Concrete Admixtures Size

Concrete Admixtures Market Growth Projections and Opportunities

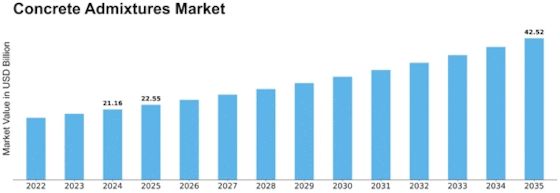

Various market forces have a significant bearing on the Concrete Admixtures Market, which ultimately determines its behavior. One of the main forces driving the industry is the global construction boom. Urbanization is continuing to grow at a pace, and therefore, there is an increasing demand for infrastructure development and an increase in building works. Concrete Admixtures Market Size was valued at USD 17.82 billion in 2021. Concrete admixtures are expected to witness a compound annual growth rate (CAGR) of 6.55% from USD 18.64 Billion in 2022 to USD 30.96 billion by 2030. Additionally, the concrete admixtures market is affected by rules set by regulators, also known as stringent regulations and standards within the industry. Governments and industry associations are becoming more aware of the need for sustainable development through eco-friendly construction practices, resulting in growing demand for concrete additives that not only improve performance but also meet environmental guidelines. Manufacturers operating within this marketplace are thus forced to be innovative so as to produce products that abide by these strict rules, thereby promoting sustainability within the construction sector. Another factor brought about by technological advancement shapes the Concrete Admixtures Market. Technological advancements lead to constant research and development efforts that make available new, improved admixture formulations. Chemical compositions or manufacturers’ innovations contribute towards formulating high-performance admixes meant to address certain shortcomings during buildings and construction. Finally, Price fluctuations in raw materials markets also affect the market dynamics. Changes can influence the cost of producing concrete admixtures in terms of the prices of key ingredients used during their manufacture. Monitoring chemical prices and other inputs helps companies control their production costs and, hence, remain competitive in such a market. Moreover, geopolitics conditions, as well as trade policies, can influence the availability of raw materials, hence affecting the total cost structure of cement additives. The economic situation has influenced this market. The use of concrete admixture will decline when economic recession affects industries operating in this area. On the contrary, when the economy is thriving, there will be more construction projects, leading to an increase in demand for admixtures. The competitive landscape of the Concrete Admixtures Market is another significant factor influencing its dynamics. The presence of several players, including global corporations and local producers, enhances competition and innovation. Strategic alliances or collaborations, mergers and acquisitions, and product launches form part of the strategies adopted by market participants toward achieving a competitive edge within the industry. The level of competition and strategic moves made by top players determine how the market grows over time.

Leave a Comment