Company Secretarial Software Size

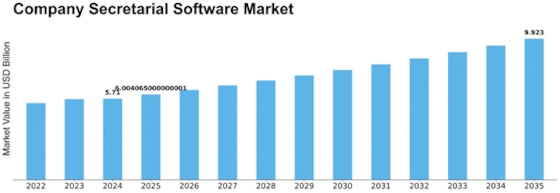

Company Secretarial Software Market Growth Projections and Opportunities

The Company Secretarial Software industry is dynamic and vital to global enterprises. This market is shaped by mechanical and administrative developments. As companies seek efficiency and consistency, demand for robust company secretarial software has skyrocketed. Many software providers compete to offer innovative solutions for businesses' unique needs.

The growing complexity of company administration and consistency requirements drives the Company Secretarial Software industry. As administrative processes become more rigorous, firms will need specific software to streamline secretarial cycles and ensure legal compliance. This has allowed software engineers to create systems that automate mundane tasks and update administrative changes, reducing the risk of resistance.

Mechanical advancements also shape market aspects. Adding artificial intelligence (AI) and ML to corporate secretarial software has revolutionized how companies handle administration. These advanced technologies enable software solutions to analyze massive data sets, predict consistency risks, and take preemptive remedies. Thus, firms are adopting complicated software that meets their current needs and future-proofs their operations.

Cloud-based arrangements also impact markets. Cloud technology has disrupted software organization structures with adaptability, availability, and cost-effectiveness. Cloud-based business secretarial software allows for coordinated effort, remote access, and scheduled refreshes, therefore organizations are increasingly using it. This shift to cloud arrangements has forced software providers to update their contributions to meet strict security and consistency standards for corporate data.

Client preferences and expectations also affect market factors. Organizations seek software that improves functional productivity and consistency. Simple interfaces, configurable features, and consistent integration with present frameworks influence client decisions. Suppliers should adapt and emphasize their contributions to meet customer needs as enterprises become more software-savvy.

In the Company Secretarial Software industry, companies and partnerships are becoming more common. To boost their solutions' appeal, software vendors are partnering with legal and consistency experts, advisory firms, and industry associations. These coordinated efforts often improve comprehensive software suites that handle administrative consistency and provide important knowledge for leader decision-making.

Global business tasks complicate market elements. Company secretarial software that can handle varied administrative settings is in high demand as companies expand internationally. Software providers must provide solutions that meet the unique administration and consistency needs of different industries to keep their products relevant internationally.

Leave a Comment