Top Industry Leaders in the Construction Adhesive Sealant Market

In the bustling world of construction, where dreams turn into concrete realities, the unsung heroes are the construction adhesives and sealants. These sticky warriors hold every nook and cranny together, from sealing windows against the elements to securing tiles in your gleaming bathroom. Let's peel back the layers of this dynamic landscape, exploring the key players, their winning strategies, and the factors that determine who builds a lasting presence in the market.

In the bustling world of construction, where dreams turn into concrete realities, the unsung heroes are the construction adhesives and sealants. These sticky warriors hold every nook and cranny together, from sealing windows against the elements to securing tiles in your gleaming bathroom. Let's peel back the layers of this dynamic landscape, exploring the key players, their winning strategies, and the factors that determine who builds a lasting presence in the market.

Key Players and Winning Strategies:

-

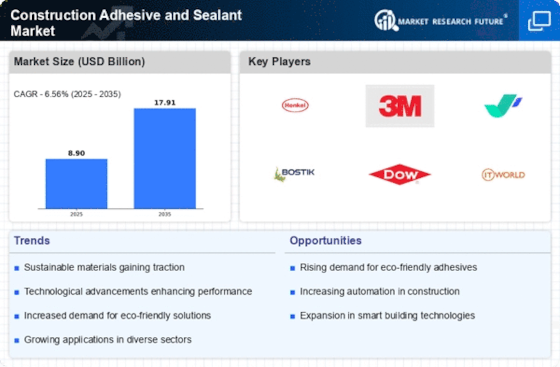

Global Adhesive Titans: Companies like Henkel, Bostik, 3M, Dow, and Sika AG hold significant market share, leveraging their vast production capacities, diverse product portfolios, and established global footprints. Henkel, for instance, dominates the high-performance construction sealants segment, catering to demanding commercial and infrastructure projects.

-

Regional Champions: Players like Mapei (Italy), Saint-Gobain (France), and Laticrete International, Inc. (United States) excel in specific regions, capitalizing on local knowledge and strong relationships with regional construction companies. Laticrete caters to the North American market with its comprehensive range of tile installation adhesives and grouts.

-

Sustainability Champions: Emerging players like EVOCHEM and Green Earth Building Products are carving a niche through eco-friendly offerings. EVOCHEM focuses on developing low-VOC and bio-based adhesives and sealants, aligning with stricter regulations and green building initiatives.

-

Niche Specialists: Smaller players like Cenospheres International and Permabond push boundaries with cutting-edge advancements. Cenospheres International's unique lightweight cenosphere-based adhesives offer improved energy efficiency and thermal insulation, while Permabond caters to specialty applications like high-temperature resistant sealants for chimneys and ovens.

Factors Shaping Market Share:

-

Performance and Durability: Meeting diverse construction needs with strong bonding strength, resistance to weathering, temperature extremes, and movement is crucial. Henkel's high-performance sealants exemplify this focus.

-

Sustainability and Environmental Footprint: Reducing VOC emissions, utilizing renewable feedstocks, and minimizing waste generation are becoming essential criteria for market penetration, driven by stricter regulations and eco-conscious construction projects. EVOCHEM's low-VOC adhesives resonate with this trend.

-

Cost-Effectiveness and Value Proposition: Balancing high performance with competitive pricing is vital, particularly in price-sensitive segments like residential construction. Laticrete's cost-effective tile adhesives find favor in budget-conscious projects.

-

Technological Advancements and Applications: Constant research and development of new adhesive and sealant formulations with additional functionalities, like fire resistance or acoustic insulation, opens up new avenues for market growth. Cenospheres International's energy-efficient adhesives illustrate this trend.

Key Companies in the Construction Adhesive and Sealant market include

- Arkema SA

- Wacker Chemie AG

- Royal Adhesives & Sealants

- PPG Industries, Inc.

- MAPEI SPA

- Huntsman International LLC

- Henkel AG & Co. KGaA

- B. Fuller Company

- Solvay

- Berry

- BASF SE

- Avery Dennison Corporation

- Ashland

- DAP Products Inc.

Recent Developments

January 2023; H.B. Fuller will be launching Swift melt 1515-I, their first bio-compatible product adherent under IMEA – India, Middle East & Africa regulations. The medical tape application will cater for application on sticky skin under extreme climatic conditions such as those found in the Indian sub-continent where there are high temperatures and humidity levels.

As part of its expansion strategy, Henkel AG & Co KGaA announced it is expanding its production plant in South Dakota in September 2022. This plant makes thermal interface material adhesives used in electronics and automotive industries by selling them under the brands Loctite and Bergquist.

Mapei started construction on their third manufacturing facility at Kosi Mathura to support Northern India demand July 2022,

Arkema closed the acquisition of Permoseal, a major provider of adhesive solutions for DIY, packaging and construction, enhancing its presence in Southern Africa in July 2022.

ITW Performance Polymers launched Plexus MA8105 as its latest adhesive in April 2022, with quick room-temperature curing and excellent mechanical properties, as well as wide adhesion range.

December 2021: For the wind energy industry, Hexcel and METYX will work together to create high-performance carbon pultruded profiles using polyurethane resin and unidirectional carbon fibre.

In April 2024, Mapei unveiled Mapeflex MS 55, a revolutionary adhesive and sealant hybrid that is designed to be used for everyday maintenance tasks. An adaptable product of a broad range of uses, it can be applied for both professional and non-professional users.

In October 2023, Henkel came up with a new line of pressure-sensitive adhesives meant for ecofriendly packaging applications that are bio-based and water based.

In October 2023: This acquisition expanded Sika AG’s range of high-temperature adhesives for industrial applications by buying out a specialty chemicals company in October 2023.

In November 2023: H.B. Fuller announced in November 2023 its collaboration with one of the leading manufacturers of electric vehicles to develop high-performance adhesives required for battery assembly.