Increased Investment in Real Estate Sector

The Commercial Real Estate Compliance Tool Market is benefiting from heightened investment in the real estate sector. As more capital flows into real estate projects, the need for compliance tools becomes more pronounced. Investors and developers are increasingly aware of the importance of adhering to regulatory standards to protect their investments and ensure project viability. This trend is reflected in the growing number of transactions and developments, which in turn drives the demand for compliance solutions. The market is expected to expand as stakeholders seek to mitigate risks associated with non-compliance, highlighting the critical role of compliance tools in the Commercial Real Estate Compliance Tool Market.

Demand for Enhanced Risk Management Solutions

The Commercial Real Estate Compliance Tool Market is witnessing a rising demand for enhanced risk management solutions. As the complexity of real estate transactions increases, organizations are seeking tools that can effectively identify, assess, and mitigate compliance risks. This trend is driven by the need to protect assets and ensure long-term sustainability in a competitive market. Compliance tools that offer comprehensive risk assessment features are becoming increasingly valuable, as they enable organizations to proactively address potential compliance issues before they escalate. The focus on risk management is expected to drive innovation and growth within the Commercial Real Estate Compliance Tool Market, as companies strive to safeguard their operations.

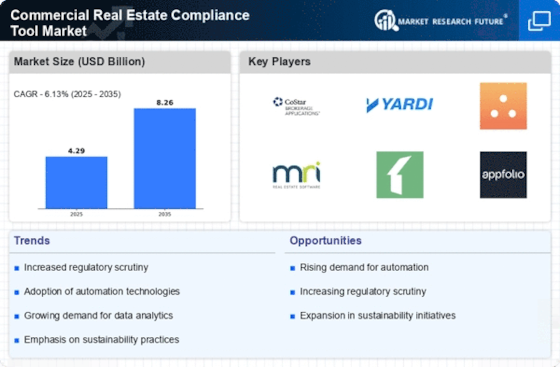

Regulatory Changes and Compliance Requirements

The Commercial Real Estate Compliance Tool Market is experiencing a surge in demand due to evolving regulatory frameworks. Governments are increasingly implementing stringent compliance requirements to ensure transparency and accountability in real estate transactions. This trend necessitates the adoption of compliance tools that can efficiently manage and monitor adherence to these regulations. As a result, organizations are investing in technology solutions that streamline compliance processes, thereby reducing the risk of penalties and legal issues. The market for compliance tools is projected to grow as businesses seek to navigate complex regulatory landscapes, indicating a robust opportunity for vendors in the Commercial Real Estate Compliance Tool Market.

Technological Advancements in Compliance Solutions

Technological innovation plays a pivotal role in shaping the Commercial Real Estate Compliance Tool Market. The integration of artificial intelligence, machine learning, and data analytics into compliance tools enhances their functionality and effectiveness. These advancements allow for real-time monitoring and reporting, which are crucial for maintaining compliance in a rapidly changing environment. Furthermore, the market is witnessing an increase in the adoption of cloud-based solutions, which offer scalability and flexibility. As organizations prioritize efficiency and accuracy in compliance management, the demand for technologically advanced tools is likely to rise, driving growth in the Commercial Real Estate Compliance Tool Market.

Rising Awareness of Environmental and Social Governance (ESG)

The emphasis on Environmental and Social Governance (ESG) is reshaping the Commercial Real Estate Compliance Tool Market. Stakeholders are increasingly prioritizing sustainability and ethical practices in real estate operations. Compliance tools that facilitate adherence to ESG criteria are becoming essential for organizations aiming to enhance their reputational standing and attract socially conscious investors. This shift is prompting companies to invest in compliance solutions that not only address regulatory requirements but also align with broader societal expectations. As awareness of ESG issues continues to grow, the demand for compliance tools that support these initiatives is likely to increase, further propelling the Commercial Real Estate Compliance Tool Market.