Regulatory Changes

Regulatory changes are playing a pivotal role in the Consumer Finance Market, influencing how financial products are developed and marketed. Governments are increasingly focusing on consumer protection, leading to stricter regulations on lending practices and transparency. For example, the implementation of new guidelines on credit reporting has compelled lenders to enhance their disclosure practices. This regulatory environment may create challenges for some firms, but it also presents opportunities for those that can navigate these changes effectively. The Consumer Finance Market must remain vigilant and adaptable to comply with evolving regulations while ensuring that they continue to meet consumer needs.

Rising Consumer Debt

The rising levels of consumer debt are a significant driver in the Consumer Finance Market, as they create both challenges and opportunities for financial institutions. Recent statistics indicate that consumer debt has reached unprecedented levels, with total household debt surpassing 15 trillion dollars. This trend is prompting consumers to seek financial solutions that can help them manage their debt more effectively. As a result, there is a growing demand for debt consolidation services and financial advisory products. Financial institutions that can offer tailored solutions to address these debt concerns are likely to thrive in the competitive landscape of the Consumer Finance Market.

Technological Advancements

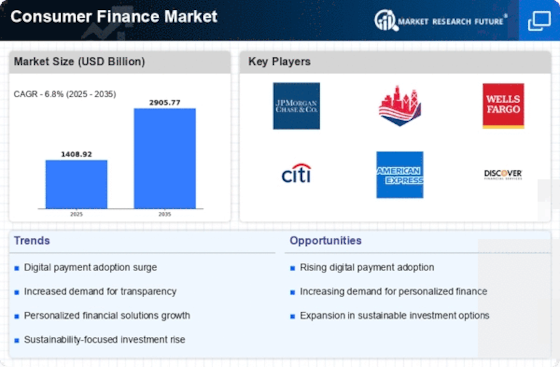

The Consumer Finance Market is currently experiencing a surge in technological advancements, which are reshaping the landscape of financial services. Innovations such as artificial intelligence, machine learning, and blockchain technology are enhancing operational efficiency and customer experience. For instance, AI-driven chatbots are streamlining customer service, while blockchain is improving transaction security. According to recent data, the adoption of fintech solutions has increased by over 30% in the last year, indicating a strong shift towards digital finance. This trend suggests that companies within the Consumer Finance Market must adapt to these technologies to remain competitive and meet evolving consumer expectations.

Increased Financial Literacy

Increased financial literacy among consumers is emerging as a crucial driver in the Consumer Finance Market. As individuals become more educated about financial products and services, they are more likely to seek out options that align with their financial goals. This trend is evident in the rising popularity of online financial education platforms and resources. Financial institutions that prioritize consumer education and provide accessible information are likely to build stronger relationships with their clients. The Consumer Finance Market must recognize this shift and invest in educational initiatives to empower consumers, thereby enhancing their overall financial well-being.

Shift Towards Sustainable Finance

The shift towards sustainable finance is gaining momentum within the Consumer Finance Market, as consumers increasingly prioritize ethical and environmentally friendly financial products. This trend is reflected in the growing demand for green loans and investment options that support sustainability initiatives. Financial institutions are responding by developing products that align with these values, such as eco-friendly mortgages and socially responsible investment funds. According to recent surveys, nearly 70% of consumers express a preference for financial products that contribute to social and environmental goals. This shift indicates that the Consumer Finance Market must adapt to these changing consumer preferences to remain relevant and competitive.