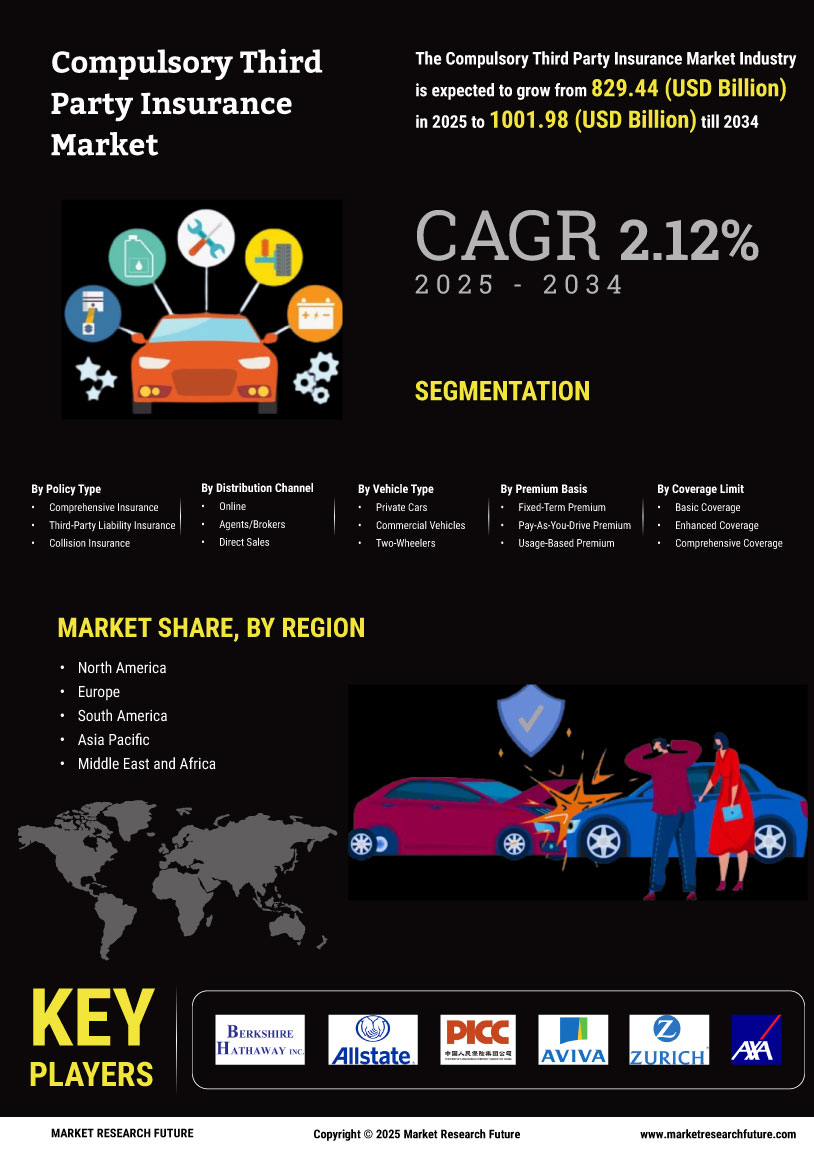

Increasing Vehicle Ownership

The rise in vehicle ownership is a pivotal driver for the Compulsory Third Party Insurance Market. As more individuals acquire vehicles, the demand for insurance coverage naturally escalates. In many regions, vehicle ownership rates have surged, with statistics indicating that the number of registered vehicles has increased by approximately 5% annually over the past few years. This trend suggests a growing need for insurance products that protect against third-party liabilities. Consequently, insurers are likely to adapt their offerings to cater to this expanding customer base, potentially leading to increased competition and innovation within the Compulsory Third Party Insurance Market.

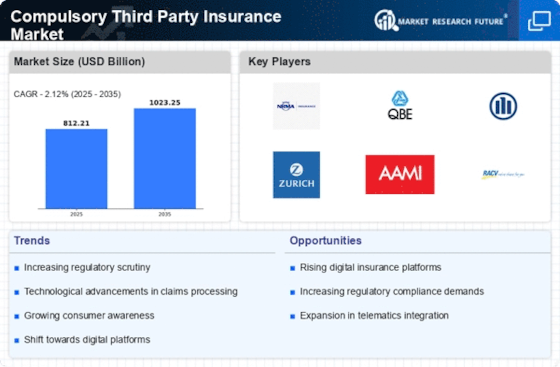

Enhanced Regulatory Frameworks

Regulatory frameworks play a crucial role in shaping the Compulsory Third Party Insurance Market. Governments are increasingly implementing stringent regulations to ensure that all vehicle owners possess adequate insurance coverage. For instance, recent legislative changes in various jurisdictions have mandated higher minimum coverage limits, thereby compelling insurers to adjust their policies accordingly. This regulatory push not only protects consumers but also fosters a more stable insurance environment. As compliance becomes essential, insurers may experience a surge in demand for their products, further driving growth within the Compulsory Third Party Insurance Market.

Growing Awareness of Insurance Benefits

Consumer awareness regarding the benefits of compulsory insurance is steadily increasing, which serves as a vital driver for the Compulsory Third Party Insurance Market. Educational campaigns and advocacy efforts have contributed to a heightened understanding of the importance of insurance in protecting against financial liabilities. As individuals become more informed about their rights and responsibilities, the demand for compulsory insurance products is expected to rise. This trend indicates a shift in consumer behavior, where individuals actively seek out insurance coverage to safeguard themselves and their assets, thereby propelling growth in the Compulsory Third Party Insurance Market.

Technological Advancements in Insurance

Technological advancements are transforming the landscape of the Compulsory Third Party Insurance Market. The integration of digital platforms and data analytics enables insurers to streamline operations and enhance customer experiences. For example, the use of telematics allows insurers to assess risk more accurately based on driving behavior, potentially leading to personalized premium rates. This innovation not only attracts tech-savvy consumers but also encourages traditional insurers to modernize their offerings. As technology continues to evolve, it is likely to play an increasingly significant role in shaping the future of the Compulsory Third Party Insurance Market.

Economic Factors Influencing Insurance Demand

Economic conditions significantly influence the dynamics of the Compulsory Third Party Insurance Market. Fluctuations in disposable income, employment rates, and overall economic stability can impact consumers' ability to purchase insurance. In periods of economic growth, individuals are more likely to invest in comprehensive insurance coverage, while economic downturns may lead to reduced spending on non-essential services. Recent data suggests that as economies recover, there is a corresponding increase in insurance uptake, indicating a direct correlation between economic health and the demand for compulsory insurance products. This relationship underscores the importance of monitoring economic indicators to anticipate trends within the Compulsory Third Party Insurance Market.