Top Industry Leaders in the CSP Network Analytics Market

Competitive Landscape of CSP Network Analytics Market

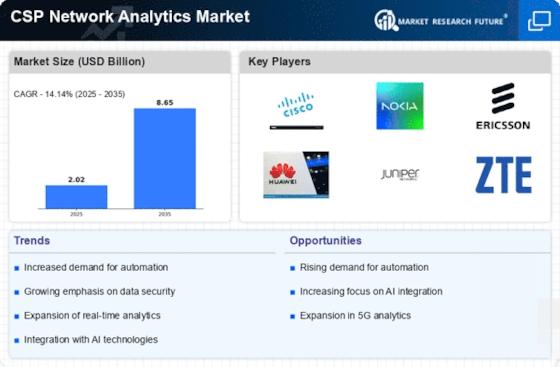

The global Communication Service Provider (CSP) Network Analytics market is a dynamic landscape with established players and emerging contenders vying for market share. This growth is driven by the increasing need of CSPs for advanced network analytics solutions to manage their complex networks, optimize performance, and deliver superior customer experience.

Key players:

- Accenture Plc

- Nokia Corporation

- Allot Corporation

- Juniper Networks Inc.

- Cisco Systems Inc.

- SAS Institute Inc.

- IBM Corporation

- Tibco Software

- Sandvine Corporation

- Broadcom Ltd

Strategies adopted:

Key players in the CSP Network Analytics market are adopting various strategies to gain a competitive edge, including:

- Product innovation: Continuous development of new and innovative solutions to address evolving customer needs.

- Mergers & Acquisitions: Strategic acquisitions of smaller companies to acquire new technologies and expand market presence.

- Partnerships & Collaborations: Collaborating with other companies to offer integrated solutions and reach new customer segments.

- Geographic expansion: Expanding operations into new regions to tap into emerging markets.

- Investment in R&D: Investing in research and development to maintain technological leadership.

Factors for market share analysis:

Several factors influence market share in the CSP Network Analytics market, including:

- Product portfolio: The range and depth of network analytics solutions offered by a vendor.

- Market presence: Geographic reach and established customer base of a vendor.

- Brand reputation: The vendor's reputation for quality, reliability, and innovation.

- Pricing strategy: The pricing model and competitive pricing offered by a vendor.

- Sales & marketing efforts: The effectiveness of a vendor's sales and marketing activities.

New and emerging companies:

Several new and emerging companies are entering the CSP Network Analytics market, offering innovative solutions and challenging the established players. These companies are often focused on specific market niches or offering unique value propositions, such as:

- Aperio Systems: Provides network analytics solutions for virtualized networks.

- CloudHedge: Offers network analytics solutions for cloud-based networks.

- Mindtree: Provides network analytics solutions for mobile networks.

- Netrounds: Offers network analytics solutions for network performance monitoring and troubleshooting.

- Spirent Communications: Provides network analytics solutions for network testing and validation.

Current company investment trends:

Current investment trends in the CSP Network Analytics market include:

- Artificial intelligence (AI) and machine learning (ML): Companies are investing in AI and ML technologies to develop advanced network analytics solutions that can automate tasks, predict network behavior, and provide actionable insights.

- Cloud-based solutions: The trend is moving towards cloud-based network analytics solutions that offer scalability, cost-effectiveness, and ease of deployment.

- Open source software: Companies are increasingly adopting open-source software for network analytics solutions to gain flexibility and control over their data.

- Network security: Growing concerns about network security are driving demand for network analytics solutions that can detect and prevent cyberattacks.

- 5G network analytics: With the rollout of 5G networks, companies are investing in network analytics solutions specifically designed to optimize the performance and security of these networks.

Latest Company Updates:

The successful telco and communications industry leaders are those who have switched to investing in network transformation, according to a recent Accenture analysis. In order to assist CSPs maximise revenue potential by providing new, more specialised products and services through networks that operate quicker, better, and cheaper, this network-led strategy integrates new technology.

In the next three years, 77% of Communications Service Providers (CSP) executives expect their network transformation activities to have a significant influence on their revenue and margin performance.

According to 98% of CSPs, increasing data demands in both the consumer and business sectors have outgrown the capacity of networks.

95% of executives in CSPs agree that moving to a software-defined, cloud-based network is crucial for achieving a cost-effective, reliable network.

The percentage of respondents who are stepping up their investments in next-generation networks is just 13%.

In order to help communications service providers (CSPs) quickly modernise their networks in a cost- and energy-efficient way as well as speed up the deployment of 5G core, RAN, and edge devices as well as lifecycle management in 2022, VMware today introduced new product advancements and partnerships. To keep up with consumer and business demand for ultra-low latency and high speed networks to assist their digital transformation, CSPs are speeding up the rollout of 5G and Open RAN.