Market Trends

Key Emerging Trends in the Compact Construction Equipment Market

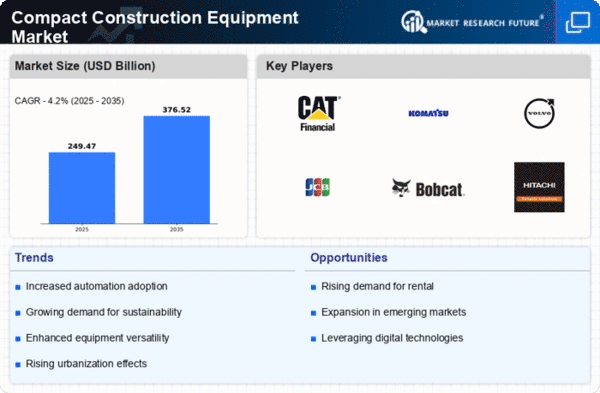

The Compact Construction Equipment market is witnessing significant trends shaped by factors such as technological innovations, urbanization, and a shift towards more sustainable construction practices. Rise in Urbanization and Infrastructure Development: A prominent trend in the Compact Construction Equipment market is the rise in urbanization and infrastructure development. As urban areas expand, the demand for compact equipment grows due to its versatility and ability to navigate tight spaces. Compact machines are crucial for urban construction projects, including residential and commercial developments, where space constraints are common. Advancements in Technology and Telematics: The market is experiencing continuous advancements in technology and telematics for compact construction equipment. Manufacturers are integrating advanced features such as GPS tracking, remote monitoring, and telematics systems that enhance equipment performance, efficiency, and provide valuable data for preventive maintenance. These technological innovations contribute to improved productivity and cost-effectiveness. Growing Demand for Electric Compact Equipment: There is a growing demand for electric compact construction equipment as the industry shifts towards more sustainable solutions. Electric machines, including compact excavators and loaders, are gaining popularity due to their reduced environmental impact, lower operating costs, and compatibility with emission regulations. The market is witnessing increased investments in the development of electric compact equipment options. Compact Track Loaders Dominating the Market: Compact track loaders are emerging as dominant players in the market. These versatile machines, equipped with tracks instead of wheels, provide increased traction and stability, making them suitable for various terrains. Compact track loaders are widely used in construction, landscaping, and agriculture, contributing to their significant market share. Rental Market Growth: The rental market for compact construction equipment is experiencing substantial growth. Construction companies and contractors are increasingly opting to rent compact machines rather than purchase them outright. This trend is driven by factors such as cost-effectiveness, flexibility in equipment selection, and the ability to access the latest technology without a long-term investment. Focus on Operator Comfort and Safety: Manufacturers are placing a strong emphasis on improving operator comfort and safety features in compact construction equipment. Ergonomically designed cabins, enhanced visibility, and advanced safety systems contribute to a better working environment for operators. This trend aligns with the industry's commitment to enhancing worker well-being and reducing the risk of accidents. Integration of Artificial Intelligence (AI) and Automation: The integration of artificial intelligence (AI) and automation is an emerging trend in the Compact Construction Equipment market. Manufacturers are exploring AI applications for predictive maintenance, autonomous operation, and machine learning algorithms that optimize equipment performance. Automation contributes to increased efficiency and reduces the need for manual labor in certain tasks. Global Supply Chain Challenges and Equipment Shortages: The Compact Construction Equipment market is not immune to global supply chain challenges, including disruptions in the availability of key components. Issues such as delays in production, shortages of critical parts, and increased lead times impact the supply and delivery of compact equipment. Manufacturers are actively addressing these challenges to meet the rising demand. Hybrid Technology and Fuel Efficiency: Hybrid technology is gaining traction in the compact construction equipment market, offering a balance between traditional and electric power sources. Hybrid machines provide fuel efficiency, reduced emissions, and the flexibility to operate in areas with limited access to electric charging infrastructure. The demand for environmentally friendly and fuel-efficient options is driving the adoption of hybrid technology.

Leave a Comment