Contactless Smart Card Size

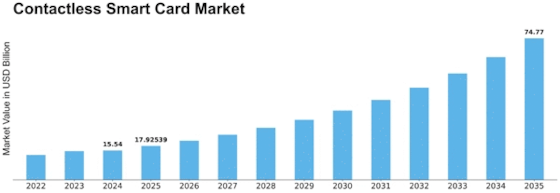

Contactless Smart Card Market Growth Projections and Opportunities

The Contact-less smart card market is going through a critical development that is powered by a shift in market aspects which is leading to a transformational change in the environment of electronic transactions. A critical driver for this market is the increasing demand for secure and convenient fintech payment programs. Customers are increasingly seeking hassle-free installment options and smart card payments fulfill the need for a continuous solution. The convenience that these cards provide whereby you merely swipe your card and make a purchase without the need for personal contact or transaction of cash is why they are popular among clients.

Not only innovation, but the progress in technology is also of utmost importance in shaping the contactless smart card market. With the rapid evolution of innovation, the features of the contactless smart cards are getting enriched. Such cards are applied for payments as well as for other things such as the access control, the transport, and ID. The flexibility of contactless smart cards though brings them favored decision in many businesses, while keys into the market's growth .

The issue concerning security is also considered as one of the significant factors affecting the contactless smart card market. Along with the growing threat of hacking and fraud, there is a growing need for secure payment methods. Contactless cards move along with innovated protection features such as encryption and verification instruments to guarantee security of clients’ financial information. This increased level of security creates trust among purchasers since adoption of contactless smart cards is more likely.

The increasing trend towards un-cash economy at the international level is one more factor in the market pushing the demand for smart cards with contactless payment. States' administrations and financial organizations successfully promote digital currencies through which they can enhance trading performance, reduce costs, and lower risks associated with cash handling. In a similar fashion, contactless smart cards subscribe to the credit only paradigm, enabling a reliable and time-saving technology, which can be used in various fields from retail to public transportation.

Moreover, the Coronavirus outbreak has accelerated the acceptance of contactless payment methods such as touch screen cards. The need of contact free exchange to prevent the spread of the infection has increased the use of contactless payment tools. Customers, organizations, and governments, all recognize the numerous health advantages of contactless exchanges, which make the sector grow.

Leave a Comment