Construction Helmet Size

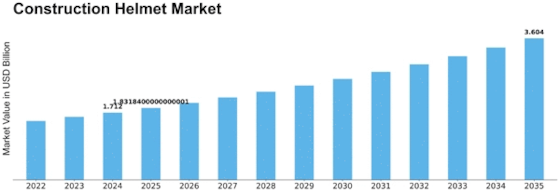

Construction Helmet Market Growth Projections and Opportunities

The global Construction Helmet market is accounted to register a CAGR of 7.00% during the forecast period and is estimated to reach USD 2.75 billion by 2032.

The Construction Helmet market is significantly influenced by a range of factors that collectively shape its dynamics within the construction and industrial safety sectors. One of the primary drivers behind the growth of the Construction Helmet market is the increasing emphasis on occupational safety and the enforcement of safety regulations in construction and industrial settings. Construction helmets, also known as hard hats, are essential personal protective equipment designed to protect workers from head injuries due to falling objects, impact, or electrical hazards. As awareness of workplace safety standards grows and regulatory compliance becomes a priority, the demand for construction helmets rises across construction sites and various industries.

Economic factors play a pivotal role in determining the demand for Construction Helmets. Economic growth, construction activities, and infrastructure development contribute to increased demand for safety equipment, including construction helmets. The construction industry, in particular, is a major consumer of helmets to ensure the well-being of workers on construction sites. Conversely, economic downturns may lead to reduced construction activities and impact the overall demand for construction helmets.

Raw material prices and availability are critical factors influencing the Construction Helmet market. The primary materials used in manufacturing construction helmets, such as high-density polyethylene (HDPE) or fiberglass, are subject to market fluctuations. Changes in raw material prices, supply chain disruptions, and advancements in helmet technologies can impact the production cost of construction helmets, influencing market dynamics. Manufacturers in the construction helmet sector must closely monitor these factors to maintain a stable supply chain and competitive pricing.

Technological advancements contribute to the evolution of the Construction Helmet market. Ongoing research and development efforts focus on improving the design, comfort, and safety features of construction helmets. Innovations such as integrated communication systems, sensors for hazard detection, and lightweight materials enhance the functionality and user experience of modern construction helmets. Manufacturers are also exploring smart helmet technologies that incorporate augmented reality (AR) features for enhanced situational awareness on construction sites.

Environmental regulations and safety standards are increasingly shaping the Construction Helmet market. As governments and regulatory bodies prioritize workplace safety, industries are under pressure to adopt and enforce safety measures. Construction helmets, being a fundamental safety device, must meet stringent standards to ensure the protection of workers. Manufacturers are aligning their products with safety certifications and regulations to meet the expectations of regulatory bodies and end-users.

Global market trends and trade dynamics also impact the Construction Helmet market. The interconnectedness of economies means that changes in one region can have cascading effects on the supply and demand for construction helmets worldwide. Trade agreements, tariffs, and geopolitical events can influence the international trade of safety equipment, affecting market conditions for manufacturers and distributors. Companies in the construction helmet market need to stay informed about global dynamics to navigate potential challenges and capitalize on opportunities.

Consumer preferences and industry standards contribute to the market factors shaping the Construction Helmet industry. The demand for comfortable, durable, and technologically advanced helmets aligns with changing consumer expectations. Manufacturers are adapting their construction helmets to meet industry standards and consumer preferences, including customization options, ventilation features, and ergonomic designs.

Leave a Comment