Top Industry Leaders in the Compressor Oil Market

The global compressor oil market, estimated hums with the symphony of competing players vying for control over this vital lubricant. Just like the engines they lubricate, this market pulsates with innovation, efficiency, and strategic maneuvering. Let's delve into the tactics driving this competition, the factors dictating dominance, and the recent advancements stirring the industry.

Strategies Fueling Market Growth:

-

Technological Crucible: Leading players like Shell and TotalEnergies aren't content with conventional formulations. They're brewing up high-performance synthetic oils with extended drain intervals, enhanced thermal stability, and improved wear protection, pushing the boundaries of compressor efficiency. -

Application Focus: Catering to diverse compressor types is key. ExxonMobil targets rotary screw compressors, while Chevron specializes in reciprocating compressors, each leveraging their expertise to carve out their niche. -

Regional Refinement: Adapting to local needs is crucial. BP focuses on affordable options for price-sensitive Asian markets, while Fuchs Group caters to high-tech solutions in demanding European markets. -

Sustainability Drive: Green credentials matter. Companies like Clariant are developing bio-based and readily biodegradable compressor oils, attracting environmentally conscious consumers and complying with stringent regulations. -

Partnerships and Alliances: Open innovation fuels progress. Collaborations with research institutions and universities, like TotalEnergies with MIT, accelerate development and broaden market reach.

Factors Dictating Market Share:

-

Brand Legacy and Expertise: Established players like Royal Dutch Shell, with their extensive track record and proven quality, inspire trust and command premium prices. -

Product Portfolio Breadth: Offering a diverse range of oils for different compressor types, operating conditions, and environmental requirements, like ExxonMobil does, caters to varied customer needs and applications. -

Technical Prowess and Customer Support: Deep knowledge of lubrication dynamics and compressor maintenance, like Chevron's technical support and training programs, provide added value beyond the product itself. -

Regulatory Compliance and Certifications: Adherence to safety and environmental regulations, like ISO certifications, opens doors to new markets and builds trust. -

Sustainability Savvy: Eco-conscious customers favor bio-based and low-VOC oils. Players like Lukoil, with their green initiatives, attract this growing segment.

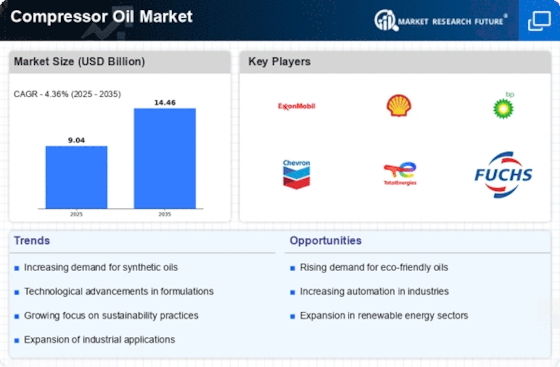

Key Players:

Exxon Mobil Corporation (US)

Sinopec Limited (China)

Royal Dutch Shell PLC (Netherlands)

BP PLC (UK)

Total S.A (France)

Chevron Corporation (US)

Croda International PLC (UK)

Fuchs Petrolub AG (Germany)

BASF SE (Germany)

Sasol Limited (South Africa)

Lukoil (Russia)

Indian Oil Corporation Ltd (India)

Hp Lubricants

Recent Developments:

-

October 2023: The American Society of Mechanical Engineers updates its standards for compressor lubrication, raising the bar for quality and performance. -

November 2023: Startups emerge offering AI-powered software for optimized oil selection and maintenance scheduling, disrupting the traditional market with data-driven efficiency. -

December 2023: Concerns about the potential environmental impact of used compressor oil spark public debate, prompting industry leaders to call for responsible disposal and recycling practices.