Market Trends

Key Emerging Trends in the Cross Linked Polyethylene Market

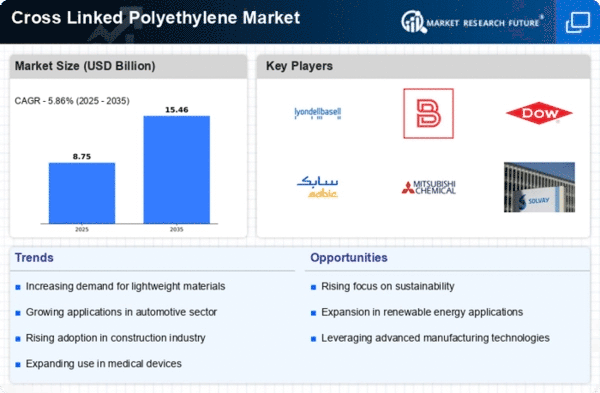

The cross-linked polyethylene (XLPE) market is experiencing notable trends driven by various factors influencing its growth trajectory. XLPE, a type of polyethylene with cross-links between polymer chains, is widely used in industries such as plumbing, electrical, automotive, and packaging due to its excellent thermal, mechanical, and chemical properties. One significant trend in the market is the increasing demand for XLPE in the wire and cable industry. With the growing infrastructure development and urbanization, there is a rising need for reliable and efficient electrical transmission and distribution systems. XLPE cables offer superior insulation properties, high thermal resistance, and low dielectric losses, making them ideal for high-voltage power transmission and distribution applications.

Furthermore, the construction industry is driving the demand for XLPE pipes and fittings due to their durability, corrosion resistance, and ease of installation. As urbanization continues to expand and water infrastructure systems undergo renovation and modernization, there is a growing requirement for high-quality piping materials that can withstand harsh environmental conditions and provide long-term performance. XLPE pipes offer advantages such as lightweight, flexibility, and resistance to chemical corrosion, making them suitable for a wide range of applications including water supply, sewage disposal, and industrial piping systems. Cross-linked HDPE states a major share in the Cross-Linked polyethylene market. The more density of the material, along with better chemical resistance and strength, creates an extra opportunity for the sales of the products.

Moreover, the automotive industry is another key driver of the XLPE market, particularly in the manufacturing of automotive components and insulation materials. With the increasing focus on vehicle electrification and lightweighting to improve fuel efficiency and reduce emissions, XLPE foam materials are gaining traction as alternatives to traditional insulation materials like rubber and PVC. XLPE foams offer excellent thermal insulation, acoustic damping, and impact resistance properties, making them suitable for applications such as automotive interiors, gaskets, seals, and NVH (Noise, Vibration, and Harshness) management.

Additionally, advancements in cross-linking technologies and manufacturing processes are shaping the market landscape of XLPE. Manufacturers are investing in research and development activities to enhance the cross-linking efficiency, mechanical properties, and processability of XLPE materials. This includes the development of advanced curing systems, irradiation techniques, and chemical formulations to optimize the cross-linking density and improve the overall performance of XLPE products. Furthermore, innovations in compounding technologies are enabling the customization of XLPE formulations with additives such as antioxidants, UV stabilizers, and flame retardants to meet specific application requirements and regulatory standards.

However, the XLPE market also faces challenges such as fluctuating raw material prices and regulatory constraints. The prices of key raw materials used in the production of XLPE, such as ethylene and peroxide cross-linking agents, are subject to volatility due to factors like supply-demand dynamics, feedstock availability, and geopolitical tensions. These price fluctuations can impact the profitability of manufacturers and influence pricing strategies in the market. Moreover, regulatory requirements related to environmental and safety standards for XLPE products can pose compliance challenges for industry players, necessitating investments in quality control measures and certification processes.

Leave a Comment