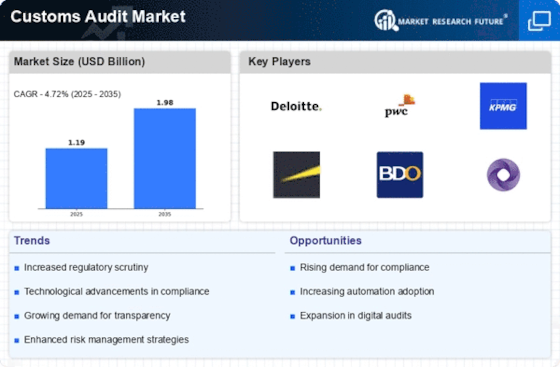

Heightened Compliance Requirements

In recent years, there has been a marked increase in compliance requirements imposed by regulatory bodies across various regions. The Customs Audit Market is directly influenced by these heightened regulations, as businesses must ensure adherence to complex customs laws and trade agreements. This compliance pressure compels organizations to invest in comprehensive auditing solutions to mitigate risks associated with non-compliance. Data indicates that companies face fines averaging 10% of their annual revenue for customs violations, underscoring the financial implications of inadequate auditing practices. Consequently, the demand for customs audit services is expected to grow as businesses seek to navigate these stringent regulatory landscapes.

Focus on Risk Management Strategies

In the current business environment, organizations are increasingly prioritizing risk management strategies, which significantly impacts the Customs Audit Market. Companies are recognizing that effective customs audits are essential for identifying potential risks associated with trade compliance and supply chain operations. This focus on risk management is driving the demand for specialized auditing services that can provide insights into vulnerabilities and compliance gaps. Data suggests that organizations implementing robust risk management frameworks can reduce their exposure to customs-related penalties by up to 25%. Therefore, the emphasis on risk management is likely to propel growth in the Customs Audit Market as businesses seek to enhance their compliance posture.

Rising International Trade Activities

The Customs Audit Market is poised for growth as international trade activities continue to expand. With the increase in cross-border transactions, the complexity of customs regulations also escalates, necessitating thorough audits to ensure compliance. Recent statistics reveal that international trade volumes have surged by approximately 5% annually, prompting businesses to reassess their customs audit strategies. This trend indicates a growing recognition of the importance of effective auditing in managing trade risks and optimizing supply chain operations. As a result, the Customs Audit Market is likely to benefit from the rising demand for auditing services that can address the challenges posed by increased trade activities.

Emergence of E-commerce and Digital Trade

The rise of e-commerce and digital trade is reshaping the Customs Audit Market, as businesses increasingly engage in online transactions that cross international borders. This shift necessitates a reevaluation of traditional customs auditing practices to accommodate the unique challenges posed by digital trade. E-commerce platforms often involve complex supply chains and diverse regulatory requirements, making effective auditing crucial for compliance. Recent data indicates that e-commerce sales are projected to grow by 15% annually, further amplifying the need for efficient customs audit solutions. As a result, the Customs Audit Market is likely to see increased demand for services tailored to the nuances of digital trade, ensuring that businesses can navigate the evolving landscape of international commerce.

Technological Integration in Customs Audit

The Customs Audit Market is experiencing a notable shift due to the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the efficiency and accuracy of audits, allowing for real-time data analysis and risk assessment. As organizations increasingly adopt these technologies, the demand for sophisticated auditing solutions is likely to rise. According to recent data, the implementation of AI in auditing processes has the potential to reduce compliance costs by up to 30%. This trend suggests that companies are prioritizing technological investments to streamline their customs audit processes, thereby driving growth in the Customs Audit Market.