Market Analysis

In-depth Analysis of Continuous Positive Airway Pressure Devices Market Industry Landscape

The Continuous Positive Airway Pressure (CPAP) devices market is a dynamic and rapidly evolving sector within the healthcare industry. CPAP devices are primarily used in the treatment of sleep apnea, a common sleep disorder characterized by pauses in breathing during sleep. The market dynamics of CPAP devices are influenced by various factors that span technological advancements, rising prevalence of sleep apnea, and increasing awareness about the importance of sleep health.

Technological innovations play a pivotal role in shaping the CPAP devices market. Manufacturers are constantly striving to enhance the performance, comfort, and user-friendliness of CPAP devices. Advances in device design, such as quieter motors, lightweight materials, and improved mask interfaces, contribute to increased patient compliance and overall market growth. Additionally, the integration of smart technologies, such as connectivity features and data monitoring capabilities, is becoming increasingly prevalent, allowing both healthcare professionals and patients to track treatment progress more effectively.

The prevalence of sleep apnea is a significant driver of market dynamics. With a growing awareness of sleep-related disorders and their potential impact on overall health, the demand for CPAP devices has witnessed a steady rise. Factors such as sedentary lifestyles, obesity, and an aging population contribute to the increasing incidence of sleep apnea. This demographic shift has led to a greater focus on sleep health, prompting individuals to seek medical intervention and contributing to the expansion of the CPAP devices market.

Awareness campaigns and educational initiatives also play a crucial role in shaping market dynamics. As understanding of sleep apnea and its consequences becomes more widespread, both healthcare professionals and the general public are recognizing the importance of early diagnosis and effective treatment. This heightened awareness translates into a larger pool of potential users for CPAP devices, thereby positively influencing market growth. Moreover, advocacy groups and healthcare organizations are actively promoting sleep health, emphasizing the role of CPAP therapy in managing sleep apnea.

Market dynamics are further influenced by the regulatory landscape governing medical devices. Stringent regulations and quality standards ensure the safety and efficacy of CPAP devices, fostering trust among healthcare providers and end-users. Adherence to regulatory requirements is imperative for market players, as non-compliance can lead to legal repercussions and damage to brand reputation. Continuous advancements in regulatory frameworks may also impact market dynamics by shaping the competitive landscape and influencing product development strategies.

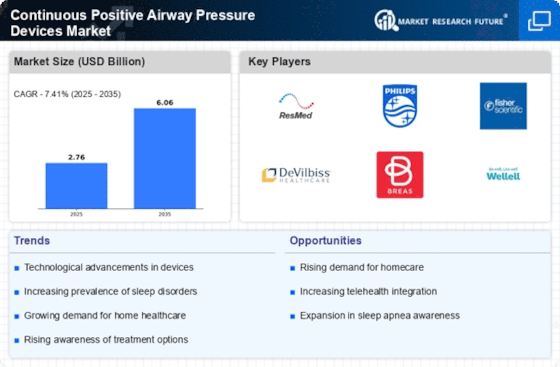

The competitive landscape of the CPAP devices market is characterized by the presence of established players, emerging companies, and strategic collaborations. Key market players continually invest in research and development to introduce innovative products, gain a competitive edge, and capture a larger market share. Partnerships and mergers between manufacturers and healthcare organizations are also prevalent, facilitating market expansion and the development of comprehensive solutions that address the diverse needs of sleep apnea patients.

Leave a Comment