Top Industry Leaders in the Composite Insulated Panel Market

In the quest for energy-efficient and sustainable construction, the humble wall is undergoing a revolutionary makeover. Enter the composite insulated panel (CIP) market, a burgeoning battleground for innovative materials and sustainable solutions. From established giants to niche players, all are vying to shape the future of buildings that stand tall while consuming less. Let's delve into the strategies powering this transformation, explore the factors influencing market share, and illuminate the recent developments paving the path to a lighter, brighter future.

In the quest for energy-efficient and sustainable construction, the humble wall is undergoing a revolutionary makeover. Enter the composite insulated panel (CIP) market, a burgeoning battleground for innovative materials and sustainable solutions. From established giants to niche players, all are vying to shape the future of buildings that stand tall while consuming less. Let's delve into the strategies powering this transformation, explore the factors influencing market share, and illuminate the recent developments paving the path to a lighter, brighter future.

Strategies Building Block by Block:

-

Product Diversification: Beyond traditional sandwich panels, leading companies like Kingspan and Alucobond are expanding into custom-profiled panels, lightweight cladding systems, and even structural insulated panels, catering to diverse architectural needs. -

Embracing Technological Advancements: Pioneering new core materials like bio-based foams, phase change materials for enhanced thermal regulation, and even fire-resistant composites, as seen in Rockwool's offerings, are key differentiators in the battle for building brilliance. -

Sustainability Focus: Utilizing recycled materials in panel cores, minimizing energy consumption in production, and offering recyclable or bio-degradable options, as seen in Tata Steel's initiatives, are becoming crucial for responsible market growth. -

Regional Expansion and Localization: Entering high-growth markets like India and China, coupled with adapting panels to local weather conditions and regulations, is key to success. ArcelorMittal's strong presence in Asia exemplifies this approach. -

Strategic Partnerships and Collaborations: Collaborations with architects, builders, and energy efficiency consultants enhance brand visibility and secure project contracts. Alumasc's partnerships with major construction firms showcase this strategy.

Factors Forging Market Share Fortresses:

-

Brand Reputation and Quality: Established brands with a long history of quality and performance, like Kingspan and PIR International, hold an edge over newer entrants. -

Production Capacity and Distribution Network: Extensive manufacturing facilities and efficient distribution networks ensure timely delivery and cost-effectiveness, giving established players like Rockwool a competitive advantage. -

Innovation and Technological Prowess: Pioneering new insulation materials, developing smart panels with integrated sensors and building management systems, and even incorporating solar PV cells, as seen in Dow's offerings, fosters market distinction. -

Price Competitiveness and Regional Considerations: Cost-effective options for mass markets in emerging economies like India and China can offer companies like Tata Steel an edge. -

Marketing and Customer Service: Engaging marketing campaigns highlighting the energy-saving benefits, ease of installation, and aesthetic appeal of CIPs, coupled with impeccable customer service, are crucial for brand loyalty and repeat business. Kingspan's focus on customer service sets them apart.

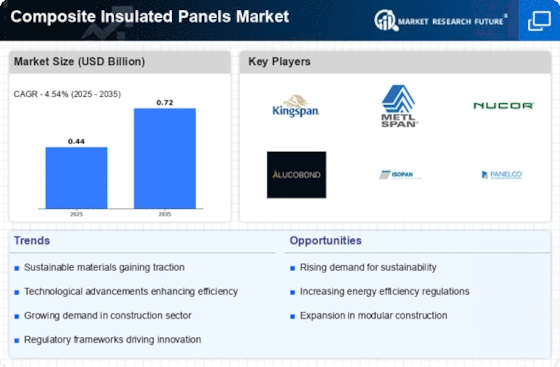

Key Companies In The Composite Insulated Panels Market Include

- Alubel SpA (Italy)

- ArcelorMittal (Luxembourg City)

- Balex-Metal (Poland)

- Dana Group Plc (UAE)

- ITALPANNELLI SRL (Italy)

- Jiangsu Jingxue Insulation Technology Co. Ltd (China)

- Kingspan Group (Ireland)

- Manni Group S.p.A (Italy)

Recent Developments

-

October 2023: The International Conference on Composite Materials showcases cutting-edge innovations in CIP technology, including self-healing surfaces, integrated air purification systems, and even 3D-printed panel options. -

November 2023: A major architectural competition announces a "Best Use of CIPs" category, further boosting awareness and adoption of this technology. -

December 2023: A consortium of CIP companies launches a research initiative focused on developing new fire-resistant and lightweight composite materials for high-rise buildings.