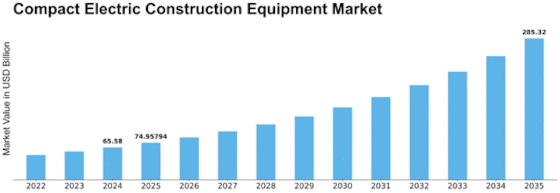

Compact Electric Construction Equipment Size

Compact Electric Construction Equipment Market Growth Projections and Opportunities

The Compact Electric Construction Equipment Market is influenced by a variety of market factors that collectively shape its dynamics and trajectory. One of the primary drivers propelling this market is the increasing emphasis on sustainability and environmental consciousness in the construction industry. Compact electric construction equipment, powered by electric batteries, addresses the growing demand for eco-friendly solutions that reduce emissions, noise pollution, and dependence on traditional fossil fuels. As construction companies and contractors prioritize green building practices, the demand for compact electric equipment continues to rise.

The Global Compact Electric Construction Equipment market is accounted to register a CAGR of 14.30% during the forecast period and is estimated to reach USD 167.15 billion by 2032.

Changing regulatory landscapes around the world significantly impact the Compact Electric Construction Equipment Market. Governments and regulatory bodies are implementing stringent emission standards and encouraging the adoption of cleaner technologies in the construction sector. In response to these regulations, construction companies are increasingly turning to compact electric equipment to meet compliance requirements, contributing to the overall market growth.

Technological advancements play a pivotal role in shaping the market dynamics of compact electric construction equipment. Continuous innovations in battery technology, electric motors, and control systems enhance the performance, efficiency, and durability of compact electric machines. The development of advanced telematics and connectivity features further contributes to the appeal of these electric construction solutions, providing real-time data on equipment usage, maintenance needs, and productivity.

Market factors are also influenced by the total cost of ownership considerations. While the initial upfront cost of compact electric construction equipment may be higher than traditional counterparts, the lower operating and maintenance costs over the equipment's lifespan make it an economically viable choice for many construction companies. The long-term savings on fuel, reduced maintenance requirements, and potential government incentives for adopting electric solutions contribute to the market adoption of compact electric construction equipment.

The demand for compact electric equipment is further fueled by the construction industry's focus on urbanization and infrastructure development in urban areas. Compact machines, with their smaller footprint and maneuverability, are well-suited for projects in confined spaces and urban environments where larger equipment may face operational challenges. The versatility and agility of compact electric construction equipment make it an ideal choice for tasks such as excavation, landscaping, and material handling in urban construction projects.

Consumer preferences and brand reputation are important factors in the Compact Electric Construction Equipment Market. As awareness of environmental issues grows, consumers, including construction companies, are increasingly choosing equipment from manufacturers with a commitment to sustainability. Brands that invest in and promote electric solutions with reliable performance and durability are likely to gain a competitive edge in the market.

The global push toward infrastructure development, coupled with the increasing demand for energy-efficient construction equipment, contributes to market growth. Governments worldwide are investing in infrastructure projects, and the construction industry is responding by adopting technologies that align with sustainability goals. Compact electric construction equipment, with its low environmental impact and efficient performance, is well-positioned to meet the requirements of these infrastructure initiatives.

The competitive landscape and collaboration within the industry influence market factors in compact electric construction equipment. Manufacturers are engaged in research and development efforts to introduce new and improved electric models, expand product portfolios, and meet the diverse needs of construction professionals. Collaborations between equipment manufacturers, technology providers, and construction companies also contribute to market advancements and the development of innovative solutions.

Leave a Comment