Aging Population

The aging population is another significant factor influencing the Compounded Pharmacy Market. As individuals age, they often experience multiple health issues that necessitate complex medication regimens. This demographic shift is expected to increase the demand for compounded medications, which can be tailored to meet the unique needs of elderly patients. Data indicates that by 2030, the number of individuals aged 65 and older will reach approximately 1.5 billion, creating a substantial market for compounded pharmaceuticals. The Compounded Pharmacy Market must adapt to this demographic trend by offering specialized services that cater to the elderly, thereby enhancing their market presence.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes, hypertension, and arthritis is a key driver for the Compounded Pharmacy Market. As these conditions often require personalized medication regimens, compounded pharmacies are well-positioned to meet the specific needs of patients. According to recent data, chronic diseases affect nearly 60% of adults, leading to a heightened demand for tailored pharmaceutical solutions. This trend suggests that compounded pharmacies will play a crucial role in managing these conditions, thereby expanding their market share. Furthermore, the Compounded Pharmacy Market is likely to see growth as healthcare providers increasingly recognize the benefits of customized medications in improving patient outcomes.

Technological Innovations in Pharmacy

Technological innovations are transforming the Compounded Pharmacy Market by streamlining operations and enhancing the quality of compounded medications. The integration of advanced compounding equipment and software solutions allows pharmacists to create precise formulations more efficiently. Moreover, technologies such as telepharmacy are expanding access to compounded medications, particularly in underserved areas. As a result, the Compounded Pharmacy Market is poised for growth, with an increasing number of pharmacies adopting these technologies to improve service delivery. This trend indicates a shift towards more efficient and patient-centered care, which is likely to attract a broader customer base.

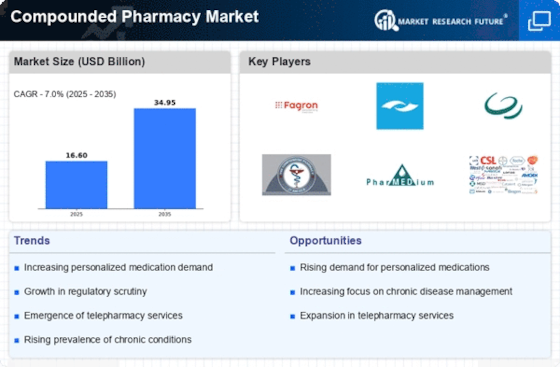

Increased Focus on Personalized Healthcare

The growing emphasis on personalized healthcare is reshaping the landscape of the Compounded Pharmacy Market. Patients are increasingly seeking medications that are tailored to their specific health needs, which has led to a surge in demand for compounded pharmaceuticals. This trend is supported by advancements in medical research and technology, which enable pharmacists to create customized formulations. As a result, the Compounded Pharmacy Market is likely to experience significant growth, with projections indicating a compound annual growth rate of over 6% in the coming years. This focus on personalized care not only enhances patient satisfaction but also drives innovation within the industry.

Regulatory Support for Compounding Practices

Regulatory support for compounding practices is a crucial driver for the Compounded Pharmacy Market. Recent legislative changes have aimed to enhance the safety and efficacy of compounded medications, thereby fostering consumer confidence. Regulatory bodies are increasingly recognizing the importance of compounded pharmaceuticals in addressing specific patient needs, which has led to a more favorable environment for compounding pharmacies. This support is expected to stimulate growth within the Compounded Pharmacy Market, as pharmacies can operate with greater assurance and compliance. Furthermore, as regulations evolve, compounded pharmacies may find new opportunities to expand their services and product offerings.