Cosmetic Bottle Packaging Size

Cosmetic Bottle Packaging Market Growth Projections and Opportunities

The Cosmetic Bottle Packaging Industry holds its own uniqueness due to the elaborate system of market factors. The industry is driven forward by the many trends which are heard throughout the market. Among the significant players in this sector is the constant need for change in users' habits and their increased consciousness about the health products they consume. With the consumers becoming more and more selective, they will all opt for packaging solutions that they can trust not only to protect their products but additionally to be part of their sustainability agenda.

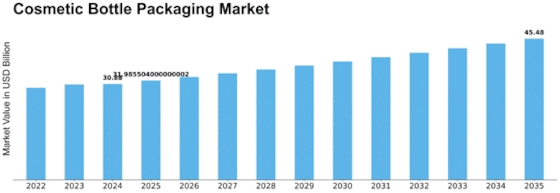

The and Twits possession in a very market was worth USD 28.5 billion in 2022. The Global Cosmetic Bottle Packaging industry is on a forecast to grow from USD29.6685 billion level in 2023 to USD40.9167779 billion level by 2032 at a compound annual growth rate (CAGR) of 4.10%.

On account of this, the economics of the planet is not only an exclusive factor, but very significant in shaping the cosmetic container market. Consumer economy largely depends on stabilization of economic situation, availability of incomes and purchasing power of buyers, which in turn influences the type of products they wish to buy. There is an increase in the consumer purchase of skincare and beauty products products during the period of economic growth. Such demand probably drives the demand for cosmetic packaging.

Besides, regulatory issues constitute another factor governing the cosmetic bottles industry. Countries and their regulatory authorities are introducing many regulation to the produce material of packaging which are mainly due to environmental concerns and safety of the consumers all over the world. Businesses sometimes need to make innovative packaging materials and technologies in order to meet these regulations which may cost them money to clear their previous not-so-sustainable practices. The transition in the material composition leads to increase in the frequency of bio-based and recycled materials gain popularity in the market.

The development of smart packaging reducing to the integration of the features such as RFID tags and QR codes enhance the users experience by giving out information of the product or usage and authenticity. Along with it manufacturing technologies are another key driver of fashion industry progression as they contribute to improved quality, cost effectiveness and ability to create complicated and aesthetically appealing designs.

Along with distribution channels and supply chain, the packaging industry of cosmetic bottles market is driven. Online shop witnessed electronic growth due to technological innovation and change of customers' shopping behavior; consequently, the area of packaging is changing its requirements. Packaging should be not only protect the product during shipment, but also looks aesthetic to buyers who tend to run their hands on throughout the process to make a buying decision.

In addition , environmental issues that the waste production from the packaging industry is causing have become an urgent problem for the industry for this reason. Hence , the adoption of plastic circular economy principles in the cosmetic bottles packaging market is gaining popularity. The costs of recyclable packaging are a major issue these days. So, manufacturers instead are designing packaging which not only is recyclable but also encourages consumers to participate in recycling programs.

Leave a Comment