Top Industry Leaders in the Current Transducer Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Current Transducer industry are:

ABB (Switzerland), CR Magnetic (US), Siemens (Germany), IME (Nepal), Phoenix Contact (US), NK Technologies (US), Topstek (Taiwan), American Aerospace Control (CR) (US), Johnson Controls (Ireland), Texas Instrument (US), Hobart (UK), Veris Industries (US), and LEM (Switzerland)

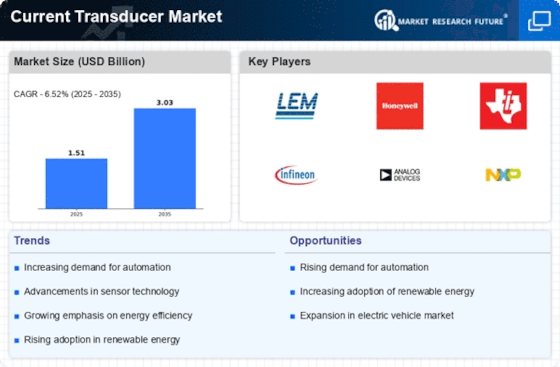

Competitive Landscape of the Current Transducer Market

The current transducer market, driven by increasing automation, renewable energy integration, and smart grid development. This steady growth attracts established players and new entrants, intensifying competition within the landscape.

Key Player Strategies:

Leading players like Texas Instruments, Infineon Technologies, and LEM Holding adopt varied strategies to maintain market share and gain an edge. These include:

Technological Innovation: Investing in research and development to create cost-effective, miniaturized, and high-precision transducers caters to rising demand for compact and efficient devices.

Diversification: Expanding product portfolios to include AC, DC, and Hall-effect transducers, along with customized solutions, caters to diverse application needs in various industries.

Strategic Partnerships: Collaborating with original equipment manufacturers (OEMs) and system integrators ensures wider market reach and product integration into specific applications.

Geographical Expansion: Focusing on high-growth regions like Asia-Pacific, particularly China and India, capitalizes on the burgeoning demand for automation and smart infrastructure.

Factors for Market Share Analysis:

Product Portfolio Breadth: Companies offering a wider range of transducers, catering to various current levels, accuracies, and installation types, hold a competitive advantage.

Technological Advancements: Companies leading in innovation, particularly in miniaturization, low-power consumption, and enhanced accuracy, attract greater market interest.

Brand Reputation and Reliability: Companies with a strong reputation for quality, reliability, and long-term performance command higher customer loyalty and market share.

Cost-Competitiveness: Offering competitive pricing while maintaining quality standards opens doors to price-sensitive segments, particularly in emerging markets.

Distribution Network and Sales Channels: Robust distribution networks and strong relationships with distributors and OEMs ensure broader market reach and product availability.

New and Emerging Trends:

Several trends are shaping the competitive landscape:

Wireless Current Transducers: The transition from wired to wireless solutions simplifies installation and data acquisition, creating new opportunities for players focusing on wireless technologies.

Integration with IoT and Smart Grids: Transducers increasingly become part of interconnected systems, requiring compatibility with IoT platforms and smart grid communication protocols.

Focus on Sustainability: Manufacturers are developing energy-efficient and recyclable transducers to meet sustainability goals and cater to environmentally conscious customers.

Market Consolidation: Mergers and acquisitions are likely as smaller players seek partnerships or exit the market due to increasing competition.

Overall Competitive Scenario:

The current transducer market is expected to remain competitive in the near future. Established players will continue to dominate, but innovative start-ups and companies focusing on niche applications can gain traction. Players who successfully adopt technological advancements, develop robust distribution networks, and cater to specific industry needs will stand out in this dynamic landscape.

The market's future success hinges on:

Continuously evolving applications, especially in renewable energy and electric vehicle charging.

Technological breakthroughs in materials, measurement techniques, and data processing.

Regulatory bodies establishing stricter energy efficiency and safety standards.

By understanding the key strategies, market share factors, and emerging trends, players can anticipate future challenges and capitalize on new opportunities in this promising market.

Latest Company Updates:

ABB (Switzerland):

- September 2023: Launched the CT-G Coreless Current Transformer series for high-precision measurement in demanding industrial applications. (Source: ABB Press Release)

CR Magnetic (US):

- November 2023: Unveiled the CT-FLEX series of flexible current transducers for space-constrained installations. (Source: CR Magnetic website)

Siemens (Germany):

- July 2023: Introduced the SENTRON PAC5200 power analyzer with integrated current transducer for real-time energy monitoring. (Source: Siemens website)

Phoenix Contact (US):

- June 2023: Released the CLIFFCON series of compact current transducers for industrial automation applications. (Source: Phoenix Contact website)

NK Technologies (US):

- September 2023: Secured funding from the US Department of Energy to develop high-efficiency current transducers for renewable energy applications. (Source: NK Technologies website)