALAYSIA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

MALAYSIA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

MALAYSIA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

THAILAND Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

THAILAND Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

THAILAND Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

INDONESIA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

INDONESIA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

INDONESIA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

REST OF APAC Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

REST OF APAC Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

REST OF APAC Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

South America Outlook (USD Billion, 2019-2035)

South America Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

South America Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

South America Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

South America Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

South America Dairy Alternatives Products Market by Regional Type

Brazil

Mexico

Argentina

Rest of South America

BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

BRAZIL Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

BRAZIL Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

BRAZIL Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

MEXICO Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

MEXICO Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

MEXICO Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

ARGENTINA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

ARGENTINA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

ARGENTINA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

REST OF SOUTH AMERICA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

MEA Outlook (USD Billion, 2019-2035)

MEA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

MEA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

MEA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

MEA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

MEA Dairy Alternatives Products Market by Regional Type

GCC Countries

South Africa

Rest of MEA

GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

GCC COUNTRIES Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

GCC COUNTRIES Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

GCC COUNTRIES Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

SOUTH AFRICA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

SOUTH AFRICA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

SOUTH AFRICA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Dairy Alternatives Products Market by Product Type

Almond Milk

Soy Milk

Oat Milk

Coconut Milk

Rice Milk

REST OF MEA Dairy Alternatives Products Market by Source Type

Nuts

Legumes

Grains

Seeds

Vegetables

REST OF MEA Dairy Alternatives Products Market by Packaging Type

Cartons

Bottles

Pouches

Cans

REST OF MEA Dairy Alternatives Products Market by Distribution Channel Type

Supermarkets

Online Stores

Health Food Stores

Convenience Stores

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment