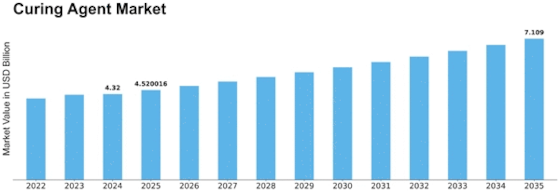

Curing Agent Size

Curing Agent Market Growth Projections and Opportunities

The market for curing agents is characterized by a dynamic environment that is shaped by a multitude of variables that work together to lead its growth and development. Understanding these market characteristics is essential for stakeholders who want to navigate this sector successfully, since they are crucial in determining the dynamics of the market. Growth of Epoxy Resin Industry: The expansion of the epoxy resin market is closely linked to the need for curing agents. Epoxy resins are commonly utilized in composites, adhesives, and coatings; but, in order for them to cure, they need curing agents. As a result, the need for curing agents is directly impacted by the growth of the epoxy resin industry. Growing building Activities: The market for curing agents is greatly impacted by the global upsurge in building activities. With the increasing number of building projects, there is a growing need for high-performance, long-lasting materials like epoxy-based coatings. Technological Developments in Coating Technologies: The Curing Agent Market is significantly shaped by these developments in coating technologies. The market for state-of-the-art curing agents is driven by the creation of new coatings with improved characteristics including increased durability, chemical resistance, and quicker curing periods. Requirements for the Automotive and Aerospace Sector: The need for sophisticated materials is driven by the aerospace and automobile sectors, which have strict performance demands. Curing agents play a major role in the growth of the market since they are widely employed in the production of high-performance composites and adhesives used in these industries. Composites are becoming more and more popular due to the growing need for strong, lightweight materials in a variety of sectors. Curing agents are essential to the creation of composite materials since they speed up the curing process and guarantee the performance and structural integrity. Tight Environmental Regulations: The market for curing agents is impacted by environmental restrictions as well as worries about volatile organic compounds (VOCs). The need for low-VOC, environmentally friendly curing agents is growing as regulatory authorities place more stringent restrictions on the use of chemicals with minimal negative effects on the environment. Industries of End Users Performance is the key: The need for specific curing agents is driven by industries like electronics, wind energy, and marine, where high-performance coatings and adhesives are essential. The necessity for curing agents that are specifically designed to fulfill application requirements has increased in these industries due to the focus placed on performance and durability.

Leave a Comment