Top Industry Leaders in the Cryogenic Capsules Market

*Disclaimer: List of key companies in no particular order

The Competitive Landscape of the Cryogenic Capsules Company Comprehensive Overview

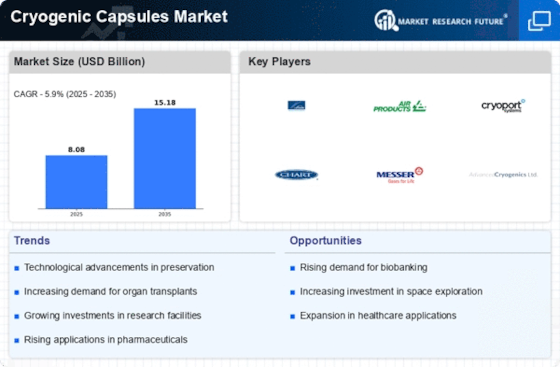

The cryogenic capsules market is fiercely competitive, witnessing a dynamic interplay between established industry giants and emerging players striving to carve out their niche. In this thriving environment, success hinges on a delicate balance of innovation, product quality, and competitive pricing. The market's trajectory is poised for significant growth, propelled by the escalating demand for cryopreservation across diverse sectors such as biobanking, pharmaceuticals, and healthcare.

Key Players:

The landscape of cryogenic capsules is diverse, featuring both seasoned industry leaders and promising newcomers. Notable participants in this market include Lab Depot, Globe Scientific, Heathrow Scientific, Sumitomo Bakelite, Starlab International GmbH, E and K Scientific Products, Caesa-Labs, Catalent, Cryolor, Thermo Fisher Scientific, Argos Technologies, Sigma-Aldrich Corporation, Capp ApS, and Corning.

Prominent Players:

Among the frontrunners are industry giants like Thermo Fisher Scientific, renowned for its extensive range of cryogenic capsules offered under the Nalgene and Nunc brands. Corning, another prominent player in life sciences, stands out with its Corning Axygen brand, specializing in cryogenic vials and tubes. Sigma-Aldrich Corporation, Lab Depot, Globe Scientific, and Cryolor also play pivotal roles in supplying diverse cryogenic solutions. Additionally, Catalent, E and K Scientific Products, Starlab International GmbH, and Sumitomo Bakelite contribute significantly to the market's vibrancy.

Strategies Adopted:

Players in the cryogenic capsules market employ various strategic initiatives to gain a competitive edge, including:

-

Product Innovation: Continuous innovation to enhance features like leak resistance, capacity, and thermal performance. -

Expansion of Product Portfolio: Diversifying product offerings to meet the varied requirements of end-users across different industries. -

Strategic Partnerships: Forming alliances with industry peers to extend market reach and leverage complementary expertise. -

Geographical Expansion: Expanding operations into new markets, with a particular focus on the burgeoning Asia-Pacific region. -

Focus on Sustainability: Emphasizing the development of sustainable cryogenic capsules through the use of recyclable materials or those with reduced environmental impact.

Factors for Market Share Analysis:

Several factors contribute to market share dynamics in the cryogenic capsules market:

-

Brand Reputation: Established players with robust brand reputations often enjoy a larger market share. -

Product Quality: The quality and performance of cryogenic capsules are pivotal factors, as customers prioritize reliable solutions for sample preservation. -

Pricing Strategy: Implementing competitive pricing strategies to attract cost-conscious customers and augment market share. -

Customer Service: Offering excellent customer service to foster loyalty and contribute to increased market share. -

Distribution Network: A robust and efficient distribution network ensures wider product availability, fostering market share growth.

New and Emerging Companies:

A cohort of innovative startups is entering the cryogenic capsules market, introducing novel products and disruptive technologies. Noteworthy entrants include Capp ApS with patented screw cap technology for enhanced leak resistance, Argos Technologies developing capsules with integrated temperature monitoring, and Caesa-Labs focusing on cryogenic storage solutions for cell and tissue therapy applications.

Industry Developments:

Several industry developments underscore the market's dynamism:

-

Lab Depot (August 2023): Launched a new line of cryogenic capsules tailored for long-term sample storage in liquid nitrogen freezers. -

Globe Scientific (July 2023): Partnered with a leading research institution to develop cryogenic capsules optimized for cell therapy applications. -

Heathrow Scientific (June 2023): Expanded its distribution network into new markets in the Asia-Pacific region. -

Sumitomo Bakelite (May 2023): Invested in a new manufacturing facility to augment production capacity for cryogenic capsules.