Top Industry Leaders in the Concentrating Solar Power Market

*Disclaimer: List of key companies in no particular order

Exploring the Competitive Dynamics of the Concentrating Solar Power Sector: An In-depth Analysis

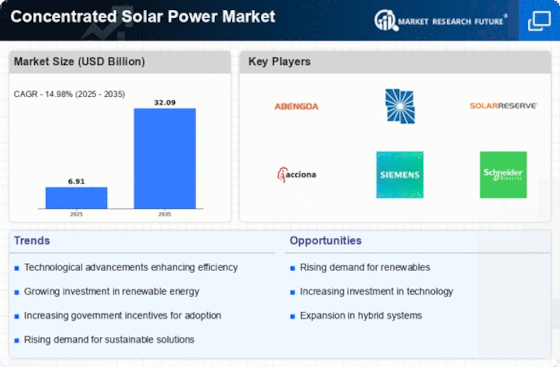

The realm of concentrating solar power (CSP), though presently overshadowed by its photovoltaic counterpart, harbors substantial potential for sustainable energy production. Propelled by environmental apprehensions and the escalating need for grid stability, this burgeoning domain unfolds as a dynamic arena where seasoned contenders and pioneering newcomers engage in fierce competition for supremacy.

Numerous facets exert influence over the analysis of market share within the CSP sphere. Parameters such as project capacity, geographical dispersion, employed technology, and the spectrum of storage solutions offered stand out as pivotal considerations. Additionally, the financial robustness of entities, governmental backing, and collaborations with key stakeholders wield significant influence. A scrutiny of these elements unveils compelling insights into the strategic maneuvers adopted by key market players:

Established Titans:

- Abengoa Solar (Spain): A trailblazer in the CSP sector, Abengoa draws on its extensive experience and global reach to secure expansive projects. With a focus on cost mitigation and cutting-edge storage technologies, the company endeavors to sustain its leadership standing.

- ACWA Power (Saudi Arabia): Supported by formidable government backing and financial resources, ACWA Power concentrates on developing economically competitive CSP projects in burgeoning markets. Strategic alliances with technology providers and investors fuel its aspirations for expansion.

- BrightSource Energy (US): A frontrunner in parabolic trough technology, BrightSource distinguishes itself through its inventive molten salt storage solution. Offering dispatchable power generation, the company targets regions with high demand and limited alternative options.

Emergent Contenders:

- Shenergy Group (China): As a state-owned enterprise, Shenergy leverages domestic capabilities and access to cost-effective materials to establish large-scale parabolic trough plants. Its emphasis on domestic expansion and technological advancements poses a challenge to established players.

- Yanjing Hi-Tech (China): Another Chinese aspirant, Yanjing Hi-Tech concentrates on the development and commercialization of innovative tower CSP technologies. Its cost-effective and scalable solutions possess the potential to disrupt prevailing market dynamics.

- Heliogen (US): A newcomer specializing in concentrated solar microreactors, Heliogen offers unique solutions for industrial heat and desalination applications. Its disruptive technology attracts significant investments and partnerships, paving the way for future market penetration.

Novel and Emerging Trends:

- Hybrid CSP-PV Systems: Merging the strengths of both technologies, hybrid systems address the intermittency challenge of photovoltaics while capitalizing on the cost advantages of CSP. Multiple entities are actively developing and deploying these hybrid solutions, unveiling fresh market opportunities.

- Advanced High-Temperature Storage: Molten salt and alternative high-temperature storage solutions extend discharge times, enhancing dispatchability and rendering CSP a more appealing option for grid integration. Ongoing research and development in this realm will be pivotal for market expansion.

- Integration with AI and Automation: Employing AI for optimized plant operation, performance prediction, and maintenance scheduling can yield substantial cost reductions and heightened efficiency. Increased automation also bolsters safety and diminishes reliance on skilled labor, augmenting the attractiveness of CSP plants to investors.

Overall Competitive Landscape: The CSP market undergoes a transition from the dominance of established players toward a more diverse scenario featuring robust regional contenders and disruptive technological innovators. The industry's focal point on cost reduction propels progress in materials, design, and storage solutions. Collaborations among technology providers, developers, and investors play a pivotal role in project financing and enlargement. With global governments advocating for cleaner energy solutions and the maturation of CSP technology, the market anticipates accelerated growth and intensified competition.

Companies adept at addressing cost challenges, delivering cutting-edge technologies, and showcasing operational excellence are poised to gain a substantial advantage in this dynamic and promising market.

Industry Developments and Recent Updates:

- October 26, 2023: Abengoa unveils a strategic partnership with Infinity Group International for the development of 500 MW of CSP projects in Oman. (Source: Abengoa press release)

- December 15, 2023: Acciona and PowerChina formalize a joint venture agreement to develop and operate CSP projects in China. (Source: Acciona press release)

- December 19, 2023: GE introduces its innovative Haliade-H wind turbine platform, designed to complement CSP for hybrid projects. (Source: GE Renewable Energy website)

- December 14, 2023: TSK Flagsol announces the successful commissioning of the 100 MW Noor III CSP plant in Dubai. (Source: CSP Today)

- December 05, 2023: Enel Green Power initiates construction on the 100 MW Kathu CSP project in South Africa. (Source: ESI Africa)