Corn Oil Size

Market Size Snapshot

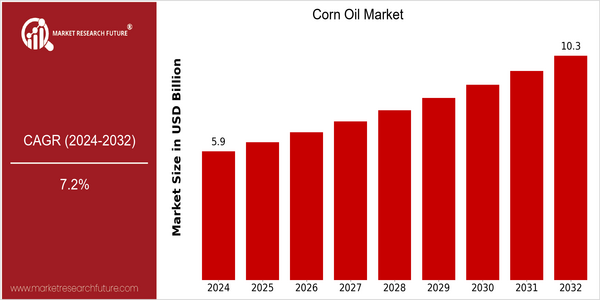

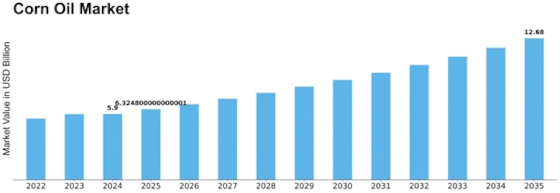

| Year | Value |

|---|---|

| 2024 | USD 5.9 Billion |

| 2032 | USD 10.3 Billion |

| CAGR (2024-2032) | 7.2 % |

Note – Market size depicts the revenue generated over the financial year

The corn oil market is estimated to be valued at $ 5.9 billion in 2024 and is expected to reach $ 10.3 billion by 2032. This growth rate is a strong CAGR of 7.2% during the forecast period. This growth is driven by the increasing demand for healthy cooking oils and the increasing awareness of the health benefits of corn oil. The growing food industry and the increasing use of corn oil in the production of biodiesel are also driving the market. The technological advancements in the extraction and refining processes are also contributing to the growth of the market by improving the quality and yield of corn oil. The major companies in the market, such as Archer Daniels, Cargill and Bunge, are constantly engaged in strategic alliances and the implementation of new production techniques. In addition, the companies have recently launched organic and non-GMO corn oil to meet the changing preferences of consumers towards healthier and more sustainable products. These factors make the corn oil market very dynamic and ensure its growth in the coming years.

Regional Market Size

Regional Deep Dive

Corn oil market is growing at a fast pace in different regions. Corn oil market is driven by the rising health consciousness, increasing demand for biofuels, and the versatility of corn oil in food preparation. Each region has its own unique characteristics. The main reasons for this are the agricultural practices, consumer preferences, and regulatory frameworks. The corn oil market is characterized by the coexistence of old and new uses. Among them, the most important are: the traditional use of corn oil in cooking and the development of new applications in the food and biodiesel industries.

Europe

- The corn oil market is also influenced by stricter regulations on food safety and labeling, in particular the European Union's Food Law, which requires food producers to be transparent. And this has led to a rise in demand for organic and non-GMO corn oil.

- The European market is also witnessing a trend towards plant-based diets, with companies like Bunge and Unilever expanding their product lines to include corn oil as a healthier alternative to traditional cooking oils, thereby driving market growth.

Asia Pacific

- The rapid urbanization and the growing middle class in the Asia-Pacific region are driving the demand for corn oil-based processed foods. In countries like China and India, the growing consumption of processed foods is influenced by the changing eating habits and the increase in the population.

- Innovations in packaging and distribution by companies such as Wilmar International and Adani Wilmar are making corn oil more accessible to consumers, which is expected to further boost market penetration in rural and urban areas alike.

Latin America

- Latin America is a booming market for corn oil, due to its rich agricultural land and the favorable climate for corn cultivation. Brazil and Argentina are the main producers, and local consumption is increasing because of the increasing popularity of corn oil.

- The region is also seeing a rise in exports, with companies like Grupo Bimbo and Cargill expanding their operations to meet international demand, which is expected to enhance the overall market dynamics.

North America

- The corn oil market in North America is influenced by the United States government's agricultural policies, notably the Renewable Fuels Standard (RFS), which promotes the use of biofuels, including corn oil, in the transportation sector. This regulatory framework is expected to boost the demand for corn oil as a source of renewable energy.

- Key players such as Archer Daniels Midland Company and Cargill, Inc. are investing in innovative extraction technologies to enhance the quality and yield of corn oil, which is anticipated to improve market competitiveness and sustainability.

Middle East And Africa

- Corn oil is used in cooking in the Middle East and Africa. There is a growing trend towards healthy eating, and demand for corn oil is increasing.

- Government initiatives aimed at promoting local agriculture, such as Egypt's Sustainable Agricultural Development Strategy, are expected to enhance domestic corn oil production, reducing reliance on imports and fostering market growth.

Did You Know?

“Did you know that corn oil has a higher smoke point than many other cooking oils, making it ideal for frying and sautéing? This property not only enhances its culinary appeal but also contributes to its growing popularity in food processing.” — Culinary Institute of America

Segmental Market Size

The Corn Oil Market is currently growing steadily. It is being driven by the growing demand for healthier cooking oils and the growing popularity of plant-based diets. The demand for corn oil is being pushed by its positive fatty acid profile and its versatility in the kitchen. The use of bio-based products is also gaining momentum, particularly in regions such as North America and Europe, where the population is more health-conscious. The Corn Oil Market is currently in a mature stage of development. The key players are Cargill and Archer Daniels Midland, who are leading the market with their new products and sustainable sourcing practices. The main applications are in food preparation, frying and the production of food products, such as margarine and salad dressings. The Corn Oil Market is being pushed by the push for sustainable and clean label products. As people become more conscious of their health and the environment, they are looking for healthier oils. The development of new extraction and refining methods will continue to shape the Corn Oil Market. These methods will ensure that corn oil is of a higher quality and purity.

Future Outlook

Corn oil is set to show significant growth from 2024 to 2032, with a projected increase in value from $ 5.9 billion to $10.4 billion. This translates into a CAGR of 7.2%. This is due to the growing awareness of the health benefits of corn oil, including its high content of polyunsaturated fatty acids and vitamin E. As consumers are more interested in healthy food, the penetration of corn oil into the household and commercial kitchens is set to increase, with the percentage of corn oil in the cooking oil market set to reach over 30% by 2032. Also, technological improvements in the extraction and refining processes are expected to increase the quality and yield of corn oil, making it more competitive against other vegetable oils. Also, government policies supporting biofuels and sustainable agriculture will continue to boost demand. The growing popularity of a plant-based diet and the growing use of corn oil in food processing and manufacturing are also set to drive the market. The industry must therefore remain flexible to keep up with the market’s evolution and to take advantage of the latest developments.

Leave a Comment