Copper Mining Size

Copper Mining Market Growth Projections and Opportunities

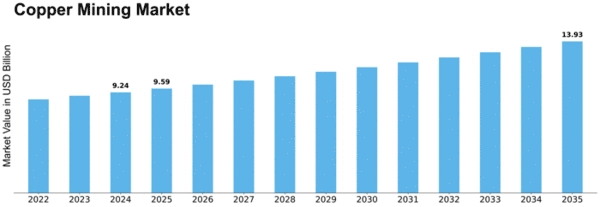

Copper Mining Market Size was valued at USD 8.6 Billion in 2022. The Copper mining industry is projected to grow from USD 8.9 Billion in 2023 to USD 12.0 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.80%

The copper mining market is profoundly influenced by a confluence of factors that collectively dictate its growth and dynamics within the global economy. Economic conditions, technological advancements, environmental considerations, and geopolitical factors all play pivotal roles in shaping the copper mining industry. Economic stability is a cornerstone driver for the copper mining market. As a vital component in various industries, including construction, electronics, and transportation, copper demand is closely tied to economic growth. During periods of economic expansion, increased infrastructure projects, manufacturing activities, and global construction contribute to a surge in copper demand. Conversely, economic downturns may lead to reduced industrial activities, impacting copper prices and production volumes.

Technological advancements are pivotal in optimizing copper mining operations. Innovations in exploration techniques, extraction methods, and processing technologies enhance the efficiency and sustainability of copper mining. Advanced technologies, such as remote sensing, satellite imaging, and data analytics, contribute to more precise ore mapping and exploration. Automation and robotics are increasingly integrated into mining processes, improving safety and productivity. Continuous advancements in smelting and refining technologies further enhance the recovery of copper from complex ore deposits.

Environmental considerations have become a significant factor influencing the copper mining market. Increasing awareness of sustainability and responsible mining practices has prompted the industry to adopt environmentally friendly approaches. Copper mining companies are investing in technologies and practices that minimize environmental impact, reduce emissions, and promote resource conservation. Compliance with stringent environmental regulations and adherence to sustainability standards are essential aspects shaping the industry's reputation and social responsibility.

Geopolitical factors play a crucial role in the copper mining market, given the global distribution of copper reserves. The geopolitical landscape, trade policies, and international relations can impact copper supply chains, trade dynamics, and pricing. Supply disruptions, export restrictions, and geopolitical tensions in major copper-producing regions may influence market stability. Copper mining companies must navigate geopolitical uncertainties to ensure secure access to resources and stable market conditions.

Market demand for copper is significantly influenced by the trends in key consumer sectors. The construction industry, electrical and electronics manufacturing, and the automotive sector are major consumers of copper. Urbanization, infrastructure development, and the growth of renewable energy technologies drive demand for copper in construction and power generation. The increasing electrification of vehicles and the development of electric vehicles further contribute to copper demand, given its essential role in electrical conductivity.

Market competition in the copper mining industry is shaped by factors such as production costs, technological efficiency, and geopolitical positioning. Copper mining companies compete on their ability to extract and process copper ore cost-effectively, adhering to environmental and safety standards. Technological innovation and efficient operational practices contribute to cost competitiveness. Companies with diversified portfolios, exploration success, and strategic global positioning are better equipped to navigate market fluctuations and maintain a competitive edge.

Leave a Comment