Emergence of Fintech Innovations

The Corporate Flows B2B Payment Market is being reshaped by the emergence of fintech innovations. Startups and established financial institutions are increasingly collaborating to develop cutting-edge payment solutions that address the evolving needs of businesses. These innovations include mobile payment applications, digital wallets, and automated invoicing systems, which enhance the overall payment experience. The fintech sector is projected to grow substantially, with investments in payment technology reaching billions of dollars. This influx of capital is likely to accelerate the development of new solutions, thereby transforming the Corporate Flows B2B Payment Market and providing businesses with more options to streamline their payment processes.

Adoption of Advanced Technologies

The Corporate Flows B2B Payment Market is experiencing a notable shift towards the adoption of advanced technologies such as artificial intelligence and blockchain. These technologies enhance transaction efficiency and security, thereby reducing operational costs. For instance, AI-driven analytics can streamline payment processes, allowing businesses to make informed decisions based on real-time data. Furthermore, blockchain technology offers a decentralized ledger that ensures transparency and traceability in transactions, which is increasingly vital in today's regulatory environment. As companies seek to optimize their payment systems, the integration of these technologies is likely to become a standard practice, potentially leading to a more robust and efficient Corporate Flows B2B Payment Market.

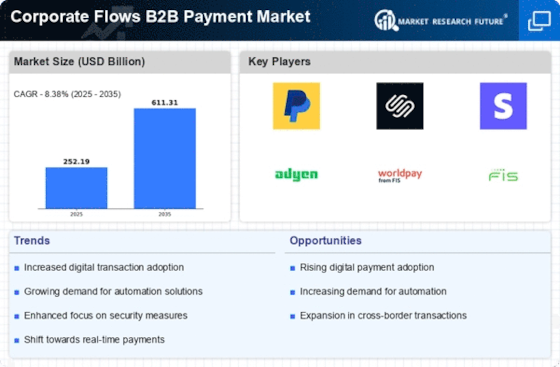

Increased Demand for Real-Time Payments

The Corporate Flows B2B Payment Market is witnessing a surge in demand for real-time payment solutions. Businesses are increasingly recognizing the need for immediate transaction capabilities to enhance cash flow management and operational efficiency. According to recent data, the real-time payments segment is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend is driven by the necessity for businesses to respond swiftly to market changes and customer needs. As a result, payment service providers are investing in technologies that facilitate instant transactions, thereby reshaping the landscape of the Corporate Flows B2B Payment Market.

Regulatory Compliance and Risk Management

In the Corporate Flows B2B Payment Market, regulatory compliance and risk management have become paramount. As governments and regulatory bodies impose stricter guidelines on financial transactions, businesses must adapt to these changes to avoid penalties and reputational damage. The implementation of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations necessitates robust compliance frameworks. Companies that proactively address these regulatory requirements are likely to gain a competitive edge, as they can assure clients of their commitment to security and transparency. This focus on compliance is expected to drive innovation in payment solutions, further influencing the Corporate Flows B2B Payment Market.

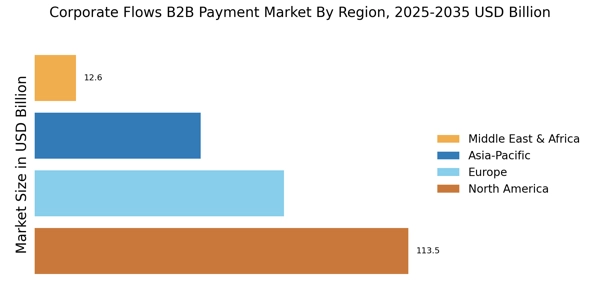

Growth of E-commerce and Digital Marketplaces

The Corporate Flows B2B Payment Market is significantly influenced by the growth of e-commerce and digital marketplaces. As more businesses transition to online platforms, the demand for efficient and secure payment solutions has escalated. Recent statistics indicate that e-commerce sales are projected to reach trillions of dollars, creating a substantial market for B2B payment solutions. This shift necessitates the development of payment systems that can handle high transaction volumes while ensuring security and compliance. Consequently, payment providers are adapting their offerings to cater to the unique needs of e-commerce businesses, thereby driving growth in the Corporate Flows B2B Payment Market.