Construction Stone Size

Construction Stone Market Growth Projections and Opportunities

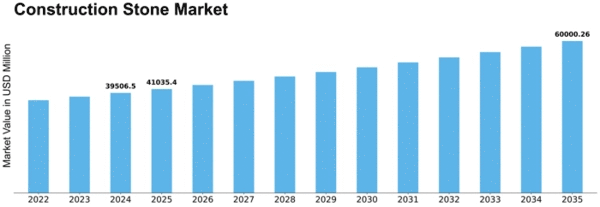

The global market size for Construction Stone was priced at approximately $36.79 billion in 2022. The industry is forecasted to be valued at around $50.46 billion by 2030, from about $38.50 billion in 2023, displaying a CAGR of 4.03%. Several factors influence the construction stone market. First and foremost, economic conditions have a lot to do with the demand for construction stone, which is determined by it. Stone has always been used as one of the main materials required during construction. Therefore, this leads to an increased demand for it as more building activities take place whenever there is any growth in the economy. In contrast, these same situations may lead to a slowdown, resulting in reduced demand. Government policies and regulations have a significant impact on the construction stone market. This includes infrastructure development-related policies, building codes, and environmental regulations, which can determine the types of stones used in construction and how they are sourced. Technological developments within the construction sector contribute towards shaping the construction stone market over time. That way, new extraction technologies can be developed, cutting techniques can be improved, and novel stones with enhanced properties can be created, among other things. Factors such as trade tensions, changes in international relations, or geopolitical events affect the global nature of the stone market for constructing buildings worldwide through their disruption of supply chains, leading to a lack of enough raw material availability, ranging from slab shortages to price hikes. The competitiveness of stoneworks globally depends on tariffs and trade agreements. Sustainability concerns have grown increasingly important in relation to construction materials made from stones. There is a growing appreciation among buyers, builders, and regulators towards green building products, generally speaking. Energy price fluctuations directly impact building rock markets. A large amount of energy goes into quarrying, dressing, and transporting rocks used during erection processes. Consumer preferences and design trends are other significant factors that affect the construction stone market. These market dynamics can be influenced by consumer preferences as well as evolving designs in the construction industry. The demand for specific types of stone, colors, and finishes may also be influenced by marketing campaigns undertaken by manufacturers. Economic, regulatory, technological issues, geopolitics, environmental, and consumer factors collectively determine the construction stone industry.

Leave a Comment